E 1R Form Fillable St Louis

What is the E 1R Form Fillable St Louis

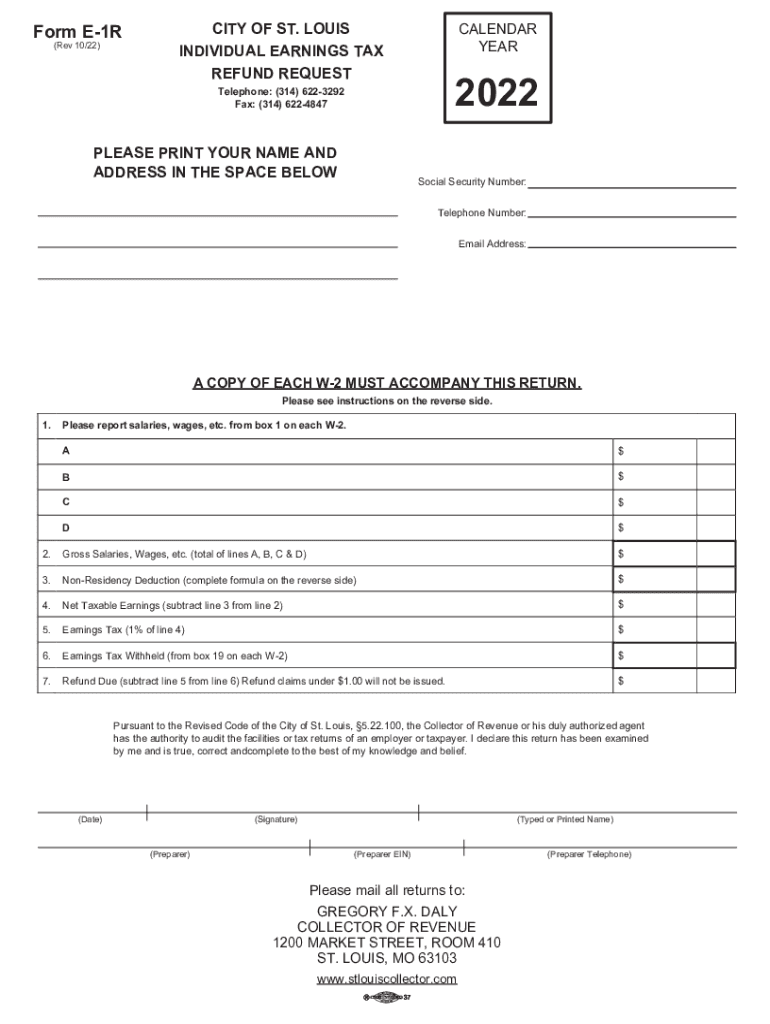

The E 1R form is a tax document used by residents of St. Louis, Missouri, to report earnings and calculate their local income tax obligations. This form is specifically designed for individuals who earn income within the city limits and need to comply with local tax regulations. It is essential for ensuring that residents accurately report their earnings and pay the appropriate amount of local taxes.

Steps to complete the E 1R Form Fillable St Louis

Completing the E 1R form involves several key steps to ensure accuracy and compliance with local tax laws:

- Gather necessary information: Collect all relevant financial documents, such as W-2s, 1099s, and any other income statements.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Accurately list all sources of income earned in St. Louis during the tax year.

- Calculate tax liability: Use the provided tax rates to determine the amount owed based on your reported earnings.

- Review and sign: Double-check all entries for accuracy before signing and dating the form.

How to obtain the E 1R Form Fillable St Louis

The E 1R form can be obtained through several convenient methods:

- Online: Visit the official St. Louis city website to download a fillable PDF version of the form.

- In-person: Visit local tax offices or city hall to request a physical copy of the form.

- Mail: Request a form by mail by contacting the St. Louis tax office directly.

Legal use of the E 1R Form Fillable St Louis

The E 1R form is legally binding when filled out correctly and submitted on time. It must comply with local tax laws to ensure that the information provided is accurate and complete. Failure to use the form properly can result in penalties or legal consequences, making it crucial for residents to understand their responsibilities regarding local taxation.

Filing Deadlines / Important Dates

Residents must be aware of the following important deadlines related to the E 1R form:

- Annual filing deadline: Typically, the form must be submitted by April 15 of each year for the previous tax year.

- Extensions: If additional time is needed, residents may file for an extension, but they must still pay any estimated taxes owed by the original deadline.

Form Submission Methods (Online / Mail / In-Person)

There are multiple ways to submit the E 1R form:

- Online submission: Use the city’s online portal to securely submit your completed form electronically.

- Mail: Send your completed form to the designated tax office address, ensuring it is postmarked by the filing deadline.

- In-person: Deliver the form directly to the local tax office during business hours for immediate processing.

Quick guide on how to complete e 1r form fillable st louis

Effortlessly Prepare E 1R Form Fillable St Louis on Any Device

The management of documents online has gained traction among companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage E 1R Form Fillable St Louis on any device using airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

The Easiest Technique to Edit and eSign E 1R Form Fillable St Louis with Ease

- Find E 1R Form Fillable St Louis and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark essential sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of missing or lost documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign E 1R Form Fillable St Louis and ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process on how to form e 1r using airSlate SignNow?

To form e 1r using airSlate SignNow, simply create an account and navigate to the document creation section. You can upload your existing forms or create new ones directly in the platform. The intuitive interface guides you through adding the necessary fields and signatures, making it easy to form e 1r efficiently.

-

What are the pricing options for forming e 1r with airSlate SignNow?

airSlate SignNow offers various pricing plans to suit different business needs, allowing you to choose the best option for forming e 1r. From individual plans to team packages, you can select a pricing tier based on the number of users and features required. Each plan includes essential tools for forming e 1r effectively.

-

What features does airSlate SignNow provide for forming e 1r?

airSlate SignNow comes equipped with a range of features that simplify how to form e 1r. Key features include customizable templates, advanced eSignature options, and secure document storage. These tools enhance your ability to prepare and finalize e 1r documents with ease.

-

How does airSlate SignNow benefit businesses when forming e 1r?

Forming e 1r with airSlate SignNow streamlines document management and signing processes, saving businesses time and resources. The user-friendly interface helps reduce errors and accelerates turnaround time for important documents. Additionally, the efficient workflow enhances collaboration within teams.

-

Can airSlate SignNow integrate with other tools for forming e 1r?

Yes, airSlate SignNow offers seamless integrations with various third-party applications that enhance how to form e 1r. Whether you use CRM software, cloud storage services, or project management tools, airSlate SignNow can connect with them to facilitate document creation and signing. This interoperability optimizes your document workflow.

-

Is it secure to form e 1r with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security, using encryption and two-factor authentication to protect your documents while you form e 1r. Compliance with industry standards ensures that your data remains secure throughout the signing process. You can confidently rely on airSlate SignNow for all your document needs.

-

How user-friendly is airSlate SignNow for forming e 1r?

airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to learn how to form e 1r quickly. The platform features an intuitive drag-and-drop interface and helpful tutorials for new users. Even those with minimal technical experience will be able to navigate and use the tool effectively.

Get more for E 1R Form Fillable St Louis

- Apartment lease rental application questionnaire iowa form

- Residential rental lease application iowa form

- Salary verification form for potential lease iowa

- Landlord agreement to allow tenant alterations to premises iowa form

- Notice of default on residential lease iowa form

- Landlord tenant lease co signer agreement iowa form

- Application for sublease iowa form

- Inventory and condition of leased premises for pre lease and post lease iowa form

Find out other E 1R Form Fillable St Louis

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien

- eSign South Carolina Mechanic's Lien Secure