Tax Colorado Govcontact Us by MailContact Us by MailDepartment of Revenue Colorado Form

Steps to complete the Colorado DR 1778

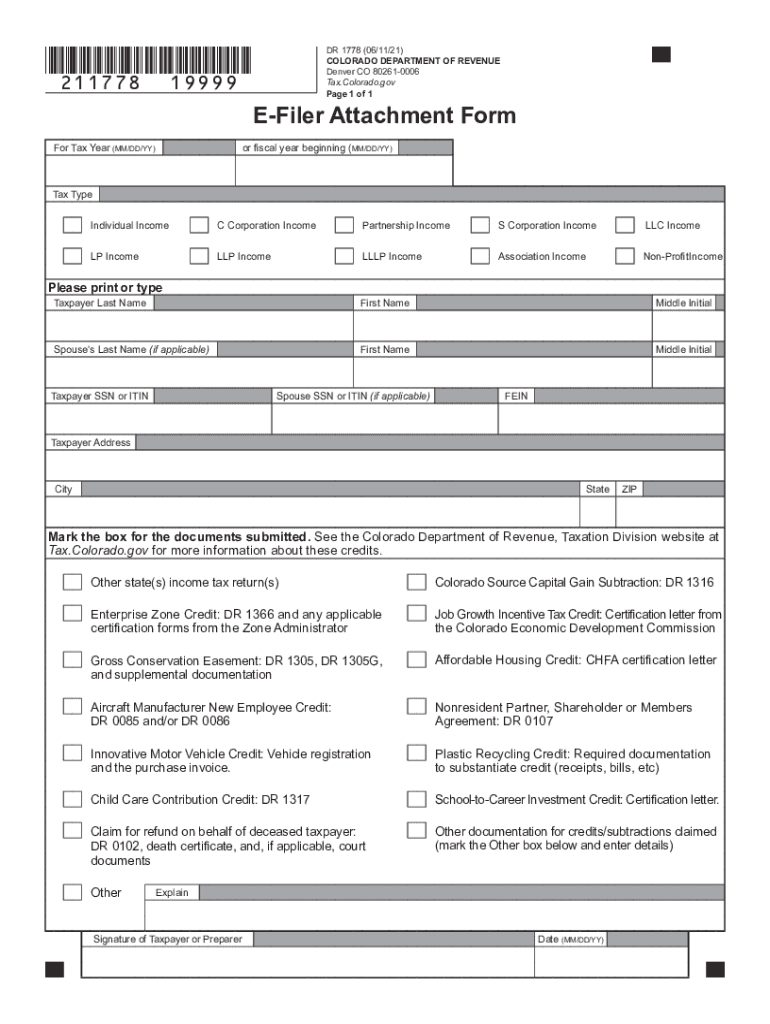

Completing the Colorado DR 1778 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including your personal details, income data, and any relevant tax documents. Ensure you have your Social Security number and any other identification numbers ready. Next, fill out the form carefully, following the instructions provided. Pay special attention to sections that require specific calculations or additional documentation. Once completed, review the form for any errors or omissions before submission.

Required Documents for the Colorado DR 1778

To successfully complete the Colorado DR 1778 form, you will need several supporting documents. These may include:

- Your most recent tax return

- W-2 forms from your employer(s)

- 1099 forms for any additional income

- Documentation for deductions or credits you plan to claim

- Any other relevant financial documents

Having these documents on hand will facilitate a smoother completion process and help ensure that your form is accurate and complete.

Form Submission Methods

The Colorado DR 1778 form can be submitted through various methods to accommodate different preferences. You can choose to file electronically using an approved e-filing system, which is often the fastest option. Alternatively, you can print the completed form and mail it to the appropriate address provided by the Colorado Department of Revenue. In-person submissions are also possible at designated locations if you prefer direct interaction. Each method has its own processing times, so consider your needs when choosing how to submit.

Legal use of the Colorado DR 1778

The Colorado DR 1778 form is legally binding when completed and submitted according to state regulations. It is essential to ensure that all information provided is accurate and truthful to avoid penalties or legal issues. The form serves as an official declaration of your tax situation, and submitting false information can lead to serious consequences. Always keep a copy of your completed form and any supporting documents for your records, as they may be required for future reference or audits.

Filing Deadlines / Important Dates

Staying aware of filing deadlines is crucial for compliance with Colorado tax regulations. Typically, the deadline for submitting the DR 1778 form aligns with the federal tax filing deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to verify the specific dates each tax year to avoid late fees or penalties. Marking these dates on your calendar can help ensure timely submission.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the Colorado DR 1778 can result in various penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is important to file your form accurately and on time to avoid these consequences. If you anticipate difficulties in meeting the requirements, consider seeking assistance or consulting with a tax professional to ensure compliance.

Quick guide on how to complete taxcoloradogovcontact us by mailcontact us by maildepartment of revenue colorado

Complete Tax colorado govcontact us by mailContact Us By MailDepartment Of Revenue Colorado effortlessly on any device

Online document management has become popular with businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents swiftly without any hindrance. Handle Tax colorado govcontact us by mailContact Us By MailDepartment Of Revenue Colorado on any platform with airSlate SignNow Android or iOS applications and simplify any document-centric process today.

The easiest way to edit and eSign Tax colorado govcontact us by mailContact Us By MailDepartment Of Revenue Colorado seamlessly

- Find Tax colorado govcontact us by mailContact Us By MailDepartment Of Revenue Colorado and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select relevant sections of your documents or redact confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you want to share your form, via email, text message (SMS), or invite link, or download it to your PC.

Forget about lost or misplaced documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Edit and eSign Tax colorado govcontact us by mailContact Us By MailDepartment Of Revenue Colorado and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Colorado Form DR 1778?

The Colorado Form DR 1778 is a legal document used for tax purposes in Colorado. It helps businesses manage and report their tax obligations efficiently. Understanding this form is essential for compliance and ensuring you meet all state requirements.

-

How can airSlate SignNow assist with the Colorado Form DR 1778?

airSlate SignNow streamlines the process of completing and signing the Colorado Form DR 1778. Our platform allows you to fill out the form electronically, ensuring that you save time and reduce errors. Plus, our solution is user-friendly, making it easy for anyone to navigate.

-

What are the pricing options for using airSlate SignNow for the Colorado Form DR 1778?

airSlate SignNow offers flexible pricing plans that cater to different business needs when handling the Colorado Form DR 1778. Our plans range from basic to advanced features, ensuring that you find an option that suits your requirements and budget. You can try the service risk-free with our trial period.

-

Is there a mobile app for managing the Colorado Form DR 1778 with airSlate SignNow?

Yes, airSlate SignNow provides a mobile app that allows you to manage the Colorado Form DR 1778 on-the-go. With our app, you can fill out, sign, and send forms directly from your mobile device, offering flexibility and convenience in your workflow.

-

What features are included with airSlate SignNow for the Colorado Form DR 1778?

With airSlate SignNow, you get a variety of features for managing the Colorado Form DR 1778, including eSignatures, custom templates, and secure storage. Our platform also integrates with various third-party applications, making it a versatile tool for your document management needs.

-

Can I integrate airSlate SignNow with other software for the Colorado Form DR 1778?

Absolutely! airSlate SignNow seamlessly integrates with popular software solutions, enhancing your ability to manage the Colorado Form DR 1778. Whether you use CRM systems or accounting software, our integrations ensure smooth data transfer and improved efficiency.

-

What are the benefits of using airSlate SignNow for the Colorado Form DR 1778?

Using airSlate SignNow for the Colorado Form DR 1778 provides numerous benefits, including faster turnaround times and reduced paperwork. Our eSignature capabilities ensure a legally binding process while simplifying remote collaboration among team members and clients alike.

Get more for Tax colorado govcontact us by mailContact Us By MailDepartment Of Revenue Colorado

- Small business accounting package hawaii form

- Company employment policies and procedures package hawaii form

- Newly divorced individuals package hawaii form

- Contractors forms package hawaii

- Power of attorney for sale of motor vehicle hawaii form

- Wedding planning or consultant package hawaii form

- Hunting forms package hawaii

- Identity theft recovery package hawaii form

Find out other Tax colorado govcontact us by mailContact Us By MailDepartment Of Revenue Colorado

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now