2306 Form Editable Download

What is the 2306 Form Editable Download

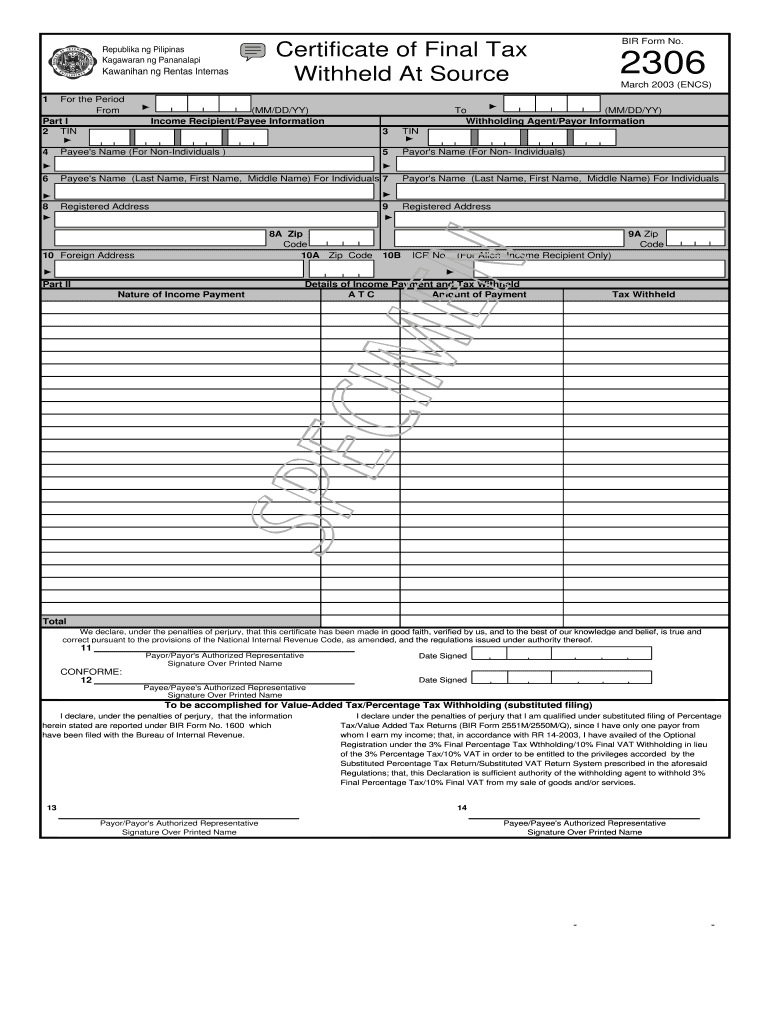

The 2306 form, often referred to as the 2306 bir form excel, is a document used primarily for tax purposes in the United States. This form allows individuals and businesses to report specific financial information to the Internal Revenue Service (IRS). The editable version of the 2306 form provides users with the flexibility to fill out the document digitally, ensuring accuracy and ease of use. By utilizing an editable format, users can easily input their information, make corrections, and save their progress without the need for printing or scanning.

Steps to complete the 2306 Form Editable Download

Completing the 2306 form editable download involves several straightforward steps:

- Download the editable version of the 2306 form from a trusted source.

- Open the form using compatible software that supports Excel formats.

- Carefully enter your personal and financial information in the designated fields.

- Review the completed form for accuracy, ensuring all required sections are filled out.

- Save the document to preserve your changes.

- If necessary, print the form for your records or for submission.

Legal use of the 2306 Form Editable Download

The 2306 form editable download is legally recognized when completed accurately and submitted in accordance with IRS guidelines. To ensure its legal standing, the form must be signed and dated appropriately, and all information provided must be truthful and complete. Utilizing a platform that complies with eSignature laws, such as ESIGN and UETA, can enhance the legal validity of your electronic submissions.

IRS Guidelines

The IRS provides specific guidelines regarding the use and submission of the 2306 form. These guidelines outline the necessary information to be reported, filing deadlines, and the acceptable methods for submission. It is essential for users to familiarize themselves with these requirements to avoid potential penalties and ensure compliance with tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The 2306 form can be submitted through various methods, depending on the preferences of the filer and the requirements of the IRS. Common submission methods include:

- Online submission through authorized e-filing platforms.

- Mailing a printed copy of the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

Examples of using the 2306 Form Editable Download

The 2306 form editable download can be utilized in various scenarios, including:

- Individuals reporting their annual income for tax purposes.

- Businesses documenting expenses and deductions to ensure accurate tax filings.

- Self-employed individuals tracking income and expenses for quarterly tax estimates.

Quick guide on how to complete 2306 form editable download 14537040

Effortlessly prepare 2306 Form Editable Download on any device

Digital document management has gained traction among businesses and individuals. It offers a superb eco-friendly substitute to conventional printed and signed paperwork, as you can access the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents swiftly without any holdups. Manage 2306 Form Editable Download on any device with the airSlate SignNow applications for Android or iOS and simplify any document-based procedure today.

Efficiently modify and electronically sign 2306 Form Editable Download with ease

- Locate 2306 Form Editable Download and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive details with tools specifically designed for that by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Decide how you would like to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign 2306 Form Editable Download and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 2306 bir form excel, and why is it important?

The 2306 bir form excel is a crucial document used in Turkey for reporting income and tax obligations. It provides businesses and individuals with a streamlined way to manage their financial declarations. Utilizing the 2306 bir form excel can help ensure compliance with tax regulations.

-

How can airSlate SignNow help with the 2306 bir form excel?

airSlate SignNow simplifies the process of preparing and signing the 2306 bir form excel by providing an easy-to-use platform for document management. With features like e-signature and document tracking, users can quickly complete and send their forms securely. This saves time and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the 2306 bir form excel?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. The investment in the tool can be justified by the time saved in managing the 2306 bir form excel, as well as the compliance benefits. A free trial is also available for users to explore its features.

-

What features does airSlate SignNow offer for the 2306 bir form excel?

airSlate SignNow provides a range of features for the 2306 bir form excel, including customizable templates, e-signature functionality, and secure cloud storage. These features enhance collaboration and make it easier to manage and share your forms effectively.

-

Can I integrate airSlate SignNow with other tools for my 2306 bir form excel?

Absolutely! airSlate SignNow supports integrations with various third-party applications, enhancing its functionality for managing the 2306 bir form excel. Popular integrations include popular CRM systems and cloud storage services, making your workflow more efficient.

-

What are the benefits of using airSlate SignNow for the 2306 bir form excel?

Utilizing airSlate SignNow for the 2306 bir form excel provides several benefits, including increased efficiency and improved accuracy in document management. The platform's ease of use allows users to focus on their core business while ensuring seamless compliance with tax requirements.

-

Is airSlate SignNow secure for handling the 2306 bir form excel?

Yes, security is a priority for airSlate SignNow. The platform employs robust encryption and complies with industry standards to protect your 2306 bir form excel and personal data. You can confidently manage sensitive documents knowing they are safeguarded.

Get more for 2306 Form Editable Download

- Pennsylvania office lease agreement form

- Pa security deposit form

- Pa affidavit form

- Pennsylvania trust form

- Pennsylvania pennsylvania installments fixed rate promissory note secured by residential real estate form

- Rhode island 5 day notice form

- Rhode island assignment of mortgage by corporate mortgage holder form

- Rhode island guaranty or guarantee of payment of rent form

Find out other 2306 Form Editable Download

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application