One Time Credit Card Payment Authorization Form Household

What is the one time credit card payment authorization form household?

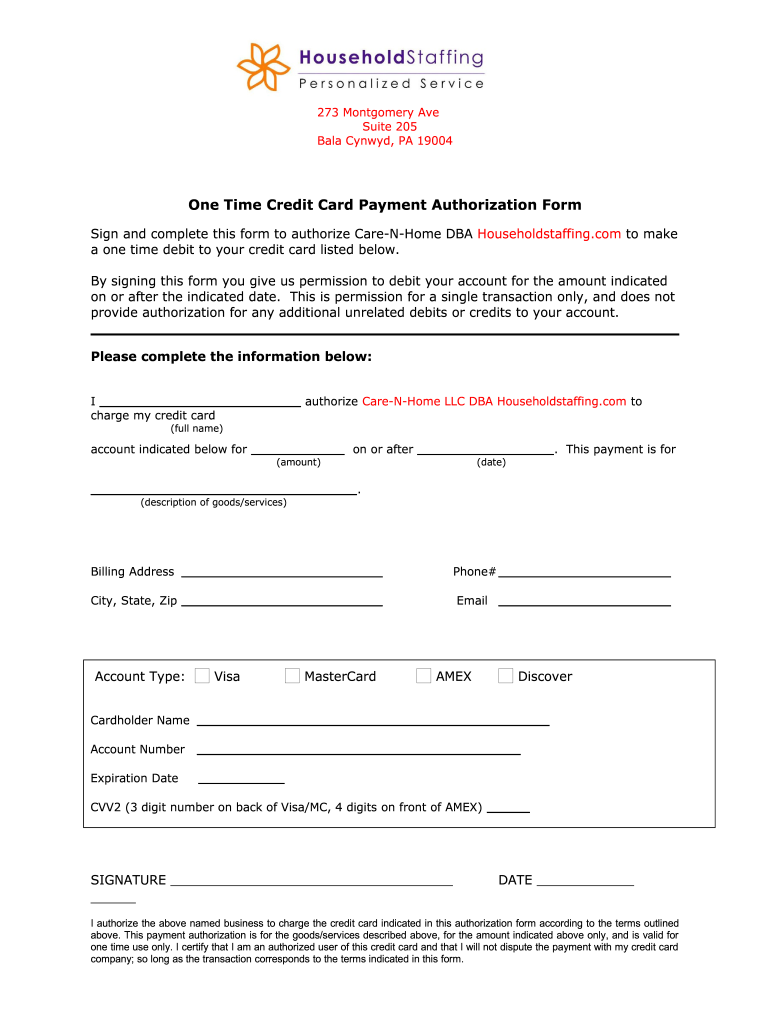

The one time credit card payment authorization form household is a document that allows individuals or businesses to authorize a one-time charge to their credit card. This form is essential for ensuring that the transaction is legitimate and that the cardholder has consented to the payment. It typically includes details such as the cardholder's name, credit card number, expiration date, and the amount to be charged. By using this form, businesses can protect themselves against fraudulent transactions and ensure compliance with payment processing regulations.

Steps to complete the one time credit card payment authorization form household

Completing the one time credit card payment authorization form household involves several straightforward steps:

- Begin by entering the cardholder's full name as it appears on the credit card.

- Provide the credit card number, ensuring that it is accurate and complete.

- Indicate the expiration date of the credit card.

- Specify the amount to be charged, making sure it aligns with the agreed transaction.

- Include any additional information, such as billing address or contact details, if required.

- Sign and date the form to confirm authorization.

Once completed, the form can be submitted to the relevant party for processing.

Legal use of the one time credit card payment authorization form household

The one time credit card payment authorization form household is legally binding when filled out correctly. It serves as proof of the cardholder's consent for the transaction, which is crucial in case of disputes. To ensure its legality, it is important to comply with relevant regulations, such as the Electronic Fund Transfer Act (EFTA) and the Fair Credit Billing Act (FCBA). These laws protect consumers and outline the requirements for electronic transactions, including the necessity of obtaining proper authorization.

Key elements of the one time credit card payment authorization form household

Several key elements must be included in the one time credit card payment authorization form household to ensure its effectiveness:

- Cardholder Information: Full name, billing address, and contact details.

- Credit Card Details: Credit card number, expiration date, and security code.

- Transaction Amount: The specific amount to be charged.

- Authorization Signature: A signature from the cardholder confirming their consent.

- Date: The date on which the authorization is provided.

Including these elements helps ensure clarity and reduces the risk of misunderstandings.

How to use the one time credit card payment authorization form household

The one time credit card payment authorization form household is used primarily in situations where a business needs to charge a customer’s credit card for a specific transaction. To use the form effectively:

- Identify the transaction that requires authorization.

- Provide the form to the customer, either electronically or in paper format.

- Ensure that the customer fills out all required fields accurately.

- Review the completed form for completeness and accuracy before processing the payment.

- Store the signed form securely for record-keeping and compliance purposes.

This process helps maintain transparency and protects both the customer and the business.

Examples of using the one time credit card payment authorization form household

The one time credit card payment authorization form household can be utilized in various scenarios, including:

- Service Providers: A contractor may require a one-time charge for home repairs.

- Event Registrations: An organization may use the form to collect fees for event participation.

- Online Purchases: E-commerce platforms may require authorization for a single transaction.

- Membership Fees: Gyms or clubs may charge a one-time fee for joining.

These examples illustrate the versatility of the form in facilitating secure transactions across different industries.

Quick guide on how to complete one time credit card payment authorization form household

The simplest method to obtain and sign One Time Credit Card Payment Authorization Form Household

At the level of your whole organization, inefficient workflows surrounding paper approvals can consume a signNow amount of working hours. Signing documents such as One Time Credit Card Payment Authorization Form Household is a routine aspect of operations in any enterprise, which is why the effectiveness of each agreement’s lifecycle signNowly impacts the overall performance of the company. With airSlate SignNow, signing your One Time Credit Card Payment Authorization Form Household can be as straightforward and quick as possible. This platform offers the latest version of nearly any form. Moreover, you can sign it instantly without the need to install external software on your computer or print hard copies.

How to obtain and sign your One Time Credit Card Payment Authorization Form Household

- Browse our collection by category or utilize the search box to locate the document you require.

- Check the form preview by clicking on Learn more to confirm it is the correct one.

- Press Get form to start editing immediately.

- Fill out your form and add any necessary information using the toolbar.

- Once finished, click the Sign tool to endorse your One Time Credit Card Payment Authorization Form Household.

- Select the signature method that works best for you: Draw, Create initials, or upload a photo of your handwritten signature.

- Click Done to complete editing and move on to document-sharing options as required.

With airSlate SignNow, you have everything you need to manage your documentation efficiently. You can find, fill out, edit, and even distribute your One Time Credit Card Payment Authorization Form Household in a single tab effortlessly. Enhance your workflows by utilizing one intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

Is it safe to give all my details: name, address, credit card number and CVV, when filling in a credit card authorization form?

Safety is relative.Ecommerce is safe as long as you know what to look for. If the site doesn't feel safe, go with your gut. Here are reasons why you have to fill out all of the information requested like name, address, CVV and full card number.1. When you are purchasing goods from a merchant, that merchant needs certain information to verify you are the valid cardholder. The merchant is assuming the real risk in assuming you aren't a fraudster using a stolen card. Put yourself in the merchant's position. Would you just take a card number and expiration date from some random cardholder and hope it's not a stolen card?2. Information such as Address and ZIP and CVV/CVC (Visa/MC) or CID (Amex/Disc) are tools to verify the card is valid. They mitigate risk for the merchant. Address and ZIP in a Card Not Present (CNP) situation also allow the merchant to get the best possible processing rates for that transaction. 3. A legitimate merchant will have a secure website (if this is the scenario to which you're referring). Look for 2 things when entering your payment information on the site.Secure Connection in the URL Address denoted by HTTPS:A Privacy and Security Statement that includes their Compliance and Security Assessor:4. Credit card numbers are created by a sophisticated algorithm which is why you can't simply input the last 4 digits into a form. There are sites that will allow you to enter the lat 4 digits once you have already registered with them to verify the choice of card, but this is after they have your card on file. There are billions of debit/credit cards in the world with different expiration dates, CVV values and different 11/12 beginning digits so the chances that your card is the only one with a unique 4 digit ending are pretty slim.What is not safe 1. Filling out a paper form with this same data and mailing it to someone. Imagine if it got lost and someone got this info. Shopping spree on the internet for them. It still amazes me that my water bill allows this info to be paid in this manner. I would never fill out a form with my credit card data an mail or fax it. A big no-no. 2. Never email you credit card data to anyone. This communication can be easily intercepted and go into the wrong hands. Email is a safe mode of transmitting sensitive card data..

-

How can I accept one time credit card payment?

I have an easier no-brainer solution for you.We have Zoho Checkout, which will let you create customized payment pages that you can embed in your website or just send the link to the customers to make the payment securely.You can take both one-time and recurring payments, and in fact allow the customers to decide the amount at checkout also.If you have a single page for payments, it will be free for you. You just need to pay for the gateway transaction fee.The solution can work for you as mPOS system, hence you need not pay for POS devices.Very soon we will be adding PayPal support as well for smoother and more payment options.Give it a go.Cheers!

-

How do payment gateways like authorize.net connect to credit card companies?

Well, a lengthy process has to be followed for this purpose. This process includes the list of following steps:Submit your credit card transaction to the Authorize .NET Payment Gateway.Authorize .NET sends the transaction to the processor through a secure connection.The transaction is then passed by the processor to the CCIS (Credit Card Interchange System).CCIS routes the transaction to the correct credit card issuer.Your transaction is then approved or rejected by your credit card issuers according to the amount/funds available in your credit card. Both the transaction results are then passed by your credit card issuer. If your transaction is approved by your credit card issuer then appropriate funds back through the same CCIS (Credit Card Interchange System).The final result of the transaction is relayed to the processor by CCIS system.The transaction is then relayed to the Authorize. NET Payment Gateway.The transaction’s result is then stored by the Authorize .NET. This result is then sent to the customer and merchant (You, the Merchant).If you are looking for a solution you need to integrate Authorize .NET with your store to be able to receive payments from customers for their shopping, you needAuthorize .NET Payment Gateway in WooCommerce extension for the following reasons:It provides support for multiple cards.It is easy to install.Offers security of payments.Offers features to help customers make payment without leaving your website.Well, the list of its amazing features doesn’t end here only. This is why I suggest you, to know more about the potential of this extension for your online business.

Create this form in 5 minutes!

How to create an eSignature for the one time credit card payment authorization form household

How to create an eSignature for the One Time Credit Card Payment Authorization Form Household in the online mode

How to create an electronic signature for your One Time Credit Card Payment Authorization Form Household in Chrome

How to make an eSignature for signing the One Time Credit Card Payment Authorization Form Household in Gmail

How to make an eSignature for the One Time Credit Card Payment Authorization Form Household straight from your smartphone

How to make an electronic signature for the One Time Credit Card Payment Authorization Form Household on iOS

How to make an eSignature for the One Time Credit Card Payment Authorization Form Household on Android

People also ask

-

What is a credit card authorization form?

A credit card authorization form is a document that allows a business to charge a customer's credit card for products or services. This form includes essential details such as the cardholder's name, card number, expiration date, and signature, ensuring that the transaction is authorized. Using airSlate SignNow, you can easily create and send credit card authorization forms for electronic signatures.

-

How can I create a credit card authorization form with airSlate SignNow?

Creating a credit card authorization form with airSlate SignNow is simple and user-friendly. You can start with a customizable template or build one from scratch within our platform. After entering the required information, you can send it to customers for quick eSigning, streamlining your payment process.

-

What are the benefits of using an electronic credit card authorization form?

Using an electronic credit card authorization form increases efficiency and security for your business. It reduces paperwork, speeds up the approval process, and minimizes errors associated with manual entry. Moreover, electronic signatures are legally binding, making them a reliable choice for transactions.

-

Is airSlate SignNow secure for processing credit card authorization forms?

Yes, airSlate SignNow prioritizes security for processing credit card authorization forms. Our platform employs advanced encryption and compliance with industry standards, ensuring that all sensitive information is protected. You can confidently capture authorizations while maintaining customer trust.

-

Can I integrate my payment system with airSlate SignNow for credit card authorization forms?

Absolutely! airSlate SignNow offers seamless integrations with various payment processing systems. This means you can easily link your existing payment solution to automate the collection of credit card authorization forms and streamline transactions right from our platform.

-

What features of airSlate SignNow enhance the use of credit card authorization forms?

airSlate SignNow provides features that enhance the creation and management of credit card authorization forms, including customizable templates, automated workflows, and tracking tools. You can monitor when forms are sent, opened, and signed, ensuring a smooth transaction process. These features help you maintain organization and efficiency.

-

How does using a credit card authorization form benefit my business?

Utilizing a credit card authorization form helps your business by ensuring that payments are authorized before services are rendered or products are shipped. This reduces the risk of chargebacks and fraud, contributing to a more secure transaction environment. Moreover, it enhances the customer experience by providing a clear and straightforward payment process.

Get more for One Time Credit Card Payment Authorization Form Household

- New mexico increase rent form

- Nm increase rent form

- 24 hour notice form

- 3 day notice to pay rent or lease terminated for nonresidential or commercial property new mexico form

- Assignment of mortgage by individual mortgage holder new mexico form

- Assignment of mortgage by corporate mortgage holder new mexico form

- Nm month form

- New mexico tenant form

Find out other One Time Credit Card Payment Authorization Form Household

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template