Dario Busch 2001-2026

What is the UCC 1 filing birth certificate?

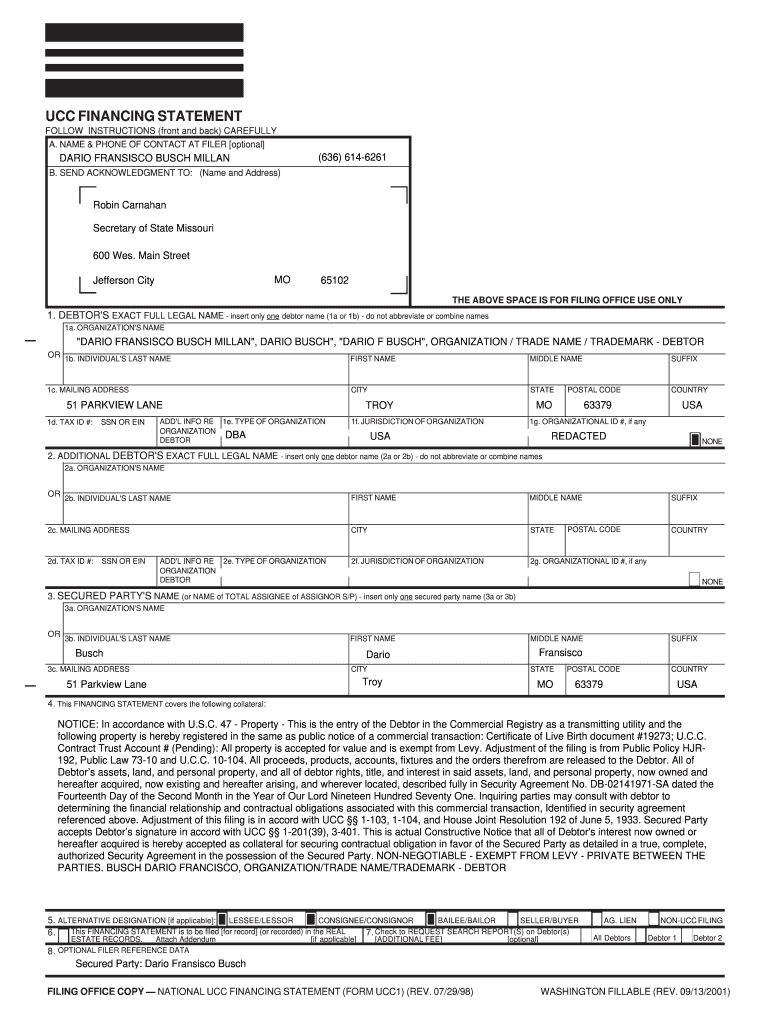

The UCC 1 filing birth certificate refers to a legal document used to secure a lender's interest in a debtor's assets. This form, known as the UCC-1 financing statement, is filed under the Uniform Commercial Code (UCC) and serves as public notice of a secured party's interest in collateral. The UCC 1 filing is crucial for establishing priority over other creditors in the event of a debtor's bankruptcy or liquidation. Understanding this document is essential for businesses and individuals seeking to protect their financial interests.

How to complete the UCC 1 filing birth certificate

Completing the UCC 1 filing birth certificate involves several important steps. First, gather necessary information, including the debtor's name and address, the secured party's details, and a description of the collateral. Next, accurately fill out the UCC-1 form, ensuring all information is correct to avoid delays. Once completed, the form can be submitted electronically or via mail to the appropriate state filing office. Each state may have specific requirements, so it is essential to verify the submission method and any associated fees.

Legal use of the UCC 1 filing birth certificate

The UCC 1 filing birth certificate is legally binding when filed correctly. It serves as a public record, providing notice to other creditors regarding the secured party's interest in the collateral. Compliance with state laws and regulations is vital to ensure the document's enforceability. Additionally, the form must be signed by the appropriate parties, and electronic signatures are accepted in many jurisdictions, provided they meet legal standards. Understanding these legalities helps protect your rights as a secured party.

Key elements of the UCC 1 filing birth certificate

Several key elements are essential for a valid UCC 1 filing birth certificate. These include:

- Debtor Information: Accurate legal name and address of the debtor.

- Secured Party Information: Name and address of the secured party.

- Collateral Description: A clear and specific description of the collateral being secured.

- Signature: Required signatures from the secured party and, if applicable, the debtor.

- Filing Office: Identification of the state filing office where the document will be submitted.

Filing methods for the UCC 1 filing birth certificate

The UCC 1 filing birth certificate can be submitted through various methods, depending on state regulations. Common methods include:

- Online Submission: Many states offer electronic filing options, allowing for quick and efficient submission.

- Mail: The form can be printed and mailed to the appropriate state office, though this may take longer for processing.

- In-Person Filing: Some jurisdictions allow for in-person submissions at designated filing offices, providing immediate confirmation of filing.

Common mistakes in UCC 1 filings

When completing the UCC 1 filing birth certificate, several common mistakes can lead to complications. These include:

- Incorrect Debtor Information: Failing to provide the correct legal name or address can invalidate the filing.

- Insufficient Collateral Description: A vague or unclear description of the collateral may result in challenges to the secured party's claim.

- Missing Signatures: Not obtaining the necessary signatures can render the form unenforceable.

- Filing in the Wrong State: Submitting the form to the incorrect jurisdiction can lead to delays and potential loss of priority.

Quick guide on how to complete ucc 1 8 form

Prepare Dario Busch effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, enabling you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Dario Busch on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related workflow today.

The simplest way to modify and eSign Dario Busch without hassle

- Find Dario Busch and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, either via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements with just a few clicks from any device you prefer. Modify and eSign Dario Busch and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill a UCC-1 form?

Usually you fill it out online through the Secretary of State’s website, but paper forms are used in some jurisdictions. In Louisiana, you file it at the local parish.Be certain to know exactly who the debtor is and spell the debtor’s legal name perfectly. Any minor clerical error can be fatal to protecting your security interest. Oddly spelling your own name correctly is not critical (shrug).

-

As a Canadian working in the US on a TN-1 visa should I fill out the IRS Form W-8BEN or W9?

Use the W-9. The W-8BEN is used for cases where you are not working in the U.S., but receiving income relating to a U.S. Corporation, Trust or Partnership.

-

Can I fill out the SBI PO online form from 10/8/1997 birth date?

Age limit is 30 years for SBI PO so u have crossed the age limit however there is age relaxation of 3 years for OBC category and 5 years for SC/ST/PWD(person with disability)

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

Create this form in 5 minutes!

How to create an eSignature for the ucc 1 8 form

How to make an eSignature for your Ucc 1 8 Form in the online mode

How to generate an electronic signature for your Ucc 1 8 Form in Chrome

How to generate an electronic signature for putting it on the Ucc 1 8 Form in Gmail

How to create an electronic signature for the Ucc 1 8 Form straight from your smart phone

How to make an electronic signature for the Ucc 1 8 Form on iOS devices

How to create an eSignature for the Ucc 1 8 Form on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to Dario Busch?

airSlate SignNow is a powerful eSignature solution that enables businesses to send and sign documents effortlessly. Dario Busch is an advocate for innovative digital solutions like airSlate SignNow, which streamline workflows and enhance document management efficiency.

-

How much does airSlate SignNow cost?

The pricing for airSlate SignNow is designed to be cost-effective, catering to businesses of all sizes. Dario Busch often emphasizes the affordability of airSlate SignNow, making it accessible for small businesses and enterprises alike.

-

What features does airSlate SignNow offer?

airSlate SignNow includes a variety of features such as customizable templates, secure eSigning, and document tracking. Dario Busch highlights the user-friendly interface of airSlate SignNow, which simplifies the signing process for both senders and recipients.

-

How can airSlate SignNow benefit my business?

Using airSlate SignNow can signNowly improve your business efficiency by reducing the time spent on document handling. Dario Busch advocates for the increased productivity that comes with adopting airSlate SignNow as it helps teams focus on core activities rather than paperwork.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers seamless integrations with various platforms such as CRM systems, cloud storage, and productivity tools. Dario Busch supports the versatility of airSlate SignNow, which enhances its functionality and allows for a more connected workflow.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow employs advanced security measures to protect sensitive documents during the signing process. Dario Busch reassures users that their data is safe, with features like encryption and compliance with industry standards.

-

How easy is it to use airSlate SignNow for new users?

airSlate SignNow is designed to be intuitive, making it easy for new users to navigate and utilize its features. Dario Busch often points out the minimal learning curve associated with airSlate SignNow, allowing teams to get started quickly and efficiently.

Get more for Dario Busch

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children new york form

- Mutual wills or last will and testaments for unmarried persons living together with minor children new york form

- Living together agreement 497321475 form

- Paternity law and procedure handbook new york form

- Bill of sale in connection with sale of business by individual or corporate seller new york form

- Order discontinuation of treatment new york form

- Petition family offense form

- Ny disposition form

Find out other Dario Busch

- How Do I Sign Louisiana Roommate Rental Agreement Template

- Sign Maine Lodger Agreement Template Computer

- Can I Sign New Jersey Lodger Agreement Template

- Sign New York Lodger Agreement Template Later

- Sign Ohio Lodger Agreement Template Online

- Sign South Carolina Lodger Agreement Template Easy

- Sign Tennessee Lodger Agreement Template Secure

- Sign Virginia Lodger Agreement Template Safe

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online

- Sign Nebraska Mortgage Quote Request Simple

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple