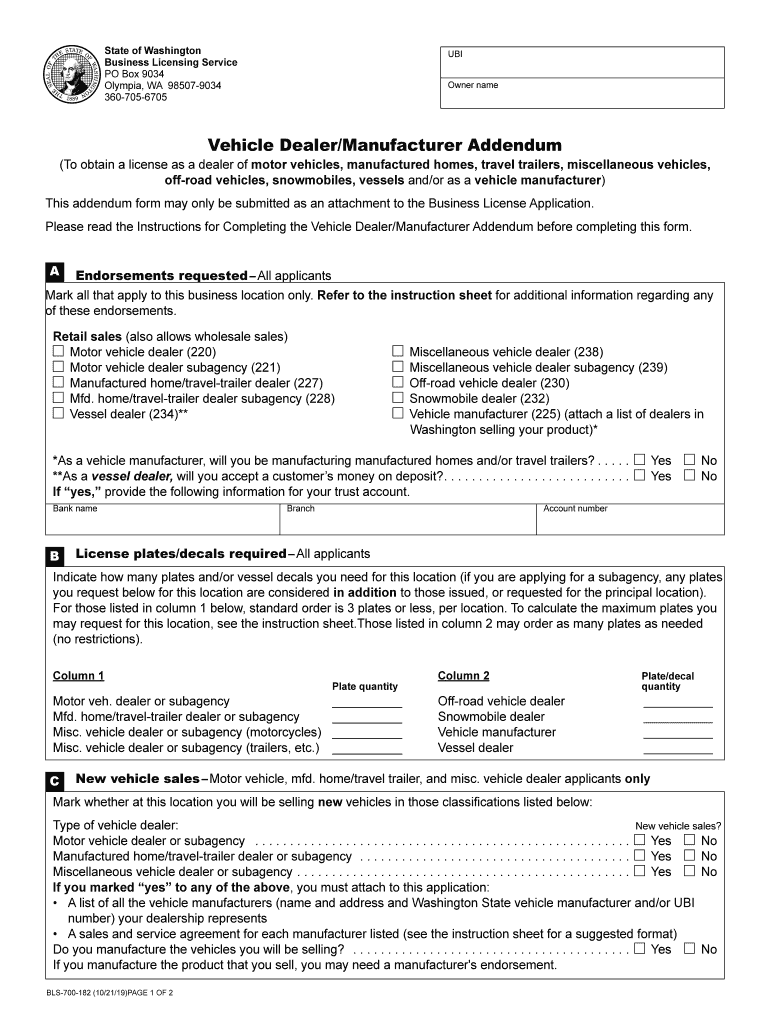

Washington Revenue Form

What is the Washington Revenue

The Washington Revenue refers to the state-specific documentation and processes involved in the taxation and regulation of vehicle dealers operating within Washington State. This includes various forms and requirements that vehicle dealers must adhere to in order to maintain compliance with state laws. Understanding the Washington Revenue is essential for vehicle dealers to ensure they are meeting their legal obligations while conducting business.

Steps to complete the Washington Revenue

Completing the Washington Revenue requires careful attention to detail. Here are the general steps involved:

- Gather all necessary documentation related to your vehicle dealership, including business licenses and tax identification numbers.

- Fill out the required forms accurately, ensuring all information is complete and up-to-date.

- Review the forms for any errors or omissions before submission.

- Submit the completed forms through the designated method, whether online, by mail, or in person.

- Keep copies of all submitted documents for your records.

Legal use of the Washington Revenue

The legal use of the Washington Revenue is governed by state laws that outline the requirements for vehicle dealers. It is crucial for dealers to understand these regulations to avoid potential legal issues. Compliance ensures that the forms submitted are recognized as valid and enforceable. This includes adhering to guidelines set forth by the Washington Department of Revenue and ensuring that all transactions are documented appropriately.

Required Documents

To complete the Washington Revenue forms, vehicle dealers must prepare specific documents. These typically include:

- Business license and registration documentation

- Tax identification number

- Proof of ownership or lease for the dealership location

- Sales records and transaction details

Having these documents ready will facilitate a smoother process when filling out the necessary forms.

Form Submission Methods

Vehicle dealers in Washington have several options for submitting their revenue forms. The methods include:

- Online: Many forms can be completed and submitted electronically through the Washington Department of Revenue's website.

- By Mail: Completed forms can be printed and mailed to the appropriate department.

- In-Person: Dealers may also choose to submit their forms in person at designated state offices.

Each method has its own timeline and requirements, so it is important to choose the one that best fits your needs.

Penalties for Non-Compliance

Failing to comply with the Washington Revenue regulations can result in significant penalties for vehicle dealers. These may include:

- Fines for late submissions or inaccuracies in reporting

- Revocation of business licenses

- Legal action for persistent non-compliance

Understanding these potential consequences emphasizes the importance of accurate and timely submissions.

Quick guide on how to complete washington revenue

Effortlessly Create Washington Revenue on Any Gadget

Web-based document administration has become increasingly popular among companies and individuals. It serves as an ideal sustainable alternative to conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without hold-ups. Manage Washington Revenue on any system using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign Washington Revenue effortlessly

- Find Washington Revenue and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure confidential information with specialized tools that airSlate SignNow offers for this purpose.

- Create your electronic signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Alter and electronically sign Washington Revenue and ensure exceptional communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What features does airSlate SignNow offer for vehicle dealers?

airSlate SignNow provides vehicle dealers with features such as secure eSigning, document templates, and automated workflows. These tools simplify the management of contracts and agreements, ensuring a streamlined process that enhances productivity. With its user-friendly interface, vehicle dealers can easily send, sign, and store documents online.

-

How can airSlate SignNow benefit vehicle dealers?

By using airSlate SignNow, vehicle dealers can reduce the time spent on paperwork, allowing them to focus more on sales and customer service. The secure eSigning feature enhances trust with clients, while improved efficiency leads to quicker transactions. Overall, the solution helps vehicle dealers close deals faster and enhance customer satisfaction.

-

Is airSlate SignNow cost-effective for vehicle dealers?

Yes, airSlate SignNow is an affordable solution designed for vehicle dealers of all sizes. With various pricing plans available, vehicle dealers can choose an option that fits their budget while enjoying full access to essential features. This cost-effectiveness allows vehicle dealers to optimize their document management without breaking the bank.

-

What integrations does airSlate SignNow offer for vehicle dealers?

airSlate SignNow integrates seamlessly with various tools that vehicle dealers commonly use, including CRMs, payment processors, and cloud storage services. This allows vehicle dealers to incorporate eSigning into their existing workflows effortlessly. With these integrations, vehicle dealers can enhance overall efficiency and maintain a smooth operation.

-

How secure is airSlate SignNow for vehicle dealers?

airSlate SignNow prioritizes security, providing vehicle dealers with encrypted data transmission and storage. The platform ensures compliance with various regulations, including GDPR and eSignature laws, which is crucial for maintaining customer trust. Vehicle dealers can eSign documents with confidence, knowing their sensitive information is protected.

-

Can vehicle dealers customize their documents with airSlate SignNow?

Absolutely! Vehicle dealers can easily customize their documents using airSlate SignNow’s templates and drag-and-drop editor. This flexibility allows vehicle dealers to create tailored agreements and contracts that meet their specific business needs. Customization enhances the professionalism of documents, leaving a positive impression on clients.

-

How does airSlate SignNow improve the client experience for vehicle dealers?

By implementing airSlate SignNow, vehicle dealers can offer their clients a more streamlined and convenient signing process. Clients can receive and sign documents anytime, anywhere, reducing delays associated with traditional methods. This enhanced client experience not only helps vehicle dealers close deals faster but also fosters long-term customer loyalty.

Get more for Washington Revenue

Find out other Washington Revenue

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed