Exemption Certificates for Sales TaxExemption Certificates for Sales TaxExemption Certificates for Sales TaxExemption Certificat Form

Understanding the Maryland Sales Tax Exemption Form

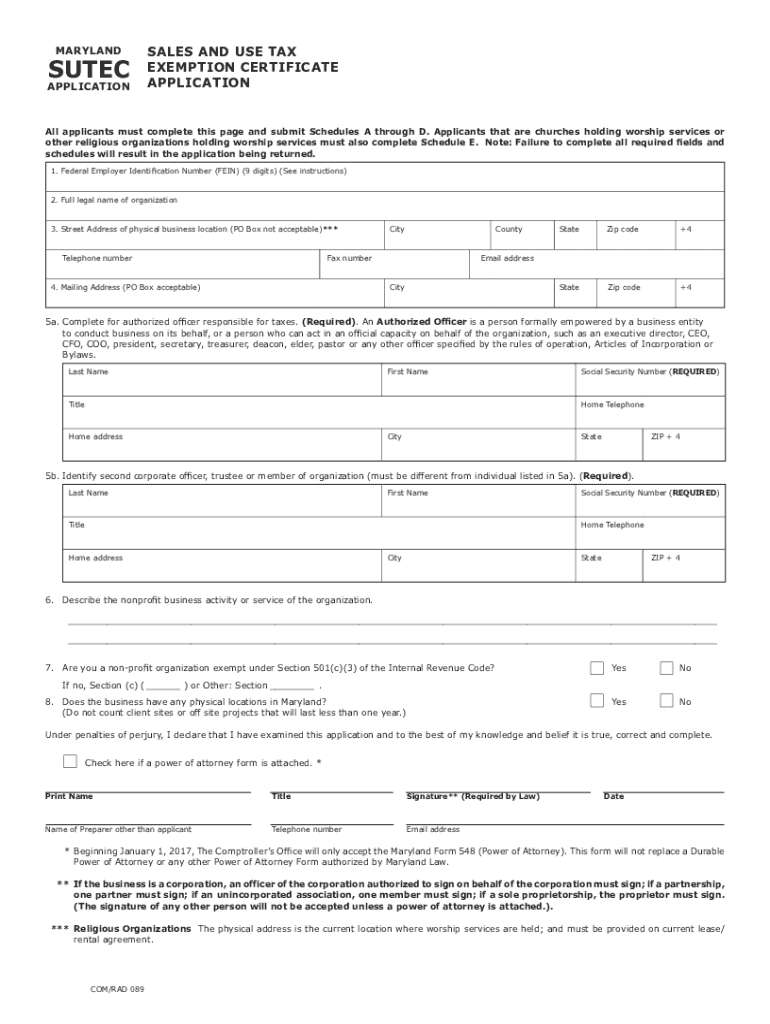

The Maryland sales tax exemption form is an essential document that allows eligible purchasers to buy certain goods and services without paying sales tax. This exemption applies to specific categories of buyers, including non-profit organizations, government entities, and certain businesses. Understanding the purpose and legal framework of this form is crucial for ensuring compliance and maximizing potential savings.

Exemption certificates are recognized under Maryland law and must be properly completed to be valid. They serve as proof that the buyer qualifies for the exemption, which helps sellers avoid collecting sales tax on exempt transactions.

Steps to Complete the Maryland Sales Tax Exemption Form

Completing the Maryland sales tax exemption form involves several key steps to ensure accuracy and compliance. Begin by gathering the necessary information, including the purchaser's name, address, and the reason for the exemption. Next, fill out the form completely, ensuring all sections are addressed.

Once the form is filled out, the authorized representative of the purchasing entity must sign and date the document. It is important to keep a copy of the completed form for your records, as it may be required for future transactions or audits.

Eligibility Criteria for the Maryland Sales Tax Exemption

To qualify for the Maryland sales tax exemption, purchasers must meet specific eligibility criteria. Generally, the exemption applies to non-profit organizations, government agencies, and certain businesses that use the purchased items exclusively for exempt purposes. For instance, non-profits must demonstrate their tax-exempt status under IRS guidelines.

Businesses must also ensure that the items purchased with the exemption are used for qualified activities, such as manufacturing or resale. Understanding these criteria is essential to avoid potential penalties for misuse of the exemption.

Legal Use of the Maryland Sales Tax Exemption Form

The legal use of the Maryland sales tax exemption form is governed by state tax laws. It is critical to ensure that the form is used only for eligible purchases and that all information provided is accurate and truthful. Misuse of the exemption can lead to significant penalties, including back taxes and fines.

Additionally, sellers are responsible for verifying the validity of the exemption certificate presented to them. This verification process helps maintain compliance with state laws and protects both buyers and sellers from potential legal issues.

Required Documents for the Maryland Sales Tax Exemption

When applying for a sales tax exemption in Maryland, certain documents may be required to substantiate the claim. These documents typically include proof of tax-exempt status, such as a 501(c)(3) letter for non-profits or government identification for state and local agencies.

It is advisable to keep these documents organized and readily available, as they may be requested during audits or when presenting the exemption form to sellers.

Form Submission Methods

The Maryland sales tax exemption form can be submitted through various methods, depending on the seller's preferences. It can be presented in person at the point of sale, mailed to the seller, or submitted electronically if the seller accepts digital copies of the form.

Regardless of the submission method, it is essential to ensure that the form is completed accurately and signed by an authorized representative to maintain its validity.

Quick guide on how to complete exemption certificates for sales taxexemption certificates for sales taxexemption certificates for sales taxexemption

Effortlessly Prepare Exemption Certificates For Sales TaxExemption Certificates For Sales TaxExemption Certificates For Sales TaxExemption Certificat on Any Device

Online document management has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow offers you all the resources required to create, edit, and eSign your documents swiftly and efficiently. Manage Exemption Certificates For Sales TaxExemption Certificates For Sales TaxExemption Certificates For Sales TaxExemption Certificat on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The easiest method to edit and eSign Exemption Certificates For Sales TaxExemption Certificates For Sales TaxExemption Certificates For Sales TaxExemption Certificat seamlessly

- Find Exemption Certificates For Sales TaxExemption Certificates For Sales TaxExemption Certificates For Sales TaxExemption Certificat and then click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for those purposes.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device you prefer. Edit and eSign Exemption Certificates For Sales TaxExemption Certificates For Sales TaxExemption Certificates For Sales TaxExemption Certificat and ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Maryland sales tax exemption form?

The Maryland sales tax exemption form is a document that allows qualifying organizations to make purchases without paying sales tax. This form can be completed by qualifying entities such as non-profits or governmental agencies, enabling them to save money on eligible purchases.

-

How do I obtain the Maryland sales tax exemption form?

You can obtain the Maryland sales tax exemption form from the official Maryland government website or through your local tax authority. It is important to ensure that you provide all required information to avoid processing delays.

-

How does airSlate SignNow help with the Maryland sales tax exemption form?

airSlate SignNow simplifies the process of filling out, signing, and submitting the Maryland sales tax exemption form. Our platform ensures secure document management and electronic signatures, making it easy for you to handle your tax exemption needs efficiently.

-

Is there a cost associated with using airSlate SignNow for the Maryland sales tax exemption form?

airSlate SignNow offers various pricing plans, including a free trial, allowing you to evaluate our eSigning features. Once you determine your needs, you can choose a cost-effective plan that includes access to the Maryland sales tax exemption form and other document management tools.

-

Can I integrate airSlate SignNow with other tools for managing the Maryland sales tax exemption form?

Yes, airSlate SignNow integrates seamlessly with various applications and tools, including cloud storage services and CRM systems. This allows you to manage the Maryland sales tax exemption form alongside your other business documents with ease.

-

What benefits does using airSlate SignNow provide for handling the Maryland sales tax exemption form?

Using airSlate SignNow for the Maryland sales tax exemption form offers numerous benefits, including enhanced security, real-time tracking, and reduced processing time. Our easy-to-use interface ensures that you can complete the form quickly and effectively.

-

Are there any specific eligibility criteria for the Maryland sales tax exemption form?

Eligibility for the Maryland sales tax exemption form typically includes non-profit organizations, government entities, and certain educational institutions. To qualify, you must provide proof of your status, which airSlate SignNow can help you document and submit efficiently.

Get more for Exemption Certificates For Sales TaxExemption Certificates For Sales TaxExemption Certificates For Sales TaxExemption Certificat

- Montana homestead form

- Montana homestead declaration form

- Unmarried head of household homestead declaration montana form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497316500 form

- Montana annual form

- Notices resolutions simple stock ledger and certificate montana form

- Minutes for organizational meeting montana montana form

- Sample transmittal letter to secretary of states office to file articles of incorporation montana montana form

Find out other Exemption Certificates For Sales TaxExemption Certificates For Sales TaxExemption Certificates For Sales TaxExemption Certificat

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online