Business Property Statement BOE 571 L and BOE 571 D Form

What is the Business Property Statement BOE 571 L and BOE 571 D

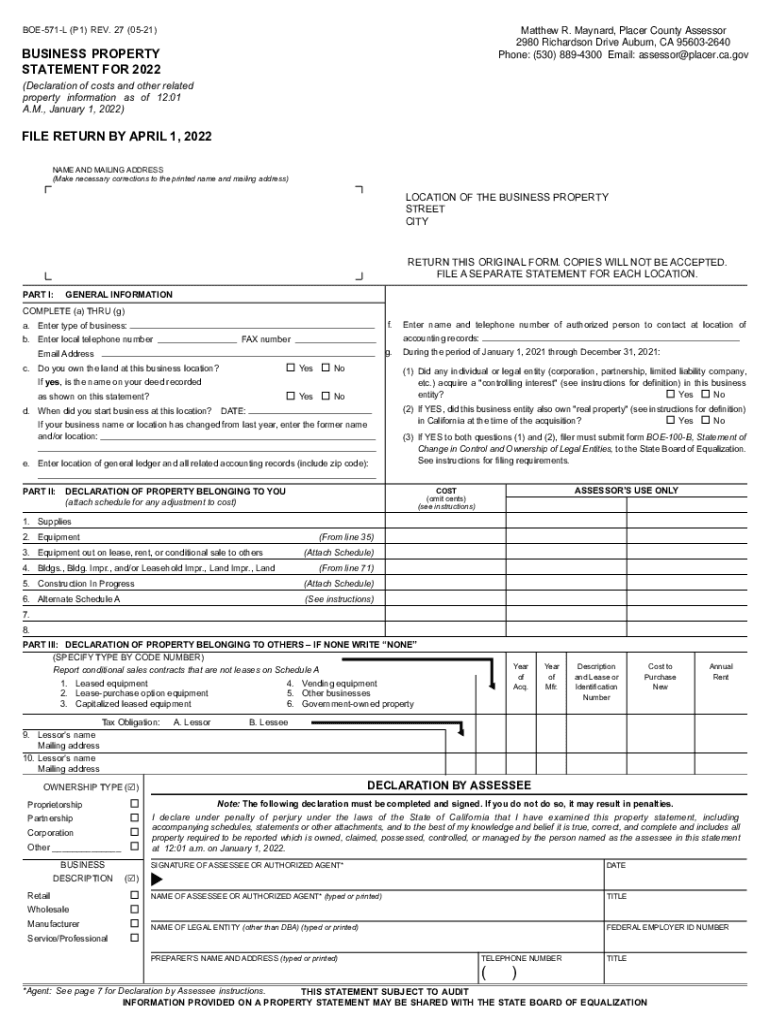

The Business Property Statement, known as BOE 571 L and BOE 571 D, is a vital document used in the United States for reporting business personal property to local tax authorities. This statement is essential for ensuring that businesses accurately declare their assets, which may include equipment, furniture, and other personal property used in the operation of the business. The BOE 571 L is specifically designed for businesses that own or lease property, while the BOE 571 D is used for property that is not subject to local assessment. Understanding these forms is crucial for compliance with local tax regulations.

Steps to Complete the Business Property Statement BOE 571 L and BOE 571 D

Completing the Business Property Statement involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your business assets, including purchase dates, costs, and current values. Next, fill out the appropriate sections of the BOE 571 L or BOE 571 D, providing detailed descriptions of each asset. It is important to double-check all entries for accuracy. Finally, submit the completed form to the local tax authority by the specified deadline. Ensuring that the form is filled out correctly can help avoid penalties and ensure that your business remains in good standing with local regulations.

Legal Use of the Business Property Statement BOE 571 L and BOE 571 D

The legal use of the Business Property Statement is paramount for businesses to maintain compliance with tax laws. These forms serve as official records of business personal property, which local tax authorities use to assess property taxes. Failing to file these statements can lead to penalties, including fines and additional taxes. Moreover, accurate reporting can protect businesses from audits and disputes regarding property values. Understanding the legal implications of these forms helps businesses navigate their responsibilities effectively.

Key Elements of the Business Property Statement BOE 571 L and BOE 571 D

Key elements of the Business Property Statement include detailed information about the business, such as the business name, address, and type of ownership. Additionally, the forms require a comprehensive list of all personal property owned or leased, including descriptions, purchase dates, and values. Accurate categorization of assets is crucial, as it affects the assessment of property taxes. Understanding these elements ensures that businesses provide complete and accurate information, which is essential for compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Business Property Statement vary by state and local jurisdiction but are typically due annually. It is essential for businesses to be aware of these deadlines to avoid late fees and penalties. Many jurisdictions require the forms to be filed by a specific date, often in the spring. Keeping track of these important dates helps ensure timely submission and compliance with local tax regulations.

Form Submission Methods (Online / Mail / In-Person)

Businesses have several options for submitting the Business Property Statement. Many local tax authorities offer online submission through their official websites, providing a convenient and efficient way to file. Alternatively, businesses can choose to mail the completed forms or deliver them in person to the local tax office. Understanding the available submission methods can help streamline the filing process and ensure that the forms are received by the deadline.

Quick guide on how to complete business property statement boe 571 l and boe 571 d

Effortlessly prepare Business Property Statement BOE 571 L And BOE 571 D on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly option to traditional printed and signed forms, as you can easily find the appropriate template and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Business Property Statement BOE 571 L And BOE 571 D on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Business Property Statement BOE 571 L And BOE 571 D with ease

- Obtain Business Property Statement BOE 571 L And BOE 571 D and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you would like to share your form—via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Business Property Statement BOE 571 L And BOE 571 D and ensure seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a property statement lease?

A property statement lease is a document that outlines the terms and conditions of leasing a property. It includes key details such as rental price, duration, and obligations of both the landlord and tenant. Understanding this document is crucial for successful property management.

-

How does airSlate SignNow simplify the property statement lease process?

airSlate SignNow streamlines the property statement lease process by providing easy-to-use tools for document creation and digital signing. With customizable templates, users can quickly generate leases that meet their specific needs. This efficiency saves time and reduces the likelihood of errors.

-

Is there a cost associated with using airSlate SignNow for property statement leases?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Users can choose a plan that best fits their budget and requirements for handling property statement leases. This flexibility makes it a cost-effective solution for businesses of all sizes.

-

What features does airSlate SignNow offer for managing property statement leases?

airSlate SignNow offers features like templates for property statement leases, eSignature functionality, document tracking, and storage. These features ensure that all lease agreements are easily accessible and securely stored. Additionally, automated reminders help ensure timely document handling.

-

Can I integrate airSlate SignNow with other tools for property statement lease management?

Yes, airSlate SignNow integrates seamlessly with various third-party applications. Whether you're using property management software or CRM tools, you can easily connect them to enhance the functionality for managing property statement leases. This integration fosters a smoother workflow.

-

How can airSlate SignNow help ensure compliance with property statement leases?

Using airSlate SignNow helps ensure compliance with property statement leases by providing legally binding eSignatures and a clear audit trail. This transparency in the documentation process strengthens the validity of lease agreements. Plus, the platform's secure cloud storage keeps all documents safe and organized.

-

What are the benefits of using eSignatures for property statement leases?

eSignatures provide numerous benefits for property statement leases, including increased speed in obtaining signatures and reduced paper usage. They eliminate the need for in-person meetings, allowing agreements to be signed from anywhere. This convenience makes the leasing process more efficient for both parties.

Get more for Business Property Statement BOE 571 L And BOE 571 D

- Missouri property 497313414 form

- General partnership package missouri form

- Mo contract deed form

- Statutory equivalent of living will or declaration missouri form

- Missouri attorney form

- Revised uniform anatomical gift act donation missouri

- Employment hiring process package missouri form

- Anatomical gift act donation by a person under 18 years old missouri form

Find out other Business Property Statement BOE 571 L And BOE 571 D

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe