0908 NYS ST 100 Tax Ny Form

What is the 0908 NYS ST 100 Tax Ny

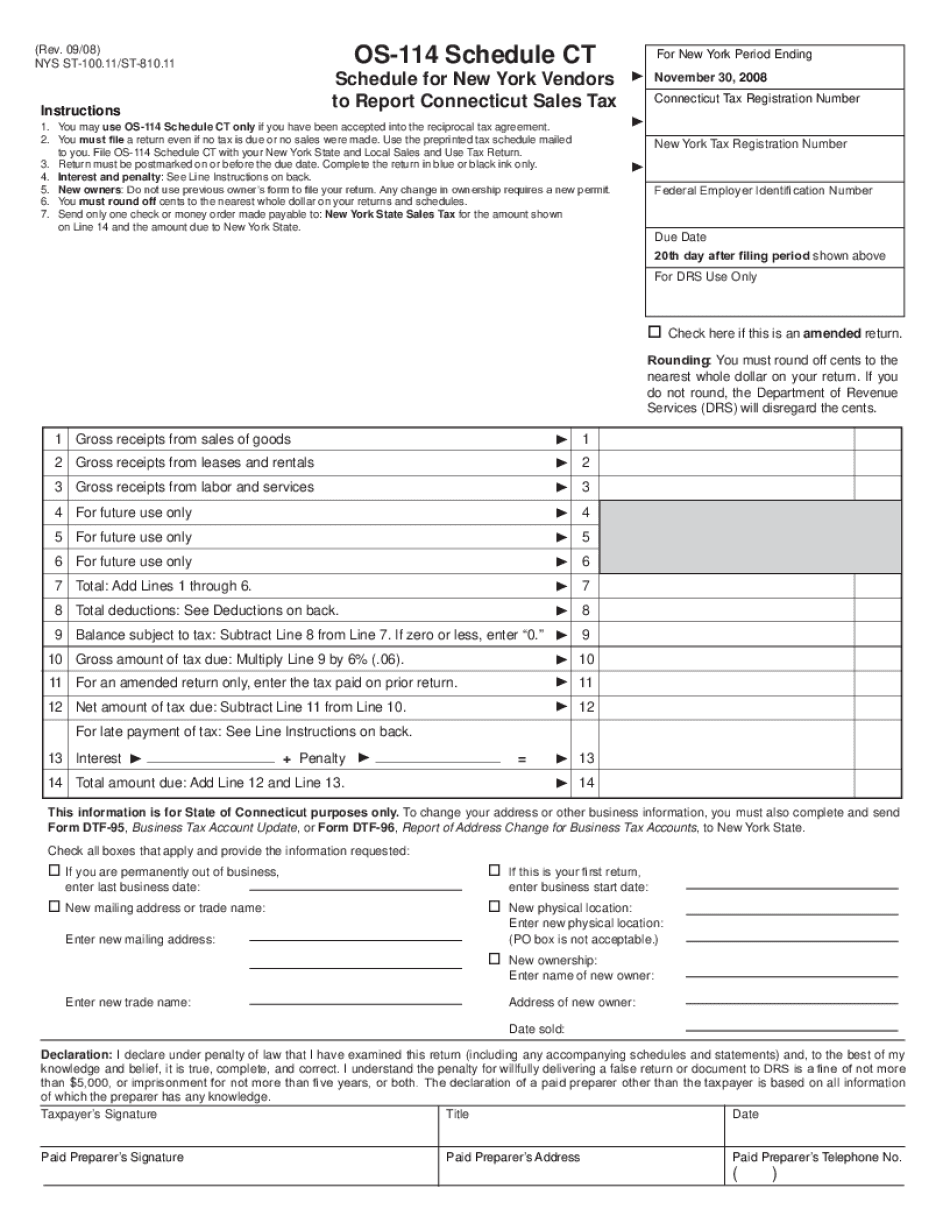

The 0908 NYS ST 100 Tax Ny form is a crucial document used for reporting and remitting sales tax in New York State. This form is specifically designed for businesses that are required to collect sales tax from customers and submit it to the state. It serves as a declaration of the sales tax collected during a specific period, ensuring compliance with state tax regulations.

How to use the 0908 NYS ST 100 Tax Ny

To use the 0908 NYS ST 100 Tax Ny form, businesses must first gather all relevant sales data for the reporting period. This includes total sales, taxable sales, and the amount of sales tax collected. Once the data is compiled, it can be entered into the appropriate sections of the form. Accurate completion is essential to avoid penalties and ensure proper tax remittance.

Steps to complete the 0908 NYS ST 100 Tax Ny

Completing the 0908 NYS ST 100 Tax Ny form involves several key steps:

- Gather all sales records for the reporting period.

- Calculate total sales and taxable sales amounts.

- Determine the total sales tax collected.

- Fill in the form with the calculated figures.

- Review the form for accuracy before submission.

Legal use of the 0908 NYS ST 100 Tax Ny

The 0908 NYS ST 100 Tax Ny form is legally binding when completed accurately and submitted on time. It must comply with New York State tax laws, which require businesses to report sales tax collected from customers. Failure to use this form correctly can result in legal penalties, including fines and interest on unpaid taxes.

Filing Deadlines / Important Dates

It is important for businesses to be aware of the filing deadlines associated with the 0908 NYS ST 100 Tax Ny form. Typically, the form must be filed quarterly or annually, depending on the business's sales volume. Missing these deadlines can lead to penalties and interest charges, making timely submission critical for compliance.

Form Submission Methods (Online / Mail / In-Person)

The 0908 NYS ST 100 Tax Ny form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission via the New York State Department of Taxation and Finance website.

- Mailing a paper copy of the completed form to the designated address.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete 0908 nys st 100 tax ny

Effortlessly Manage [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any delays. Handle [SKS] on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The Easiest Way to Modify and eSign [SKS] Effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize critical sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 0908 NYS ST 100 Tax Ny

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to 0908 NYS ST 100 Tax Ny?

airSlate SignNow is an electronic signature solution that allows businesses to easily send, sign, and manage documents online. For entities dealing with 0908 NYS ST 100 Tax Ny, our platform streamlines the document-signing process, ensuring compliance and efficiency in handling tax-related paperwork.

-

What features does airSlate SignNow offer for managing 0908 NYS ST 100 Tax Ny documents?

With airSlate SignNow, you can securely eSign and send documents related to 0908 NYS ST 100 Tax Ny. Our features include templates, customizable workflows, and an audit trail, giving you peace of mind that your tax documents are handled correctly and securely.

-

How does pricing work for airSlate SignNow, specifically for businesses focusing on 0908 NYS ST 100 Tax Ny?

airSlate SignNow offers flexible pricing plans, making it accessible for businesses of all sizes dealing with 0908 NYS ST 100 Tax Ny. Our plans are designed to provide value, ensuring that you get a cost-effective solution without compromising on features necessary for managing tax documents.

-

Can airSlate SignNow integrate with other software for 0908 NYS ST 100 Tax Ny?

Yes, airSlate SignNow easily integrates with popular software and applications, making it convenient for managing 0908 NYS ST 100 Tax Ny documents alongside your existing tools. This integration capability enhances productivity and ensures a seamless workflow for your tax-related documentation.

-

What are the benefits of using airSlate SignNow for 0908 NYS ST 100 Tax Ny?

By using airSlate SignNow for 0908 NYS ST 100 Tax Ny, businesses can save time and reduce errors associated with manual document handling. Our easy-to-use platform allows for quick signing and status tracking, which can signNowly streamline the tax filing process.

-

Is airSlate SignNow secure for handling sensitive 0908 NYS ST 100 Tax Ny documents?

Absolutely! airSlate SignNow prioritizes your security, implementing advanced encryption and compliance with industry standards. When dealing with sensitive 0908 NYS ST 100 Tax Ny documents, you can trust our platform to keep your information safe and secure.

-

What types of documents can I send and sign related to 0908 NYS ST 100 Tax Ny?

With airSlate SignNow, you can send and sign various documents related to 0908 NYS ST 100 Tax Ny, such as tax returns, acknowledgment forms, and financial statements. Our platform supports multiple document formats, ensuring that you can manage all your tax paperwork efficiently.

Get more for 0908 NYS ST 100 Tax Ny

Find out other 0908 NYS ST 100 Tax Ny

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors