4923 Non HIghway Use Motor Fuel Refund Claim Form

Understanding the 4923 Non Highway Use Motor Fuel Refund Claim

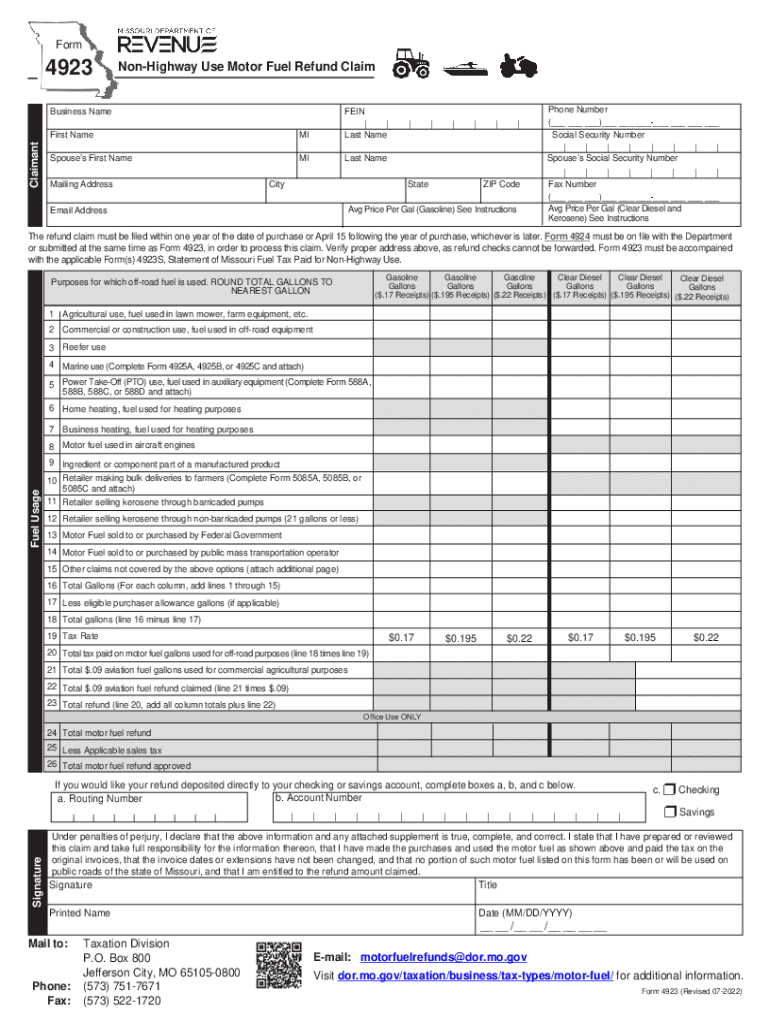

The mo dor form 4923, also known as the Non Highway Use Motor Fuel Refund Claim, is designed for individuals and businesses seeking a refund for fuel taxes paid on fuel that is not used on public highways. This form is particularly relevant for those who utilize fuel for off-road purposes, such as farming, construction, or other non-highway activities. Understanding the eligibility criteria and the specifics of the claim process is crucial for a successful refund.

Steps to Complete the 4923 Non Highway Use Motor Fuel Refund Claim

Completing the mo 4923 claim involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including receipts and proof of fuel purchases. Next, fill out the form accurately, providing details such as your name, address, and the amount of fuel used for non-highway purposes. It is essential to double-check all entries for completeness. Finally, submit the form according to the specified submission methods, either online or via mail.

Eligibility Criteria for the 4923 Non Highway Use Motor Fuel Refund Claim

To qualify for a refund using the mo 4923 form, applicants must meet specific eligibility criteria. Primarily, the fuel must have been purchased for non-highway use. Additionally, the claimant must be able to demonstrate that they have paid the applicable fuel taxes. This may include providing documentation such as invoices or receipts that clearly indicate the fuel type and usage. Understanding these criteria helps streamline the refund process.

Required Documents for the 4923 Non Highway Use Motor Fuel Refund Claim

When filing the mo 4923 fuel claim, certain documents are required to support your application. These typically include:

- Receipts or invoices for fuel purchases

- Proof of non-highway use, such as vehicle registration or usage logs

- Any previous correspondence with the Department of Revenue regarding fuel refunds

Having these documents ready will facilitate a smoother claim process and reduce the likelihood of delays.

Form Submission Methods for the 4923 Non Highway Use Motor Fuel Refund Claim

The mo dor form 4923 can be submitted through various methods, providing flexibility for applicants. These methods include:

- Online submission via the Missouri Department of Revenue's website

- Mailing the completed form to the appropriate address as specified in the form instructions

- In-person submission at designated Department of Revenue offices

Choosing the most convenient submission method can help expedite the processing of your claim.

Key Elements of the 4923 Non Highway Use Motor Fuel Refund Claim

Several key elements are essential to the mo 4923 form. These include:

- Claimant's identification information

- Details of fuel purchases, including quantity and type

- Explanation of how the fuel was used for non-highway purposes

- Signature and date to verify the accuracy of the information provided

Ensuring that all key elements are thoroughly addressed will enhance the likelihood of a successful refund claim.

Quick guide on how to complete 4923 non highway use motor fuel refund claim

Easily Prepare 4923 Non HIghway Use Motor Fuel Refund Claim on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage 4923 Non HIghway Use Motor Fuel Refund Claim on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The Simplest Way to Edit and Electronically Sign 4923 Non HIghway Use Motor Fuel Refund Claim

- Obtain 4923 Non HIghway Use Motor Fuel Refund Claim and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 4923 Non HIghway Use Motor Fuel Refund Claim and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the MO DOR Form 4923 and why is it important?

The MO DOR Form 4923 is a crucial document for individuals and businesses in Missouri, as it facilitates specific tax-related processes. Understanding this form is essential for compliance with local regulations. airSlate SignNow offers an efficient platform for electronically signing and managing this form, ensuring that you stay organized and compliant.

-

How does airSlate SignNow simplify the completion of MO DOR Form 4923?

airSlate SignNow enables users to easily fill out and eSign the MO DOR Form 4923 online. The intuitive interface allows for quick document preparation, preventing delays in submissions. Additionally, the platform saves all your completed forms for easy access in the future.

-

What are the pricing plans for using airSlate SignNow for MO DOR Form 4923?

airSlate SignNow offers competitive pricing plans to accommodate different business needs, starting with a free trial that allows you to test its features. For those specifically needing to handle the MO DOR Form 4923, subscription options provide unlimited document access, team collaboration, and enhanced security at an affordable rate.

-

Can I integrate airSlate SignNow with my existing software for MO DOR Form 4923?

Yes, airSlate SignNow boasts seamless integrations with various software platforms, making it easier to manage the MO DOR Form 4923 alongside your current tools. Whether you use CRMs, project management applications, or cloud storage solutions, integration options are available to streamline your workflow.

-

What features does airSlate SignNow offer for managing the MO DOR Form 4923?

airSlate SignNow provides a range of features designed to enhance your experience with the MO DOR Form 4923. These include customizable templates, automated workflows, and advanced security measures, all ensuring that your documents are handled efficiently and securely from start to finish.

-

Is airSlate SignNow secure for completing MO DOR Form 4923?

Absolutely! airSlate SignNow implements advanced security protocols and encryption standards to protect your sensitive information when completing the MO DOR Form 4923. You can eSign and share documents with confidence, knowing that your data is safeguarded against unauthorized access.

-

Are there mobile options for signing MO DOR Form 4923 with airSlate SignNow?

Yes, airSlate SignNow is mobile-friendly, allowing you to complete and eSign the MO DOR Form 4923 on-the-go. With the mobile app, you can access your documents from any device, ensuring flexibility and convenience for busy professionals.

Get more for 4923 Non HIghway Use Motor Fuel Refund Claim

Find out other 4923 Non HIghway Use Motor Fuel Refund Claim

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation