Oromia Revenue Authority Declaration Form

What is the Oromia Revenue Authority Declaration Form

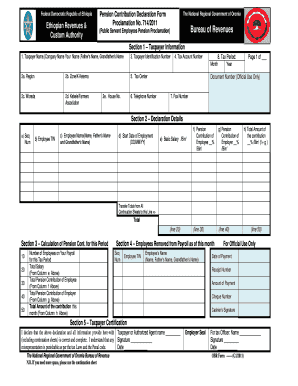

The Oromia Revenue Authority Declaration Form is a crucial document used for declaring income and tax obligations within the Oromia region. This form is essential for individuals and businesses to report their financial activities accurately to the Oromia Revenue Authority. It serves as a formal declaration of income, allowing the authority to assess tax liabilities and ensure compliance with regional tax laws. The form is designed to capture various types of income, including wages, business profits, and other sources of revenue.

How to use the Oromia Revenue Authority Declaration Form

Using the Oromia Revenue Authority Declaration Form involves a few straightforward steps. First, individuals must obtain the form, which is available in both digital and printable formats. Once the form is in hand, users should carefully fill out all required sections, ensuring that all information is accurate and complete. After completing the form, it can be submitted electronically through the Oromia Revenue Authority website or printed and mailed to the appropriate office. It is important to keep a copy of the submitted form for personal records.

Steps to complete the Oromia Revenue Authority Declaration Form

Completing the Oromia Revenue Authority Declaration Form requires attention to detail. Here are the key steps:

- Download the form from the Oromia Revenue Authority website or obtain a physical copy.

- Fill in personal identification information, including name, address, and taxpayer identification number.

- Report all sources of income accurately, ensuring that amounts are clearly stated.

- Include any deductions or credits applicable to your situation.

- Review the completed form for accuracy before submission.

- Submit the form electronically or by mail, depending on your preference.

Legal use of the Oromia Revenue Authority Declaration Form

The Oromia Revenue Authority Declaration Form is legally binding when filled out and submitted according to the regulations set forth by the Oromia Revenue Authority. It is important to ensure that all provided information is truthful and complete, as any discrepancies may lead to penalties or legal consequences. The form must be submitted by the designated deadlines to avoid issues with compliance. Additionally, electronic submissions must meet specific legal standards to be considered valid.

Required Documents

When filling out the Oromia Revenue Authority Declaration Form, certain documents may be required to support the information provided. These documents typically include:

- Proof of income, such as pay stubs or business financial statements.

- Identification documents, like a government-issued ID or taxpayer identification number.

- Any relevant tax documents from previous years.

- Documentation for deductions or credits claimed.

Form Submission Methods

The Oromia Revenue Authority Declaration Form can be submitted through various methods to accommodate different preferences. Users can choose to:

- Submit the form electronically via the Oromia Revenue Authority website, which may offer a more efficient processing time.

- Print the completed form and mail it to the appropriate office, ensuring that it is sent before the deadline.

- Deliver the form in person to the local Oromia Revenue Authority office, if preferred.

Quick guide on how to complete oromia revenue authority declaration form

Complete Oromia Revenue Authority Declaration Form effortlessly on any device

Web-based document management has gained traction among enterprises and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without any delays. Handle Oromia Revenue Authority Declaration Form on any device using airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Oromia Revenue Authority Declaration Form without hassle

- Find Oromia Revenue Authority Declaration Form and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight essential sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Oromia Revenue Authority Declaration Form to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Oromia Revenue Authority Declaration Form?

The Oromia Revenue Authority Declaration Form is a necessary document for taxpayers in the Oromia region of Ethiopia. This form is used to declare various types of income and assets to the revenue authority. Businesses can streamline this process using airSlate SignNow's eSigning solution.

-

How can airSlate SignNow simplify the completion of the Oromia Revenue Authority Declaration Form?

AirSlate SignNow simplifies the completion of the Oromia Revenue Authority Declaration Form by allowing users to fill out and sign documents electronically. This reduces paperwork and provides a faster turnaround time. Additionally, our platform ensures that all signatures are legally binding.

-

Is there a cost associated with using airSlate SignNow for the Oromia Revenue Authority Declaration Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan includes features that can simplify the completion of forms like the Oromia Revenue Authority Declaration Form. Visit our pricing page for more details on the plans available.

-

What features does airSlate SignNow offer for handling the Oromia Revenue Authority Declaration Form?

AirSlate SignNow provides features such as template creation, automated workflows, and eSignature capabilities specifically designed for forms like the Oromia Revenue Authority Declaration Form. These features help you manage your documents efficiently and ensure compliance with local regulations.

-

Can I integrate airSlate SignNow with other applications for my business?

Absolutely! airSlate SignNow supports integrations with various applications, allowing you to connect your workflows seamlessly. By integrating with your favorite tools, you can easily manage the completion of the Oromia Revenue Authority Declaration Form and other necessary documents.

-

What are the benefits of using airSlate SignNow for tax declaration forms?

Using airSlate SignNow for tax declaration forms, like the Oromia Revenue Authority Declaration Form, provides numerous benefits such as time efficiency, reduced paper waste, and secure document handling. Our platform ensures that every document is easy to access, sign, and store digitally.

-

Is the Oromia Revenue Authority Declaration Form legally binding when signed electronically?

Yes, signatures made through airSlate SignNow on the Oromia Revenue Authority Declaration Form are legally binding and compliant with both local and international laws. This ensures that your completed forms are valid and acceptable to the authorities.

Get more for Oromia Revenue Authority Declaration Form

- Legal last will and testament form for divorced person not remarried with adult and minor children arizona

- Mutual wills package with last wills and testaments for married couple with adult children arizona form

- Will married couple 497298077 form

- Mutual wills package with last wills and testaments for married couple with minor children arizona form

- Legal last will and testament form for married person with adult and minor children from prior marriage arizona

- Legal last will and testament form for married person with adult and minor children arizona

- Mutual wills package with last wills and testaments for married couple with adult and minor children arizona form

- Arizona widow form

Find out other Oromia Revenue Authority Declaration Form

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile