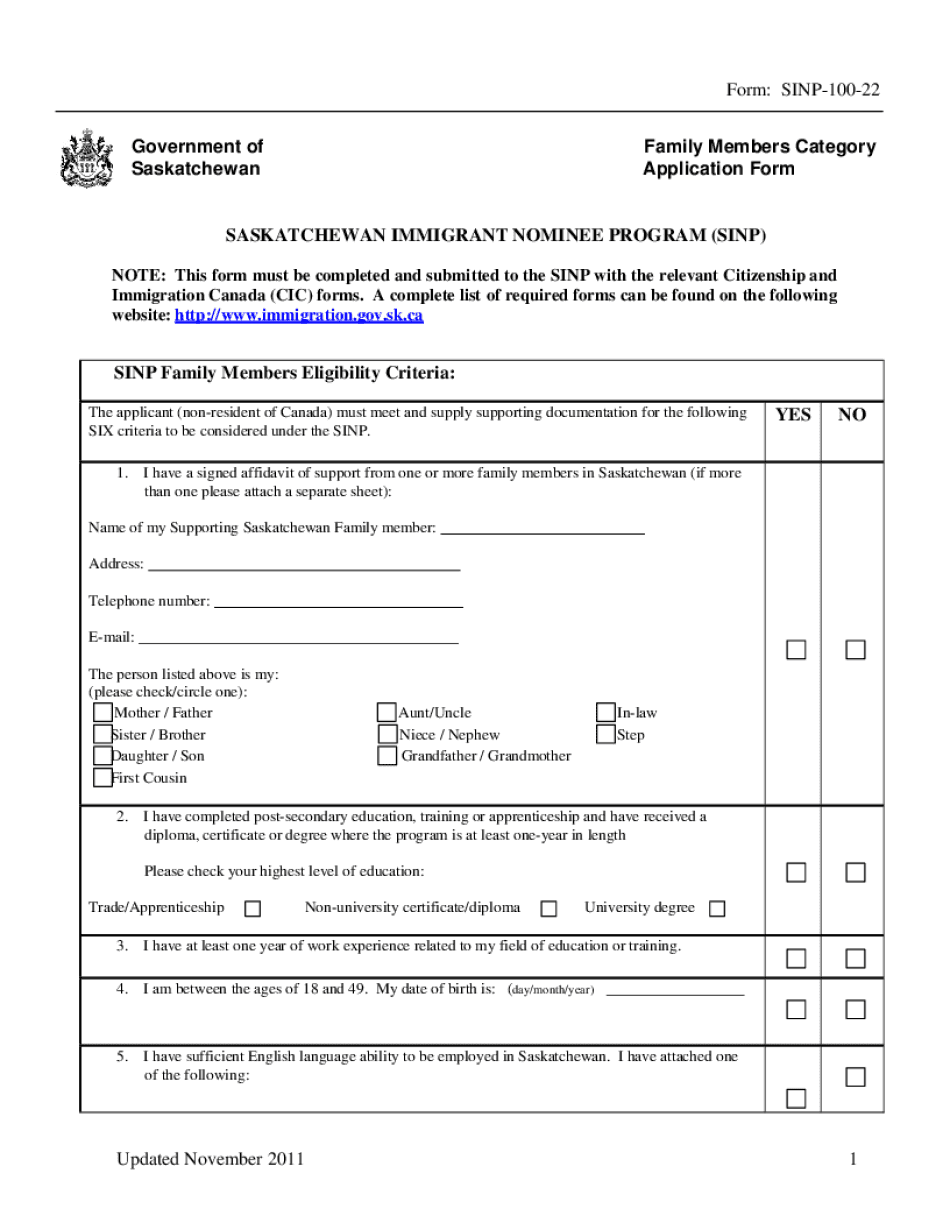

Sinp 100 22 Form

What is the Sinp 100 22 Form

The Sinp 100 22 Form is a specific document used primarily for reporting certain tax-related information in the United States. This form is designed to facilitate the collection of data required by the Internal Revenue Service (IRS) and other relevant authorities. It is essential for individuals and businesses to accurately complete this form to ensure compliance with federal tax laws. Understanding the purpose of the Sinp 100 22 Form is crucial for effective tax management and reporting.

How to use the Sinp 100 22 Form

Using the Sinp 100 22 Form involves several straightforward steps. First, ensure you have the correct version of the form, which can be obtained from official sources. Next, gather all necessary information and documentation required to complete the form. This may include personal details, financial information, and any relevant tax identification numbers. Once you have all the information, carefully fill out the form, ensuring accuracy to avoid potential issues with the IRS. After completing the form, you can submit it according to the specified submission methods.

Steps to complete the Sinp 100 22 Form

Completing the Sinp 100 22 Form involves a systematic approach:

- Obtain the latest version of the form from a reliable source.

- Read the instructions carefully to understand the requirements.

- Gather all necessary documents and information, such as income statements and identification numbers.

- Fill out the form accurately, ensuring all fields are completed as required.

- Review the completed form for any errors or omissions.

- Submit the form through the appropriate channels, whether online, by mail, or in person.

Legal use of the Sinp 100 22 Form

The legal use of the Sinp 100 22 Form is governed by IRS regulations and guidelines. To ensure that the form is considered valid, it must be completed accurately and submitted on time. Additionally, the information provided must be truthful and verifiable. Failure to comply with these legal requirements may result in penalties or other legal consequences. It is advisable to consult with a tax professional if there are any uncertainties regarding the legal implications of using this form.

Who Issues the Form

The Sinp 100 22 Form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers have the necessary resources to comply with federal tax laws. It is essential to use the most current version of the form issued by the IRS to avoid any discrepancies or issues during the filing process.

Form Submission Methods

Submitting the Sinp 100 22 Form can be done through various methods, depending on the preferences of the filer and the requirements set by the IRS. Common submission methods include:

- Online submission through the IRS e-filing system, which is often the fastest method.

- Mailing a paper copy of the completed form to the designated IRS address.

- In-person submission at local IRS offices, which may be suitable for those needing assistance.

Choosing the right submission method can help ensure timely processing and compliance with tax deadlines.

Quick guide on how to complete sinp 100 22 form

Complete Sinp 100 22 Form effortlessly on any device

Online document management has gained popularity among companies and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Sinp 100 22 Form on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to alter and electronically sign Sinp 100 22 Form with ease

- Find Sinp 100 22 Form and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Alter and electronically sign Sinp 100 22 Form and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Sinp 100 22 Form?

The Sinp 100 22 Form is a specific document required for signing and submitting various agreements and contracts. It is designed to streamline the signing process and ensure compliance with administrative requirements. Utilizing the Sinp 100 22 Form with airSlate SignNow makes it easy to manage and store signed documents securely.

-

How can I fill out the Sinp 100 22 Form using airSlate SignNow?

Filling out the Sinp 100 22 Form with airSlate SignNow is straightforward and efficient. You can upload your document, add fields for signatures, dates, and other necessary information, and then send it out for eSignature. This digital process reduces paperwork hassles and speeds up document turnaround time.

-

Is airSlate SignNow a cost-effective solution for using the Sinp 100 22 Form?

Yes, airSlate SignNow provides a cost-effective solution for managing the Sinp 100 22 Form. With flexible pricing plans, businesses can choose the package that best fits their needs, ensuring they only pay for the features they use. This affordability, combined with the platform’s extensive functionalities, makes it ideal for organizations of all sizes.

-

What features does airSlate SignNow offer for the Sinp 100 22 Form?

airSlate SignNow offers a range of features specifically designed for the Sinp 100 22 Form, including customizable templates, document sharing, and eSignature capabilities. Additionally, it provides tracking options to monitor document status and reminders for pending signatures. These features enhance workflow efficiency and ensure timely completion of important documents.

-

Can I integrate the Sinp 100 22 Form with other tools?

Absolutely! airSlate SignNow supports integrations with various third-party applications, allowing you to connect the Sinp 100 22 Form with your existing workflow. Popular integrations include CRM systems, cloud storage services, and project management tools, enabling seamless document management across platforms.

-

What are the benefits of using the Sinp 100 22 Form with airSlate SignNow?

Using the Sinp 100 22 Form with airSlate SignNow improves efficiency, accuracy, and security in your document signing process. It eliminates the need for physical paperwork, reduces the time needed for signing, and enhances record keeping. Furthermore, the platform's compliance features ensure that your documents meet legal standards.

-

How secure is the Sinp 100 22 Form when using airSlate SignNow?

Security is a top priority for airSlate SignNow, especially when it comes to the Sinp 100 22 Form. The platform utilizes bank-level encryption and secure storage options to safeguard your sensitive information. With comprehensive audit trails and compliance measures, you can trust that your documents are handled safely and efficiently.

Get more for Sinp 100 22 Form

- Essential legal life documents for new parents georgia form

- Georgia general form

- Small business accounting package georgia form

- Designation of standby guardian georgia form

- Georgia procedures form

- Revocation of power of attorney for child care or children georgia form

- Newly divorced individuals package georgia form

- Ga 10 6 form

Find out other Sinp 100 22 Form

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe