Mw507 Form

What is the Maryland MW507?

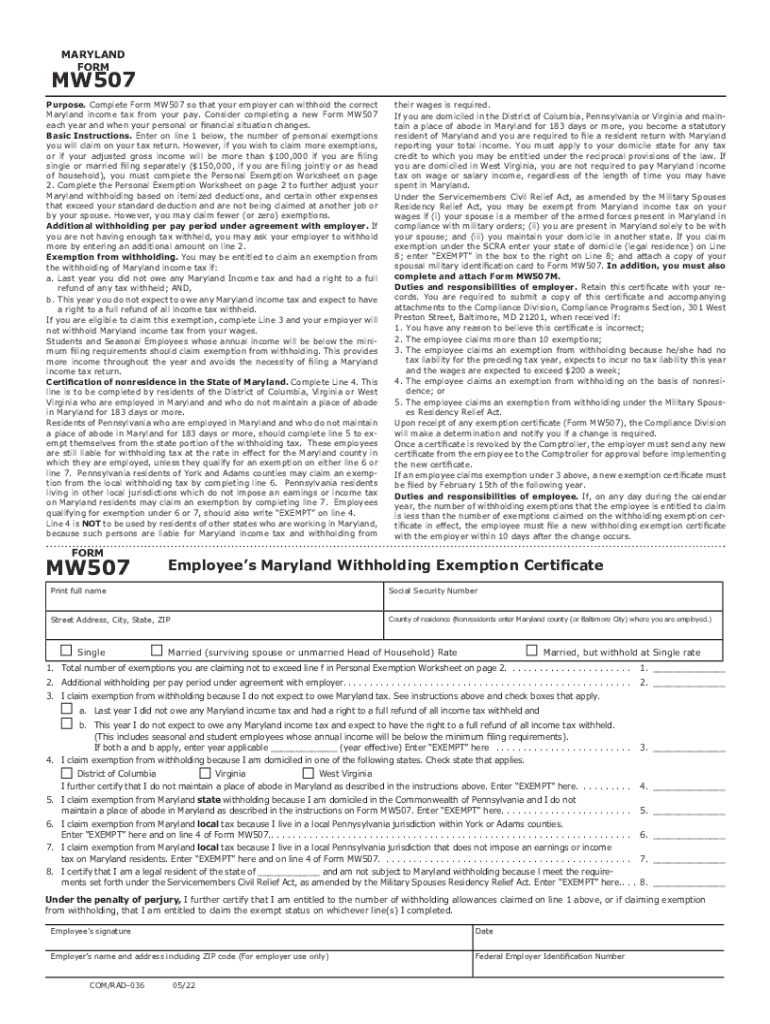

The Maryland MW507 is a state-specific form used for withholding tax purposes. This form is essential for employees in Maryland who need to declare their exemptions from state income tax withholding. It helps employers determine the correct amount of state tax to withhold from an employee's paycheck. The MW507 is particularly important for individuals who may qualify for exemptions based on specific criteria, such as having no tax liability in the previous year or expecting to have none in the current year. Understanding the MW507 is crucial for compliance with Maryland tax regulations.

Steps to Complete the MW507

Completing the MW507 involves several straightforward steps. First, obtain the latest version of the form, which can be downloaded from official state resources. Next, fill out personal information, including your name, address, and Social Security number. Then, indicate your filing status and any exemptions you wish to claim. It is important to provide accurate information to avoid issues with tax withholding. After completing the form, review it for accuracy and submit it to your employer. Keeping a copy for your records is also advisable.

Legal Use of the MW507

The MW507 is legally binding when completed accurately and submitted to your employer. It complies with Maryland state tax laws, which require employers to withhold the appropriate amount of state income tax from employee wages. To ensure that the form is legally valid, it must be filled out truthfully, and any exemptions claimed should be substantiated. Failure to comply with the legal requirements surrounding the MW507 can result in penalties for both the employee and the employer.

How to Obtain the MW507

The MW507 form can be easily obtained online. It is available for download on the Maryland State Comptroller’s website. Alternatively, you can request a physical copy from your employer or local tax office. Ensure that you are using the most current version of the form, as tax laws and requirements may change annually. Having the latest form is essential for proper compliance and to avoid any complications with your tax withholding.

State-Specific Rules for the MW507

Maryland has specific rules governing the use of the MW507. These rules dictate who can claim exemptions and under what circumstances. For instance, individuals who had no tax liability in the previous year may qualify for exemption. Additionally, the form must be submitted to the employer at the start of employment or whenever there are changes in tax status. Familiarizing yourself with these state-specific rules is crucial for ensuring compliance and optimizing your tax withholding.

Examples of Using the MW507

Using the MW507 can vary based on individual circumstances. For example, a recent graduate starting their first job may complete the form to claim exemption from withholding if they expect no tax liability. Conversely, a married couple filing jointly may use the form to adjust their withholding based on their combined income. Each situation is unique, and understanding how to apply the MW507 according to personal tax situations can lead to better financial outcomes.

Filing Deadlines / Important Dates

Filing deadlines for the MW507 typically align with the start of employment or changes in tax status. It is advisable to submit the form as soon as you begin a new job or if you experience a significant life change, such as marriage or divorce. Additionally, keeping track of annual tax deadlines is essential for ensuring compliance with state tax regulations. Being proactive about these important dates can help prevent unnecessary tax liabilities.

Quick guide on how to complete mw507

Handle Mw507 effortlessly on any gadget

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the proper form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents rapidly without any delays. Manage Mw507 on any gadget with airSlate SignNow’s Android or iOS applications and enhance any document-focused task today.

Steps to edit and eSign Mw507 with ease

- Find Mw507 and click on Get Form to initiate.

- Use the tools we offer to fill out your form.

- Mark relevant sections of your documents or obscure sensitive details with features that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to keep your changes.

- Select how you wish to send your form, whether by email, SMS, or sharing a link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Mw507 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Maryland withholding for 2022?

Maryland withholding for 2022 refers to the amount of income tax that employers are required to withhold from their employees' paychecks. This system is designed to help employees manage their tax liabilities throughout the year. Understanding Maryland withholding for 2022 is essential for accurate payroll processing.

-

How can airSlate SignNow assist with Maryland withholding 2022 forms?

AirSlate SignNow streamlines the process of completing and signing Maryland withholding 2022 forms electronically. Our platform allows for easy document management and ensures compliance with state regulations. You can quickly fill out, send, and eSign forms related to Maryland withholding 2022, saving time and resources.

-

What are the costs associated with using airSlate SignNow for 2022?

The pricing for airSlate SignNow is competitive and varies depending on the features you need. For accessing tools that help manage Maryland withholding 2022 forms, you can choose from several plans tailored to different business sizes. Each plan offers a cost-effective solution to meet your document signing needs.

-

Are there any specific features in airSlate SignNow that cater to Maryland withholding 2022?

Yes, airSlate SignNow offers features specifically designed to address the requirements of Maryland withholding 2022. Users can track the signing process in real-time, ensuring that all necessary documents are completed and submitted correctly. Our platform also provides customization options for forms related to Maryland withholding.

-

What compliance measures does airSlate SignNow offer for Maryland withholding 2022?

AirSlate SignNow ensures compliance with Maryland’s tax withholding regulations for the year 2022 by providing up-to-date templates and document validations. Our solution incorporates digital signatures that meet legal standards, making it easy to generate compliant documents. This helps businesses avoid penalties and ensures accurate filing.

-

Can airSlate SignNow integrate with payroll systems for Maryland withholding 2022?

Absolutely, airSlate SignNow can integrate with various payroll systems to simplify Maryland withholding 2022 processes. By linking your payroll software to our eSignature platform, you can efficiently manage and file the necessary forms. This integration helps to reduce manual data entry and enhances overall workflow efficiency.

-

What are the benefits of using airSlate SignNow for managing Maryland withholding 2022?

Using airSlate SignNow for Maryland withholding 2022 offers numerous benefits, including increased efficiency and reduced paperwork. The platform enables quick document preparation and facilitates faster eSigning, leading to improved turnaround times. Additionally, our cloud-based solution allows for remote access, making it easier to collaborate with teams.

Get more for Mw507

- Delaware bankruptcy 7 form

- Bill of sale with warranty by individual seller delaware form

- Bill of sale with warranty for corporate seller delaware form

- Bill of sale without warranty by individual seller delaware form

- Bill of sale without warranty by corporate seller delaware form

- Chapter 13 plan delaware form

- Chapter 13 plan analysis delaware form

- Verification of creditors matrix delaware form

Find out other Mw507

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors