Www Michigan Govtaxes 2368 Principal Residence Exemption PRE Affidavit Michigan Form

Understanding the Michigan Principal Residence Exemption Affidavit

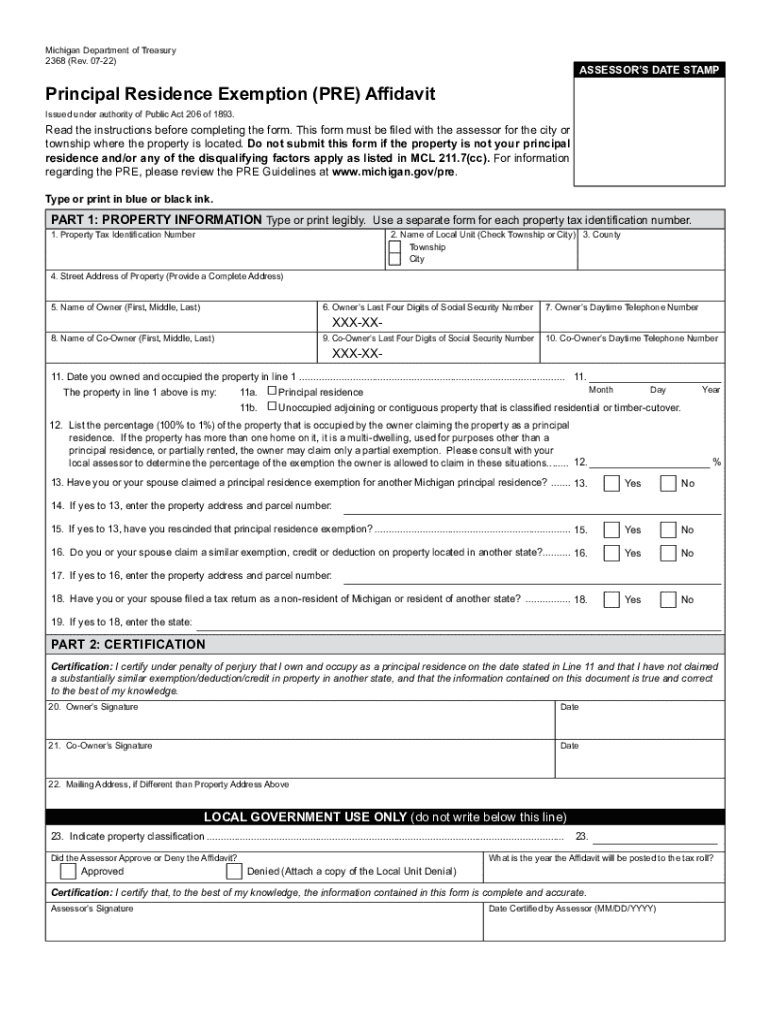

The Michigan form 2368, commonly known as the Principal Residence Exemption (PRE) Affidavit, is a crucial document for homeowners in Michigan. This form allows homeowners to claim an exemption from property taxes on their primary residence. By filing this affidavit, eligible homeowners can reduce their property tax burden, making homeownership more affordable. The exemption applies to the primary residence, which is defined as the dwelling where the owner resides for more than six months of the year.

Steps to Complete the Michigan Principal Residence Exemption Affidavit

Filling out the Michigan form 2368 involves several key steps to ensure accuracy and compliance. First, gather necessary information, including your name, address, and property details. Next, complete the form by providing the required personal and property information. Be sure to indicate that the property is your principal residence. After completing the form, sign and date it to validate your claim. Finally, submit the form to your local tax assessor's office by the specified deadline to ensure you receive the exemption for the current tax year.

Eligibility Criteria for the Michigan Principal Residence Exemption

To qualify for the Michigan form 2368, certain eligibility criteria must be met. The property must be the owner's primary residence, and the owner must occupy the home for more than six months each year. Additionally, the homeowner must not claim a principal residence exemption on any other property. If the homeowner is married, both spouses must be listed on the form if they jointly own the property. Meeting these criteria is essential to successfully obtaining the exemption.

Required Documents for the Michigan Principal Residence Exemption Affidavit

When preparing to submit the Michigan form 2368, homeowners should have several documents ready. These may include proof of residency, such as a driver’s license or utility bills, to confirm the property is indeed the primary residence. Additionally, any previous property tax statements may be helpful for reference. Having these documents on hand can streamline the application process and ensure that all necessary information is provided.

Legal Use of the Michigan Principal Residence Exemption Affidavit

The Michigan form 2368 is legally binding, provided it is completed and submitted in accordance with state regulations. The form must be filed with the local tax assessor's office to be recognized for tax purposes. It is essential to ensure that all information is accurate and truthful, as providing false information can result in penalties, including the loss of the exemption and potential fines. Understanding the legal implications of this form helps homeowners navigate the process with confidence.

Form Submission Methods for the Michigan Principal Residence Exemption Affidavit

The Michigan form 2368 can be submitted through various methods to accommodate different preferences. Homeowners may choose to submit the form by mail, delivering it directly to their local tax assessor's office. Alternatively, some jurisdictions may allow for in-person submissions, providing an opportunity to ask questions if needed. It's important to check with the local tax authority for specific submission guidelines, including any online options that may be available.

Quick guide on how to complete wwwmichigangovtaxes 2368 principal residence exemption pre affidavit michigan

Effortlessly Prepare Www michigan govtaxes 2368 Principal Residence Exemption PRE Affidavit Michigan on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed materials, allowing you to find the right template and securely store it online. airSlate SignNow provides all the essential tools to create, modify, and eSign your documents swiftly without delays. Handle Www michigan govtaxes 2368 Principal Residence Exemption PRE Affidavit Michigan on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Edit and eSign Www michigan govtaxes 2368 Principal Residence Exemption PRE Affidavit Michigan with Ease

- Find Www michigan govtaxes 2368 Principal Residence Exemption PRE Affidavit Michigan and click Get Form to begin.

- Utilize the tools available to complete your document.

- Mark important sections of your documents or conceal sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Www michigan govtaxes 2368 Principal Residence Exemption PRE Affidavit Michigan and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is form 2368 and how can airSlate SignNow help with it?

Form 2368 is a document that may require signatures for approval or processing. airSlate SignNow enables users to easily eSign and send form 2368 online, streamlining the workflow and ensuring that documents are signed quickly and securely.

-

What features does airSlate SignNow offer for managing form 2368?

airSlate SignNow offers features like customizable templates, real-time tracking of document status, and integrations with various applications to enhance the management of form 2368. These tools help reduce processing time and improve collaboration among stakeholders.

-

Is there a mobile app for signing form 2368 on the go?

Yes, airSlate SignNow provides a mobile app that allows users to sign form 2368 from any device. This portability ensures that you can handle document signing anytime, anywhere, without being tethered to a desktop computer.

-

What is the pricing structure for using airSlate SignNow to manage form 2368?

airSlate SignNow offers flexible pricing plans tailored to fit different business needs. Users can select a plan based on the volume of documents they manage, including specific options for processing documents like form 2368 at an affordable rate.

-

How secure is airSlate SignNow for signing form 2368?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption and compliance with legal standards to ensure that form 2368 and other sensitive documents are protected during transmission and storage.

-

Can I integrate airSlate SignNow with my existing software to handle form 2368?

Absolutely! airSlate SignNow supports integrations with a variety of software applications such as CRM and project management tools. This capability allows businesses to seamlessly handle form 2368 within their existing workflows.

-

What are the benefits of using airSlate SignNow for form 2368?

Using airSlate SignNow for form 2368 provides numerous benefits, including enhanced efficiency, reduced turnaround times, and improved accuracy in document management. It enables teams to collaborate effectively and ensures that no steps are missed in the approval process.

Get more for Www michigan govtaxes 2368 Principal Residence Exemption PRE Affidavit Michigan

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles maine form

- Letter from tenant to landlord about landlords failure to make repairs maine form

- Letter from landlord to tenant as notice that rent was voluntarily lowered in exchange for tenant agreeing to make repairs 497310784 form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession maine form

- Letter from tenant to landlord about illegal entry by landlord maine form

- Letter from landlord to tenant about time of intent to enter premises maine form

- Letter from tenant to landlord containing notice to cease unjustified nonacceptance of rent maine form

- Letter from tenant to landlord about sexual harassment maine form

Find out other Www michigan govtaxes 2368 Principal Residence Exemption PRE Affidavit Michigan

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation