Www Irs Govforms Pubsabout Form 1094 CAbout Form 1094 C, Transmittal of Employer Provided Health

What is the 1094 C transmittal?

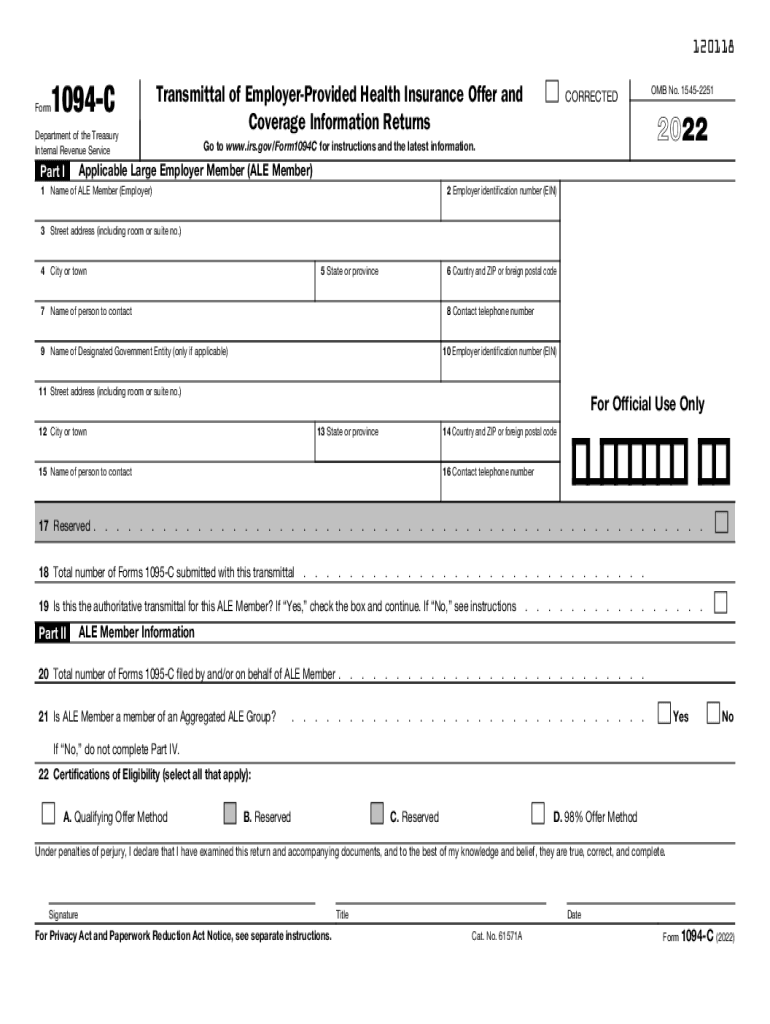

The 1094 C transmittal is a crucial form used by applicable large employers (ALEs) to report information about health coverage offered to their employees. This form serves as a cover sheet for the 1095 C forms, which provide detailed information about each employee's health coverage. The 1094 C includes essential data such as the employer's name, address, and Employer Identification Number (EIN), along with the total number of 1095 C forms being submitted. Understanding this form is vital for compliance with the Affordable Care Act (ACA) reporting requirements.

Steps to complete the 1094 C transmittal

Completing the 1094 C transmittal involves several key steps:

- Gather necessary information about your organization, including the name, address, and EIN.

- Determine the number of 1095 C forms you will be submitting, as this will need to be reported on the 1094 C.

- Fill out the form accurately, ensuring that all required fields are completed, such as the contact information for the person responsible for the filing.

- Review the completed form for accuracy and completeness to avoid potential penalties.

- Submit the 1094 C along with the 1095 C forms either electronically or via mail, depending on your filing preference.

Filing deadlines for the 1094 C transmittal

Filing deadlines for the 1094 C transmittal are critical to ensure compliance with IRS regulations. Generally, the forms must be submitted by February twenty-eighth if filing by mail or by March thirty-first if filing electronically. It is essential to keep track of these dates to avoid penalties. Employers should also check for any updates or changes to the deadlines each tax year, as they may vary.

Legal use of the 1094 C transmittal

The legal use of the 1094 C transmittal is governed by the requirements set forth by the IRS under the ACA. This form must be filed by ALEs to demonstrate compliance with the employer shared responsibility provisions. Failure to file the 1094 C accurately and on time can result in significant penalties. Employers should ensure that they are familiar with the legal implications of the form and maintain records of their submissions for future reference.

Key elements of the 1094 C transmittal

Key elements of the 1094 C transmittal include:

- Employer Information: Name, address, and EIN of the employer.

- Contact Information: Details of the person to contact regarding the form.

- Number of 1095 C Forms: Total count of 1095 C forms being submitted.

- Applicable Large Employer Status: Indication of whether the employer meets the criteria for being an ALE.

Form submission methods for the 1094 C transmittal

The 1094 C transmittal can be submitted through various methods:

- Electronic Filing: Recommended for employers submitting fifty or more forms, as it is more efficient and allows for quicker processing.

- Paper Filing: Employers can also choose to mail the forms to the IRS, but this method may take longer for processing and confirmation.

Quick guide on how to complete wwwirsgovforms pubsabout form 1094 cabout form 1094 c transmittal of employer provided health

Effortlessly complete Www irs govforms pubsabout form 1094 cAbout Form 1094 C, Transmittal Of Employer Provided Health on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Www irs govforms pubsabout form 1094 cAbout Form 1094 C, Transmittal Of Employer Provided Health on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Www irs govforms pubsabout form 1094 cAbout Form 1094 C, Transmittal Of Employer Provided Health with ease

- Find Www irs govforms pubsabout form 1094 cAbout Form 1094 C, Transmittal Of Employer Provided Health and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your method of sharing the form, via email, text message (SMS), or a shareable link, or download it to your computer.

No more lost or misplaced files, cumbersome form navigation, or mistakes requiring new document prints. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Www irs govforms pubsabout form 1094 cAbout Form 1094 C, Transmittal Of Employer Provided Health to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a 1094 c transmittal?

The 1094 c transmittal is a form used by employers to report information about health coverage offered to their employees. It serves as a summary of the 1095-C forms that detail specific employee coverage. Understanding how to properly complete a 1094 c transmittal is essential for compliance with IRS regulations.

-

How does airSlate SignNow help with the 1094 c transmittal process?

airSlate SignNow simplifies the 1094 c transmittal process by allowing users to easily create, send, and eSign the necessary documents. With its user-friendly features, businesses can ensure that their 1094 c transmittal is completed accurately and submitted on time. This streamlines compliance and reduces the risk of penalties.

-

What are the benefits of using airSlate SignNow for my 1094 c transmittal?

Using airSlate SignNow for your 1094 c transmittal ensures a fast and efficient filing process. The platform enhances document security and allows for real-time tracking of form submissions. Additionally, its cost-effective pricing provides great value for businesses managing multiple forms.

-

Is airSlate SignNow compliant with IRS requirements for 1094 c transmittal?

Yes, airSlate SignNow is designed to be compliant with IRS requirements for the 1094 c transmittal. The platform includes templates and features that help ensure all necessary information is accurately captured. This adherence to compliance helps businesses avoid potential issues with the IRS.

-

What features does airSlate SignNow offer for managing the 1094 c transmittal?

airSlate SignNow offers several features for managing the 1094 c transmittal, including customizable templates, eSigning capabilities, and integration with various accounting software. These features make it easy to collect necessary information and streamline the submission process. The platform also provides notifications and reminders to help keep track of deadlines.

-

How much does it cost to use airSlate SignNow for 1094 c transmittal?

airSlate SignNow offers competitive pricing plans based on the needs of your business. The cost varies depending on the features required and the number of users. Investing in airSlate SignNow for your 1094 c transmittal can save time and reduce errors, which may outweigh the initial costs.

-

Can airSlate SignNow integrate with my current payroll system for 1094 c transmittal?

Yes, airSlate SignNow can integrate with various payroll and human resources management systems, making it easy to gather the necessary data for your 1094 c transmittal. Integrations help streamline workflows and ensure that information is consistent across platforms. This saves time and minimizes the chances of errors.

Get more for Www irs govforms pubsabout form 1094 cAbout Form 1094 C, Transmittal Of Employer Provided Health

- Apartment rules and regulations new jersey form

- Nj cancellation form

- Amendment residential lease 497319350 form

- Agreement for payment of unpaid rent new jersey form

- New jersey assignment 497319352 form

- Tenant reference form 497319353

- Residential lease or rental agreement for month to month new jersey form

- Residential rental lease agreement new jersey form

Find out other Www irs govforms pubsabout form 1094 cAbout Form 1094 C, Transmittal Of Employer Provided Health

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast