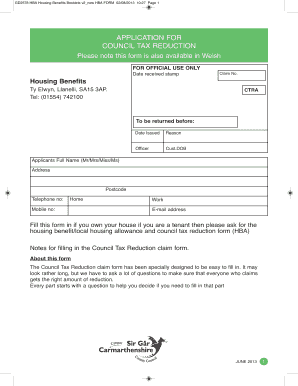

Application Council Tax Reduction Form

What is the Application Council Tax Reduction

The application council tax reduction form is a document used by individuals in the United States to request a reduction in their housing council tax. This form is essential for those who may qualify for financial assistance based on their income, disability status, or other qualifying factors. By completing this form, applicants can potentially lower their tax burden, making housing more affordable.

Eligibility Criteria

To qualify for a council tax reduction, applicants must meet specific eligibility criteria. These may include:

- Income level: Applicants must demonstrate that their income falls below a certain threshold.

- Household composition: Factors such as the number of dependents or whether anyone in the household is disabled can affect eligibility.

- Residency status: Applicants must be residents of the property for which they are requesting the reduction.

It is important to review local guidelines, as eligibility requirements can vary by state or municipality.

Steps to Complete the Application Council Tax Reduction

Completing the application council tax reduction form involves several key steps:

- Gather necessary documentation, including proof of income and residency.

- Access the application form, which can typically be found on your local government’s website.

- Fill out the form, ensuring all sections are completed accurately.

- Review the application for any errors or missing information.

- Submit the form through the designated method, whether online, by mail, or in person.

Following these steps carefully can help ensure a smooth application process.

Form Submission Methods

The application council tax reduction form can be submitted through various methods, depending on local regulations:

- Online: Many municipalities allow for electronic submission via their official websites.

- Mail: Applicants can print the completed form and send it to the appropriate local office.

- In-Person: Some applicants may prefer to submit the form directly at their local government office for assistance.

Choosing the right submission method can help expedite the review process.

Legal Use of the Application Council Tax Reduction

The application council tax reduction form must be completed and submitted in compliance with local laws and regulations. This includes providing accurate information and any required documentation. Misrepresentation or failure to disclose relevant details may result in penalties or denial of the application. Understanding the legal implications of submitting this form is crucial for all applicants.

Required Documents

When applying for a council tax reduction, several documents are typically required to support your application. These may include:

- Proof of income, such as pay stubs or tax returns.

- Identification documents, like a driver's license or social security card.

- Proof of residency, such as a utility bill or lease agreement.

Having these documents ready can streamline the application process and help ensure a successful outcome.

Quick guide on how to complete application council tax reduction

Effortlessly Create Application Council Tax Reduction on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely preserve it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents promptly and without interruptions. Manage Application Council Tax Reduction on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and Electronically Sign Application Council Tax Reduction with Ease

- Obtain Application Council Tax Reduction and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools offered by airSlate SignNow specifically for this purpose.

- Generate your electronic signature using the Sign tool, which only takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or a shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate reprinting document copies. airSlate SignNow caters to all your document management requirements in just a few clicks from your chosen device. Edit and electronically sign Application Council Tax Reduction to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is housing council tax reduction and who is eligible?

Housing council tax reduction is a benefit that helps reduce the amount of council tax you need to pay based on your circumstances. Eligibility typically includes low-income individuals, those on certain benefits, or pensioners. It's crucial to check your local council's criteria, as it may vary by region.

-

How can airSlate SignNow help with housing council tax reduction applications?

AirSlate SignNow simplifies the application process for housing council tax reduction by allowing users to electronically sign and send necessary documents quickly and easily. Our platform ensures that you can complete applications from anywhere, improving efficiency and reducing the time spent on paperwork.

-

Is there a cost associated with using airSlate SignNow for housing council tax reduction?

Using airSlate SignNow typically involves a subscription fee, which varies based on the features you choose. However, the cost is generally offset by the time saved in processing your housing council tax reduction documents and the convenience it brings. It's a cost-effective solution for managing your documentation needs.

-

What features does airSlate SignNow offer that support housing council tax reduction processes?

AirSlate SignNow offers features such as customizable templates, secure document storage, and automatic reminders for signing to help manage housing council tax reduction applications efficiently. These features streamline the workflow, ensuring you can gather signatures and submit forms without unnecessary delays.

-

Can airSlate SignNow integrate with other tools to assist with housing council tax reduction?

Yes, airSlate SignNow integrates seamlessly with various tools and platforms to enhance your housing council tax reduction applications. Whether you need to connect with CRM systems or document management software, our integrations enable a smooth workflow, reducing manual data entry and improving accuracy.

-

How does the eSigning process work for housing council tax reduction documents?

The eSigning process with airSlate SignNow is straightforward: you upload your document, add signers, and send it for signature. Signers receive an email notification with a link to the document, ensuring a secure and quick signing process. This method speeds up the submission of housing council tax reduction applications.

-

What benefits does electronic signing provide for housing council tax reduction?

Electronic signing offers numerous benefits for housing council tax reduction, including faster processing times and reduced paperwork. It minimizes the risk of errors and helps keep all parties informed throughout the workflow. Additionally, eSigning is environmentally friendly, reducing the need for printouts.

Get more for Application Council Tax Reduction

Find out other Application Council Tax Reduction

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple