Form MT 903 FUT Fuel Use Tax Return Revised 722

What is the Form MT 903 FUT Fuel Use Tax Return Revised 722

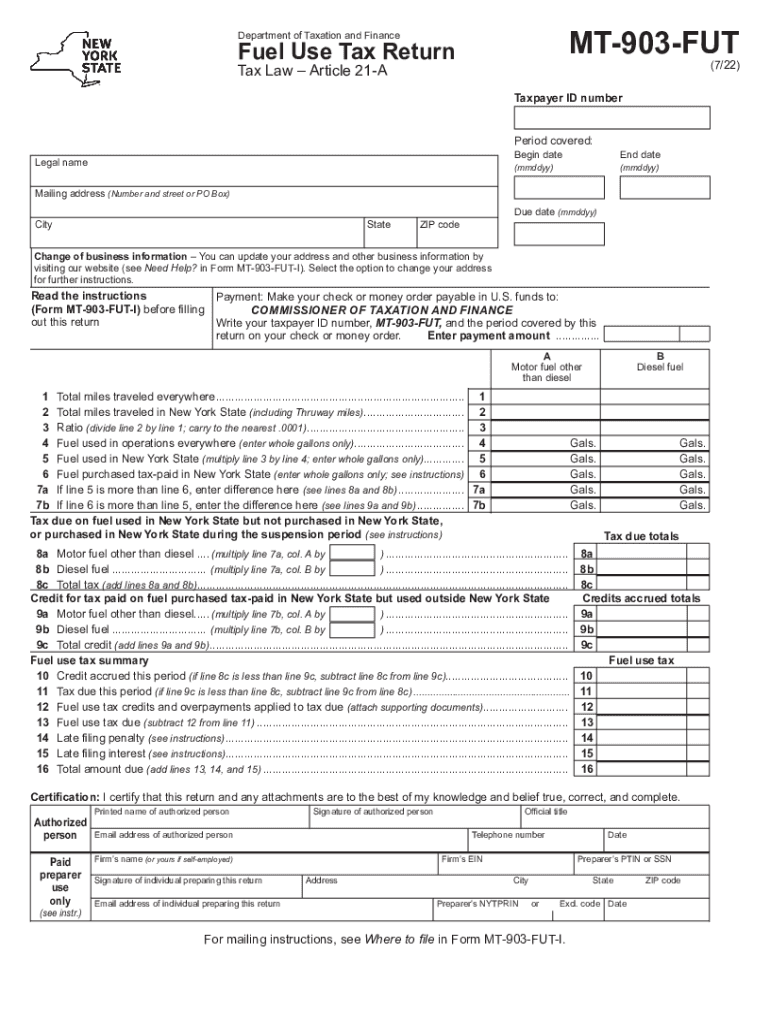

The Form MT 903 FUT Fuel Use Tax Return Revised 722 is a tax document used by businesses that operate motor vehicles on public highways in the United States. This form is specifically designed for reporting fuel usage and calculating the fuel use tax owed to the state. It is essential for ensuring compliance with state tax regulations and for accurately assessing the amount of tax due based on the fuel consumed during operations.

How to use the Form MT 903 FUT Fuel Use Tax Return Revised 722

Using the Form MT 903 FUT involves several steps. First, gather all necessary fuel purchase receipts and mileage logs for the reporting period. Next, accurately fill out the form by entering the total gallons of fuel used and the corresponding tax rates. After completing the form, review it for accuracy before submission. This ensures that all information is correct, minimizing the risk of errors that could lead to penalties.

Steps to complete the Form MT 903 FUT Fuel Use Tax Return Revised 722

Completing the Form MT 903 FUT requires a systematic approach. Begin by entering your business information, including name, address, and tax identification number. Next, report the total fuel consumed, separating it into categories if necessary, such as gasoline and diesel. Calculate the total tax owed based on the applicable rates. Finally, sign and date the form, affirming that the information provided is accurate and complete.

Legal use of the Form MT 903 FUT Fuel Use Tax Return Revised 722

The legal use of the Form MT 903 FUT is governed by state tax laws. To be considered valid, the form must be filled out accurately and submitted within the designated filing deadlines. Additionally, eSignatures can be used to sign the form electronically, provided that they comply with the legal standards set by the ESIGN Act and UETA. This ensures that the form is legally binding and recognized by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Form MT 903 FUT vary by state and are typically set on a quarterly basis. It is crucial to be aware of these deadlines to avoid penalties. Generally, the form must be submitted by the last day of the month following the end of each quarter. Keeping track of these dates helps ensure timely compliance and prevents unnecessary financial repercussions.

Form Submission Methods (Online / Mail / In-Person)

The Form MT 903 FUT can be submitted through various methods, including online, by mail, or in person. Online submission is often the most efficient option, allowing for quicker processing times. If submitting by mail, ensure that the form is sent to the correct address and postmarked by the filing deadline. In-person submissions may be available at designated tax offices, providing an opportunity to receive immediate feedback on the form.

Quick guide on how to complete form mt 903 fut fuel use tax return revised 722

Complete Form MT 903 FUT Fuel Use Tax Return Revised 722 effortlessly on any device

Online document management has surged in popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily locate the correct form and securely save it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents promptly without any delays. Handle Form MT 903 FUT Fuel Use Tax Return Revised 722 on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric operation today.

How to edit and eSign Form MT 903 FUT Fuel Use Tax Return Revised 722 with ease

- Locate Form MT 903 FUT Fuel Use Tax Return Revised 722 and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or hide sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes necessitating new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign Form MT 903 FUT Fuel Use Tax Return Revised 722 to ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an MT 903 FUT and how does it work?

An MT 903 FUT is a financial message type used for reporting the status of a SWIFT transaction. It serves as a confirmation that a funds transfer has been completed. By integrating airSlate SignNow's eSigning capabilities, you can ensure these important documents are signed securely and efficiently.

-

How can airSlate SignNow help with MT 903 FUT transactions?

airSlate SignNow facilitates the seamless electronic signing of MT 903 FUT documents, making it easier to manage your financial transactions. With its easy-to-use interface, you can quickly send and receive signed confirmations without the hassle of paperwork. This not only speeds up the process but also enhances security.

-

Is airSlate SignNow affordable for businesses dealing with MT 903 FUT?

Yes, airSlate SignNow offers a cost-effective solution suitable for businesses of all sizes dealing with MT 903 FUT transactions. The flexible pricing plans allow you to choose options that best match your business needs while keeping expenses in check. This ensures that you still have access to top-notch features without overspending.

-

What features does airSlate SignNow provide for handling MT 903 FUT documents?

airSlate SignNow provides a range of features for managing MT 903 FUT documents, including secure electronic signatures, document templates, and tracking functionality. This allows you to streamline your signing process and maintain detailed records of transactions. Additionally, you can easily customize documents to your specific requirements.

-

Can airSlate SignNow integrate with other financial systems for MT 903 FUT?

Absolutely! airSlate SignNow can seamlessly integrate with various financial systems that handle MT 903 FUT transactions. This integration ensures the efficient flow of information and allows for automated document generation and signing processes. Such connections help in reducing errors and maintaining data integrity.

-

How secure is the signing process for MT 903 FUT with airSlate SignNow?

The signing process for MT 903 FUT with airSlate SignNow is highly secure. It utilizes advanced encryption methods and complies with industry standards to protect sensitive information. Therefore, you can trust that your financial transactions remain confidential and secure throughout the entire process.

-

What support does airSlate SignNow offer for users dealing with MT 903 FUT?

airSlate SignNow provides comprehensive customer support for users managing MT 903 FUT transactions. This includes access to a dedicated support team, helpful resources, and tutorials to ensure you get the most out of the platform. Whether you need troubleshooting assistance or guidance on features, support is readily available.

Get more for Form MT 903 FUT Fuel Use Tax Return Revised 722

- Employment hiring process package north carolina form

- Revocation of anatomical gift donation north carolina form

- Nc employment form

- Newly widowed individuals package north carolina form

- Employment interview package north carolina form

- Employment employee personnel file package north carolina form

- Assignment of mortgage package north carolina form

- Assignment of lease package north carolina form

Find out other Form MT 903 FUT Fuel Use Tax Return Revised 722

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online