Telenor Microfinance Bank Loan Calculator Form

What is the Telenor Microfinance Bank Loan Calculator

The Telenor Microfinance Bank Loan Calculator is a digital tool designed to assist users in estimating their potential loan amounts, monthly payments, and interest rates. This calculator simplifies the loan application process by providing a clear understanding of financial commitments before applying for a loan. By inputting various parameters such as loan amount, term, and interest rate, users can obtain a detailed breakdown of their expected payments, making it easier to plan their finances accordingly.

How to use the Telenor Microfinance Bank Loan Calculator

Using the Telenor Microfinance Bank Loan Calculator is straightforward. Users begin by entering the desired loan amount and the loan term, typically expressed in months. Next, they input the applicable interest rate. Once these details are filled in, the calculator generates an estimate of monthly payments and the total cost of the loan. This process allows users to adjust their inputs to see how changes in loan amount or interest rate affect their payments, enabling informed financial decisions.

Eligibility Criteria

To qualify for a loan through Telenor Microfinance Bank, applicants must meet specific eligibility criteria. Generally, these include being a resident of the United States, having a steady source of income, and being of legal age, typically eighteen years or older. Additionally, the bank may require applicants to provide proof of identity and financial stability, such as bank statements or pay stubs. Meeting these criteria is essential for a successful loan application.

Application Process & Approval Time

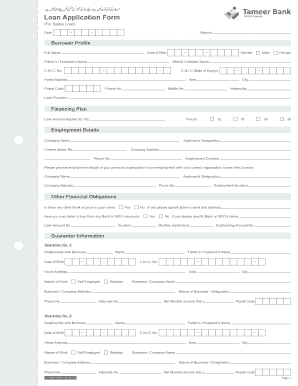

The application process for a Telenor Microfinance Bank loan can be completed online. Applicants need to fill out the loan application form, providing necessary personal and financial information. After submission, the bank reviews the application, which may take a few business days. Approval time can vary based on the applicant's financial profile and the completeness of the submitted information. Once approved, the funds are typically disbursed quickly, allowing borrowers to access their loans without significant delays.

Required Documents

When applying for a Telenor Microfinance Bank loan, applicants must prepare several documents to support their application. Commonly required documents include a government-issued ID for identity verification, proof of income such as recent pay stubs or tax returns, and bank statements to demonstrate financial stability. Having these documents ready can expedite the application process and improve the chances of approval.

Legal use of the Telenor Microfinance Bank Loan Calculator

The Telenor Microfinance Bank Loan Calculator is designed to comply with applicable laws and regulations governing financial tools and lending practices. Users can rely on the calculator to provide accurate estimates based on the inputs they provide. However, it is important to note that the results are estimates and not guarantees of loan approval or specific terms. Understanding the legal framework surrounding loan applications can help users navigate the process more effectively.

Key elements of the Telenor Microfinance Bank Loan Calculator

Key elements of the Telenor Microfinance Bank Loan Calculator include its user-friendly interface, customizable input fields for loan terms, and real-time calculation of monthly payments. Additionally, the calculator often provides visual aids, such as graphs or charts, to help users understand their payment schedules better. These features enhance the overall user experience, making it easier for individuals to make informed financial decisions regarding their loans.

Quick guide on how to complete telenor microfinance bank loan calculator

Accomplish Telenor Microfinance Bank Loan Calculator effortlessly on any device

Digital document management has gained traction with both businesses and individuals. It offers an excellent environmentally friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely preserve it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without delays. Handle Telenor Microfinance Bank Loan Calculator on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related operation today.

How to modify and eSign Telenor Microfinance Bank Loan Calculator effortlessly

- Obtain Telenor Microfinance Bank Loan Calculator and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select relevant sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Verify the information and click on the Done button to preserve your modifications.

- Decide how you wish to send your form, via email, SMS, or a shared link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Telenor Microfinance Bank Loan Calculator to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Telenor Microfinance Bank loan calculator?

The Telenor Microfinance Bank loan calculator is an online tool that helps users estimate their potential loan repayments. By simply entering the loan amount and terms, customers can assess the monthly payments and total interest, making financial planning easier.

-

How do I use the Telenor Microfinance Bank loan calculator?

To use the Telenor Microfinance Bank loan calculator, enter your desired loan amount, interest rate, and repayment duration. The calculator will then provide you with detailed information on your monthly payments and total repayment amount, allowing you to make informed decisions.

-

Is there a cost associated with using the Telenor Microfinance Bank loan calculator?

No, the Telenor Microfinance Bank loan calculator is free to use. This tool is designed to help you plan your finances without any hidden fees, enabling you to easily analyze your loan options.

-

What features does the Telenor Microfinance Bank loan calculator offer?

The Telenor Microfinance Bank loan calculator offers several features including customizable loan amounts, varying interest rates, and adjustable repayment terms. This flexibility allows users to simulate different scenarios to see what fits their financial situation best.

-

What are the benefits of using the Telenor Microfinance Bank loan calculator?

Using the Telenor Microfinance Bank loan calculator helps you plan your finances effectively by giving you a clear picture of your obligations. It saves time in researching loans and simplifies the decision-making process, ensuring you choose the right loan for your needs.

-

Can the Telenor Microfinance Bank loan calculator integrate with other financial tools?

Currently, the Telenor Microfinance Bank loan calculator operates as a standalone tool. However, you can manually input the results into your personal finance software to keep track of your overall financial health.

-

Is the Telenor Microfinance Bank loan calculator suitable for all loan types?

The Telenor Microfinance Bank loan calculator is specifically designed for microfinance loans offered by Telenor. While it may give a general idea of loan costs, you should consult with a financial advisor for specific mortgage or personal loan calculations.

Get more for Telenor Microfinance Bank Loan Calculator

Find out other Telenor Microfinance Bank Loan Calculator

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free