Instructions for Form 941 Rev June Instructions for Form 941, Employer's QUARTERLY Federal Tax Return

Understanding the 2022 Form 941 Instructions

The 2022 Form 941, also known as the Employer's Quarterly Federal Tax Return, is essential for employers to report income taxes withheld from employee wages, as well as the employer and employee portions of Social Security and Medicare taxes. The instructions for this form provide detailed guidance on how to accurately complete and file it. These instructions are crucial for ensuring compliance with IRS regulations and avoiding potential penalties.

Steps to Complete the 2022 Form 941

Completing the 2022 Form 941 involves several key steps:

- Gather necessary information: Collect details about your business, including the number of employees, wages paid, and taxes withheld.

- Fill out the form: Enter your business information, total wages, and tax amounts in the appropriate sections of the form.

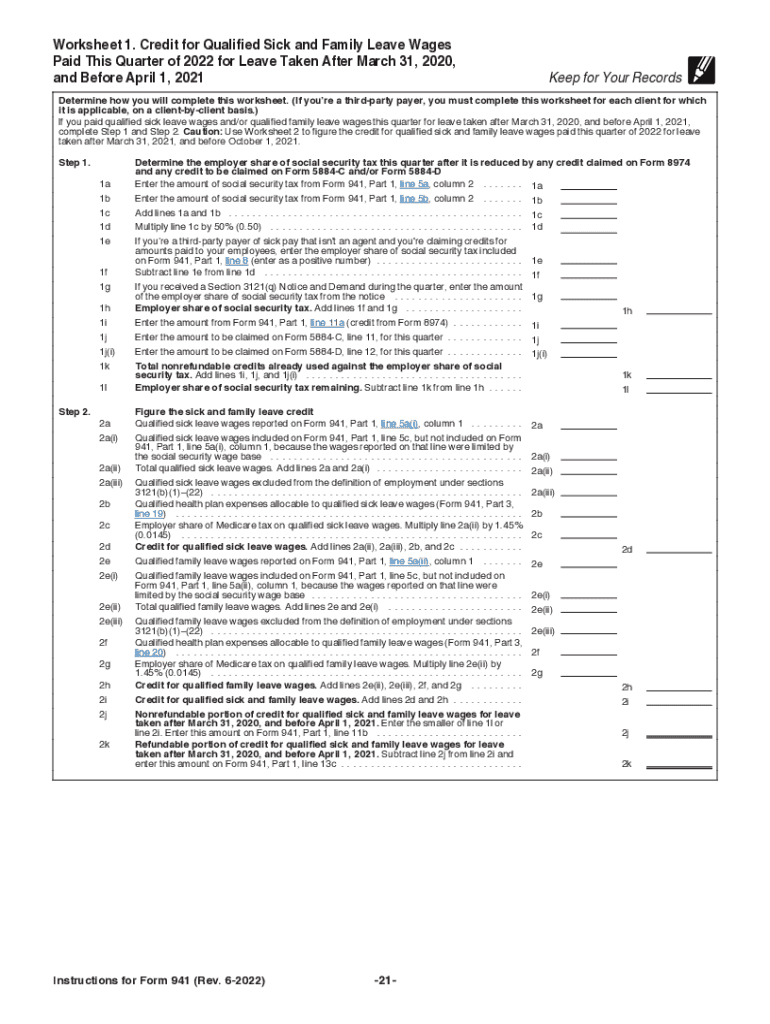

- Calculate taxes owed: Use the provided worksheets in the instructions to determine the total taxes owed for the quarter.

- Review for accuracy: Double-check all entries to ensure accuracy before submission.

- Submit the form: File the completed form electronically or via mail, following the guidelines outlined in the instructions.

Filing Deadlines for the 2022 Form 941

It is important to adhere to the filing deadlines for the 2022 Form 941 to avoid penalties. Generally, the form must be filed quarterly, with the following deadlines:

- First quarter (January to March): April 30

- Second quarter (April to June): July 31

- Third quarter (July to September): October 31

- Fourth quarter (October to December): January 31 of the following year

Legal Use of the 2022 Form 941 Instructions

The instructions for the 2022 Form 941 are legally binding and must be followed to ensure compliance with IRS regulations. Properly completing and filing this form is vital for maintaining good standing with the IRS and avoiding fines. Employers should familiarize themselves with these instructions to understand their obligations regarding tax reporting and payment.

Form Submission Methods for the 2022 Form 941

Employers have several options for submitting the 2022 Form 941:

- Electronic filing: Many employers choose to file electronically through the IRS e-file system, which is efficient and secure.

- Mail: Employers can also mail the completed form to the appropriate IRS address, as specified in the instructions.

- In-person: While less common, some employers may opt to deliver their forms in person at local IRS offices.

Required Documents for Filing the 2022 Form 941

When preparing to file the 2022 Form 941, employers should have the following documents on hand:

- Payroll records, including total wages paid and taxes withheld

- Previous Form 941 filings for reference

- Any relevant tax documents that pertain to employee earnings and deductions

Quick guide on how to complete instructions for form 941 rev june 2022 instructions for form 941 employers quarterly federal tax return

Complete Instructions For Form 941 Rev June Instructions For Form 941, Employer's QUARTERLY Federal Tax Return effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to generate, modify, and eSign your documents quickly and efficiently. Manage Instructions For Form 941 Rev June Instructions For Form 941, Employer's QUARTERLY Federal Tax Return across any platform using airSlate SignNow apps for Android or iOS and enhance any document-based task today.

How to modify and eSign Instructions For Form 941 Rev June Instructions For Form 941, Employer's QUARTERLY Federal Tax Return with ease

- Obtain Instructions For Form 941 Rev June Instructions For Form 941, Employer's QUARTERLY Federal Tax Return and click on Get Form to commence.

- Employ the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form: via email, SMS, invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Alter and eSign Instructions For Form 941 Rev June Instructions For Form 941, Employer's QUARTERLY Federal Tax Return and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the 2022 941 instructions?

The 2022 941 instructions provide guidance for employers to fill out the IRS Form 941, which is used for reporting income taxes withheld from employee wages. These instructions include detailed information regarding the changes made to the Form 941 for 2022, ensuring accurate tax reporting.

-

How can airSlate SignNow assist me with the 2022 941 instructions?

airSlate SignNow simplifies the document signing process, allowing you to easily send, sign, and manage documents related to the 2022 941 instructions. Our platform ensures that you can streamline your tax reporting tasks while maintaining compliance with IRS regulations.

-

What features does airSlate SignNow offer for managing 2022 941 forms?

With airSlate SignNow, you can utilize features like eSignature, document templates, and real-time collaboration to efficiently manage your 2022 941 forms. This not only saves time but also enhances the accuracy of your tax reporting.

-

Is airSlate SignNow cost-effective for small businesses handling 2022 941 instructions?

Yes, airSlate SignNow offers a cost-effective solution for small businesses needing assistance with 2022 941 instructions. Our subscription plans are designed to fit various budgets while providing powerful features to streamline your document signing processes.

-

Can airSlate SignNow integrate with my existing accounting software for 2022 941 preparations?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easy to manage your 2022 941 preparations. This integration helps synchronize your data, reducing manual entry errors and improving efficiency.

-

What benefits do I gain by using airSlate SignNow for 2022 941 documentation?

Using airSlate SignNow for your 2022 941 documentation maximizes efficiency, enhances compliance, and simplifies the signing process. With secure eSignatures and customizable workflows, you can ensure accurate submissions to the IRS without unnecessary delays.

-

How can I ensure compliance with the 2022 941 instructions using airSlate SignNow?

airSlate SignNow helps ensure compliance with the 2022 941 instructions by providing templates and guidance throughout the document preparation process. Our platform offers compliance checks that alert you to any potential issues before submission.

Get more for Instructions For Form 941 Rev June Instructions For Form 941, Employer's QUARTERLY Federal Tax Return

Find out other Instructions For Form 941 Rev June Instructions For Form 941, Employer's QUARTERLY Federal Tax Return

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile