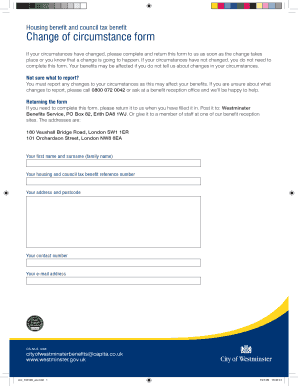

Westminster Change of Circumstances Form

What is the Westminster Change Of Circumstances Form

The Westminster Change of Circumstances Form is a crucial document used to report any changes in personal circumstances that may affect housing benefit and council tax support. This form is necessary for individuals receiving benefits to ensure that their financial assistance remains accurate and up-to-date. Changes might include alterations in income, household composition, or residency status. Properly completing this form helps local councils assess eligibility and adjust benefits accordingly.

How to use the Westminster Change Of Circumstances Form

Using the Westminster Change of Circumstances Form involves several steps to ensure accurate reporting of changes. First, gather all relevant information regarding the change, such as income statements or documentation of new household members. Next, fill out the form with precise details, ensuring that all sections are completed. After completing the form, submit it to the appropriate local council office, either online or via mail, depending on the council's submission guidelines. Keeping a copy of the submitted form for your records is advisable.

Steps to complete the Westminster Change Of Circumstances Form

Completing the Westminster Change of Circumstances Form requires careful attention to detail. Follow these steps for successful completion:

- Identify the specific changes in your circumstances that need reporting.

- Collect necessary documents that support your changes, such as pay stubs or proof of residency.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the form through the designated method outlined by your local council.

Eligibility Criteria

To qualify for housing benefit and council tax support, applicants must meet specific eligibility criteria. Generally, these criteria include being a resident of the area, having a low income, and being responsible for paying rent or council tax. Additionally, certain groups, such as students or individuals on disability benefits, may have different eligibility requirements. It is essential to review the criteria set by your local council to ensure compliance when submitting the Change of Circumstances Form.

Required Documents

When completing the Westminster Change of Circumstances Form, specific documents may be required to substantiate the changes reported. Commonly required documents include:

- Proof of income, such as pay stubs or bank statements.

- Identification documents, including a driver's license or passport.

- Proof of residency, like a utility bill or lease agreement.

- Any relevant documentation related to changes in household composition.

Form Submission Methods (Online / Mail / In-Person)

The Westminster Change of Circumstances Form can typically be submitted through various methods, depending on the local council's preferences. Common submission methods include:

- Online: Many councils offer an online portal for submitting forms directly.

- Mail: Completed forms can be sent via postal service to the designated council office.

- In-Person: Applicants may also have the option to submit the form in person at their local council office.

Quick guide on how to complete westminster change of circumstances form

Complete Westminster Change Of Circumstances Form effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as it allows you to find the correct template and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Westminster Change Of Circumstances Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest method to edit and electronically sign Westminster Change Of Circumstances Form seamlessly

- Find Westminster Change Of Circumstances Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Westminster Change Of Circumstances Form to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the UK housing council tax?

The UK housing council tax is a local taxation system for residential properties, which helps fund local services provided by councils. It is based on the estimated value of your property, and the amount varies depending on your location. Understanding how council tax works is crucial for homeowners and renters alike.

-

How can airSlate SignNow help with UK housing council tax documentation?

AirSlate SignNow enables businesses to streamline the signing process for important UK housing council tax documents. Our electronic signature solution allows you to send, eSign, and manage documents efficiently, reducing the time spent on administration. This ensures you stay compliant and organized when handling tax-related paperwork.

-

What features does airSlate SignNow offer for managing UK housing council tax forms?

AirSlate SignNow provides features like customizable templates, remote signing, and document tracking specifically beneficial for UK housing council tax forms. These features simplify the process, allowing you to adapt documents to meet your needs quickly. Our platform keeps everything secure and compliant with regulations.

-

Is airSlate SignNow cost-effective for small businesses handling UK housing council tax?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing UK housing council tax tasks. Pricing plans are designed to accommodate various business sizes, ensuring you pay only for what you need. This allows smaller enterprises to focus resources on growth while efficiently managing their administrative tasks.

-

Can airSlate SignNow integrate with accounting software for UK housing council tax management?

Absolutely! AirSlate SignNow offers integration options with various accounting software that can help manage UK housing council tax efficiently. By connecting your eSignature workflows with your accounting systems, you simplify data management and ensure that all financial responsibilities are met seamlessly.

-

What are the benefits of using airSlate SignNow for UK housing council tax?

Using airSlate SignNow for UK housing council tax provides several benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform allows quick access to essential documents, enabling faster responses to council communications. Additionally, electronic signatures enhance the overall compliance and tracking of important documents.

-

How secure is airSlate SignNow for managing UK housing council tax documents?

AirSlate SignNow prioritizes security when it comes to managing your UK housing council tax documents. Our platform employs industry-standard encryption and authentication methods to protect sensitive data. Users can rest assured that their information is safe while facilitating smooth transactions and communications.

Get more for Westminster Change Of Circumstances Form

- Amendment to prenuptial or premarital agreement colorado form

- Financial statements only in connection with prenuptial premarital agreement colorado form

- Revocation of premarital or prenuptial agreement colorado form

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children colorado form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497299728 form

- Colorado pre incorporation agreement shareholders agreement and confidentiality agreement colorado form

- Colorado bylaws for corporation colorado form

- Corporate records maintenance package for existing corporations colorado form

Find out other Westminster Change Of Circumstances Form

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe