Missouri Form MO SCC Shared Care Tax Credit TaxFormFinder

Understanding the Missouri Form MO SCC Shared Care Tax Credit

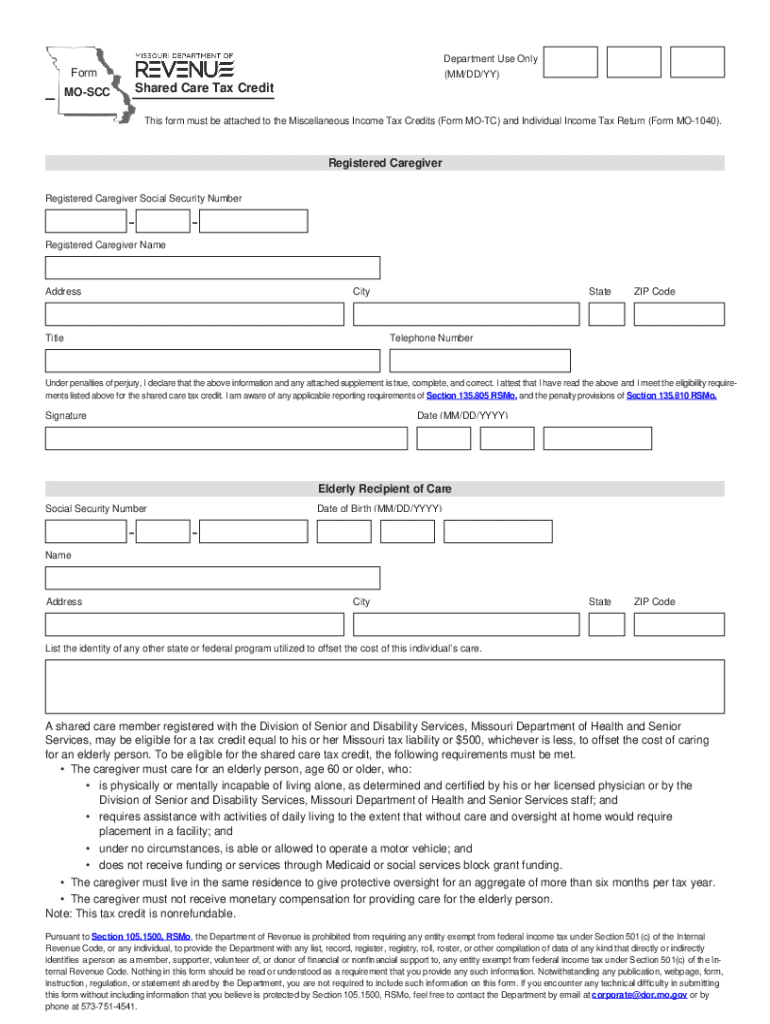

The Missouri Form MO SCC is designed for taxpayers seeking to claim the Shared Care Tax Credit. This credit is specifically aimed at individuals and businesses that provide shared care services, which can include childcare or eldercare. Understanding the purpose of this form is crucial for ensuring compliance and maximizing potential tax benefits. The form captures essential information about the taxpayer, the care services provided, and the eligibility for the credit.

Steps to Complete the Missouri Form MO SCC Shared Care Tax Credit

Completing the Missouri Form MO SCC involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including proof of care services and any related expenses. Follow these steps:

- Fill out your personal information, including your name, address, and Social Security number.

- Detail the type of shared care services provided and the associated costs.

- Calculate the total credit amount based on the guidelines provided with the form.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the Missouri Form MO SCC Shared Care Tax Credit

To qualify for the Shared Care Tax Credit, certain eligibility criteria must be met. Taxpayers must provide shared care services that comply with Missouri state regulations. Key criteria include:

- The taxpayer must be a resident of Missouri.

- Services must be provided to qualifying individuals, such as children or seniors.

- Expenses claimed must be documented and directly related to the care services.

Legal Use of the Missouri Form MO SCC Shared Care Tax Credit

The Missouri Form MO SCC is legally recognized when completed and submitted in accordance with state regulations. It is essential to ensure that all information provided is accurate and truthful to avoid any legal repercussions. The form must be filed within the specified deadlines to maintain compliance with Missouri tax laws.

How to Obtain the Missouri Form MO SCC Shared Care Tax Credit

The Missouri Form MO SCC can be obtained through various channels. Taxpayers can access the form online through the Missouri Department of Revenue's website or request a physical copy by contacting their local tax office. It is advisable to ensure that you are using the most current version of the form to avoid any issues during the filing process.

Form Submission Methods for the Missouri Form MO SCC Shared Care Tax Credit

Once the Missouri Form MO SCC is completed, it can be submitted through multiple methods. Taxpayers may choose to file electronically via the Missouri Department of Revenue's online portal, or they can submit a paper copy by mail. In-person submissions are also accepted at designated tax offices. Each method has specific guidelines and processing times, so it is important to choose the option that best meets your needs.

Quick guide on how to complete missouri form mo scc shared care tax credit taxformfinder

Effortlessly prepare Missouri Form MO SCC Shared Care Tax Credit TaxFormFinder on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Missouri Form MO SCC Shared Care Tax Credit TaxFormFinder on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Missouri Form MO SCC Shared Care Tax Credit TaxFormFinder with ease

- Locate Missouri Form MO SCC Shared Care Tax Credit TaxFormFinder and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize essential parts of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Modify and eSign Missouri Form MO SCC Shared Care Tax Credit TaxFormFinder to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is mo scc and how does airSlate SignNow utilize it?

Mo scc refers to the seamless integration of secure document signing and workflow automation within airSlate SignNow. This feature allows businesses to streamline their document management processes, signNowly enhancing efficiency and reducing turnaround times.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers multiple pricing tiers to accommodate businesses of all sizes. With options ranging from basic to advanced features, users can choose a plan that best fits their needs, particularly those seeking efficient solutions like mo scc for document processing.

-

What features does airSlate SignNow provide for document management?

AirSlate SignNow includes a variety of features such as eSigning, document templates, and integration with other applications. These functionalities, particularly mo scc, enable users to create, send, and manage documents seamlessly and securely.

-

What benefits does airSlate SignNow offer to businesses?

The primary benefit of using airSlate SignNow is its ability to simplify the document signing process, saving time and reducing errors. With features like mo scc, businesses can ensure secure transactions and enhance workflow efficiency.

-

Can I integrate airSlate SignNow with other software solutions?

Yes, airSlate SignNow provides robust integration options with various software applications, enhancing flexibility and functionality. By leveraging mo scc, you can connect with tools like CRM and project management software to optimize your workflows.

-

Is airSlate SignNow user-friendly for non-technical users?

Absolutely, airSlate SignNow is designed with an intuitive interface that allows non-technical users to navigate easily. This ease of use is further enhanced by features like mo scc, which simplify complex processes into straightforward tasks.

-

What type of support does airSlate SignNow provide for its users?

AirSlate SignNow offers comprehensive customer support, including live chat, email, and extensive documentation. This ensures that users can easily resolve any issues related to features like mo scc or other functionalities.

Get more for Missouri Form MO SCC Shared Care Tax Credit TaxFormFinder

Find out other Missouri Form MO SCC Shared Care Tax Credit TaxFormFinder

- Erase eSign Presentation Secure

- Redact eSign PDF Online

- Redact eSign PDF Now

- Redact eSign PDF Free

- Redact eSign PDF Android

- How To Redact eSign PDF

- How Can I Redact eSign PDF

- Draw eSign Word Mac

- Draw eSign Document Free

- Draw eSign Form Online

- Draw eSign Form Now

- Draw eSign Presentation Later

- How To Draw eSign Presentation

- Encrypt eSign PDF Fast

- How To Encrypt eSign Form

- Search eSign PDF Computer

- How Can I Search eSign PDF

- Search eSign PDF Secure

- Search eSign PDF Android

- Search eSign Word Safe