Withholding Forms CT GOV Connecticut's Official State

Understanding the Connecticut Withholding Form CT W4P

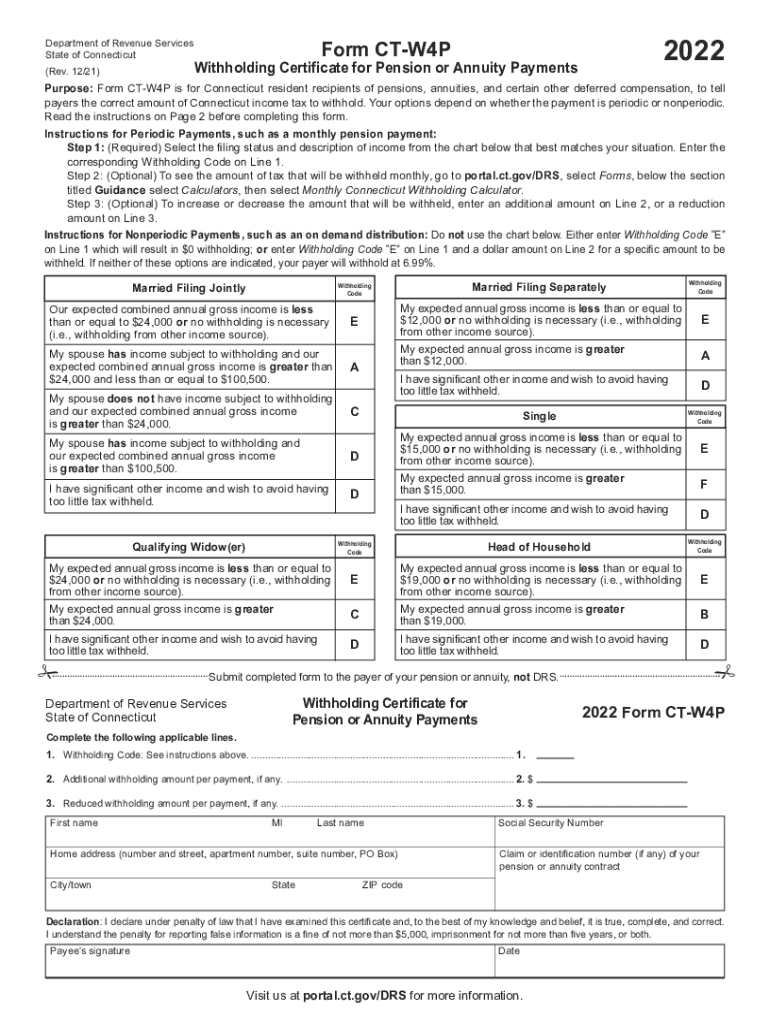

The Connecticut withholding form CT W4P is essential for individuals receiving pension or annuity payments in the state. This form allows recipients to instruct their pension payers on the amount of state income tax to withhold from their payments. Proper completion of the CT W4P ensures that the correct amount of taxes is withheld, helping to avoid underpayment penalties during tax season. It is crucial for recipients to understand their tax obligations and how the withholding process works in relation to their overall income tax strategy.

Steps to Complete the CT W4P Form

Completing the CT W4P form requires careful attention to detail. Here are the steps to ensure accurate completion:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status, which may include options like single, married, or head of household.

- Specify the amount you wish to have withheld from your pension or annuity payments. This can be a specific dollar amount or a percentage.

- Review your entries for accuracy before signing and dating the form.

- Submit the completed form to your pension plan administrator to ensure they update your withholding accordingly.

Legal Considerations for the CT W4P Form

The CT W4P form is legally binding and must comply with state regulations regarding tax withholding. When completed correctly, it serves as a directive to pension payers to withhold the specified amount from your payments. It is important to keep a copy of the submitted form for your records. Additionally, staying informed about changes in tax laws or withholding requirements can help ensure compliance and avoid potential issues with the Connecticut Department of Revenue Services.

Key Elements of the CT W4P Form

Understanding the key elements of the CT W4P form is vital for effective tax planning. Key components include:

- Personal Information: Essential for identifying the taxpayer and linking the form to the correct pension account.

- Filing Status: Determines the tax rates that apply to the individual’s income.

- Withholding Amount: Specifies how much tax should be withheld, which can be adjusted based on individual financial circumstances.

Filing Deadlines for the CT W4P Form

It is important to be aware of the filing deadlines associated with the CT W4P form. Generally, the form should be submitted to your pension plan administrator as soon as you begin receiving payments or when there are changes to your withholding preferences. Keeping track of these deadlines helps ensure that your tax withholding aligns with your financial situation throughout the year.

Form Submission Methods for the CT W4P

The CT W4P form can be submitted in various ways, depending on the preferences of the pension plan administrator. Common submission methods include:

- Online Submission: Many pension plans offer online portals for easy form submission.

- Mail: You can send a completed paper form via postal service to your pension plan administrator.

- In-Person: Some individuals may choose to deliver the form directly to the pension office for immediate processing.

Quick guide on how to complete withholding forms ctgov connecticuts official state

Complete Withholding Forms CT GOV Connecticut's Official State effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-conscious substitute for traditional printed and signed documents, allowing you to locate the needed form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Withholding Forms CT GOV Connecticut's Official State on any gadget using airSlate SignNow's apps for Android or iOS and simplify your document-related tasks today.

The simplest method to modify and eSign Withholding Forms CT GOV Connecticut's Official State with ease

- Locate Withholding Forms CT GOV Connecticut's Official State and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review all entered information and click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searching, or errors that necessitate printing new document versions. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign Withholding Forms CT GOV Connecticut's Official State while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is ct ctw4p and how does airSlate SignNow utilize it?

The ct ctw4p is a powerful tool offered by airSlate SignNow that streamlines the document signing process. By integrating ct ctw4p, businesses can efficiently send, sign, and manage documents online, ensuring a seamless workflow.

-

How much does airSlate SignNow with ct ctw4p cost?

AirSlate SignNow offers competitive pricing plans that include access to ct ctw4p features. Pricing typically starts at a monthly rate, providing businesses with a cost-effective solution tailored to their signing and document management needs.

-

What features does the ct ctw4p offer on airSlate SignNow?

The ct ctw4p package includes features such as customizable templates, bulk sending options, and real-time tracking of document status. These functionalities enhance user experience and improve efficiency in handling important signatures.

-

Can I integrate airSlate SignNow's ct ctw4p with other applications?

Yes, airSlate SignNow with ct ctw4p supports integrations with various popular applications such as Google Drive, Salesforce, and Dropbox. This ensures you can work within your existing ecosystem while enjoying robust eSigning capabilities.

-

What benefits can I expect from using airSlate SignNow with ct ctw4p?

Utilizing the ct ctw4p through airSlate SignNow provides numerous benefits, including enhanced efficiency, reduced turnaround times, and improved document security. It's an ideal solution for businesses looking to streamline their signing processes.

-

Is airSlate SignNow with ct ctw4p suitable for small businesses?

Absolutely! The affordability and ease of use of airSlate SignNow with ct ctw4p make it perfect for small businesses. It allows them to manage document signing without the complexities often associated with traditional methods.

-

How does airSlate SignNow ensure security for documents signed with ct ctw4p?

AirSlate SignNow employs advanced security measures, including encryption and compliance with legal standards, to protect documents signed using ct ctw4p. This ensures that sensitive information remains secure throughout the signing process.

Get more for Withholding Forms CT GOV Connecticut's Official State

Find out other Withholding Forms CT GOV Connecticut's Official State

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe