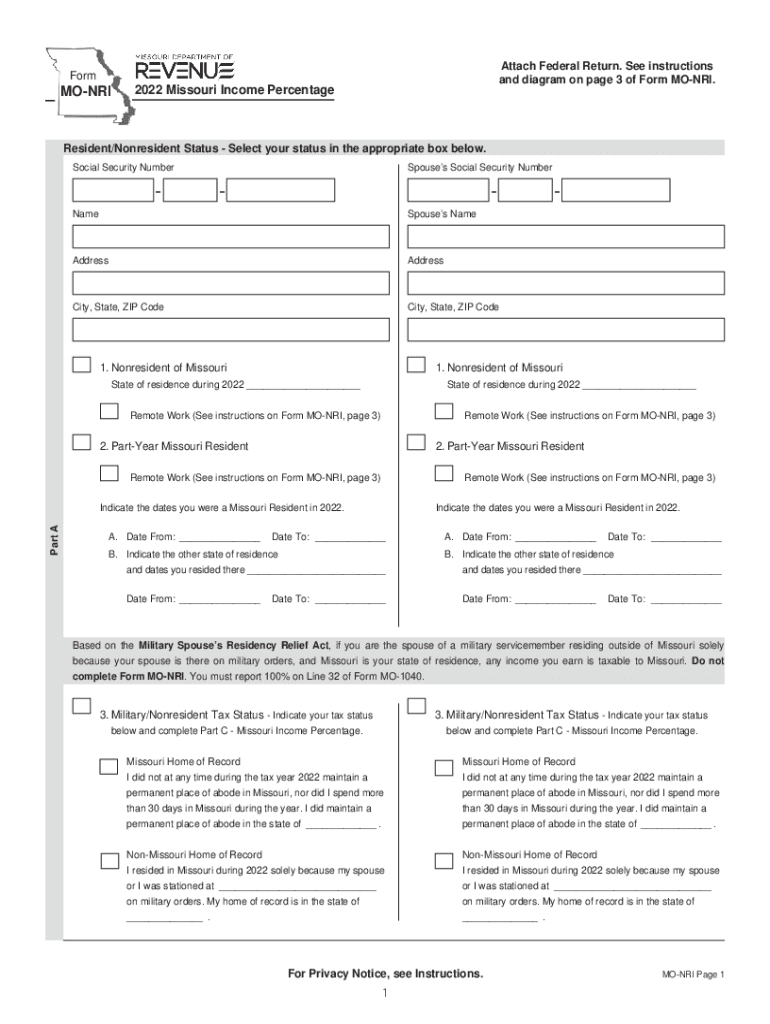

Missouri Form MO NRI Missouri Nonresident Income Percentage

What is the Missouri Form MO NRI?

The Missouri Form MO NRI, also known as the Missouri Nonresident Income Percentage form, is a critical document for individuals who earn income in Missouri but reside in another state. This form allows nonresidents to calculate the percentage of their income that is taxable in Missouri. Understanding this form is essential for ensuring compliance with state tax laws and accurately reporting income to the Missouri Department of Revenue.

How to Use the Missouri Form MO NRI

Using the Missouri Form MO NRI involves a few straightforward steps. First, gather all necessary income documentation, including W-2s and 1099s. Next, complete the form by entering your total income and the amount earned in Missouri. Calculate the nonresident income percentage based on the income earned in the state compared to your total income. Finally, submit the completed form with your Missouri tax return to ensure proper processing.

Steps to Complete the Missouri Form MO NRI

Completing the Missouri Form MO NRI requires careful attention to detail. Follow these steps:

- Collect all relevant income statements.

- Fill out your total income on the form.

- Identify and report the income earned in Missouri.

- Calculate the nonresident income percentage.

- Double-check all entries for accuracy.

- Attach the form to your Missouri tax return.

Legal Use of the Missouri Form MO NRI

The Missouri Form MO NRI is legally binding when filled out correctly and submitted on time. It is essential for nonresidents to use this form to report their Missouri-sourced income accurately. Failure to do so may result in penalties or legal repercussions. The form complies with state tax regulations, ensuring that nonresidents fulfill their tax obligations without overpaying or underreporting their income.

Filing Deadlines for the Missouri Form MO NRI

Filing deadlines for the Missouri Form MO NRI align with the standard tax filing deadlines. Typically, the form must be submitted by April 15 for the previous tax year. If the deadline falls on a weekend or holiday, it is extended to the next business day. It is crucial for nonresidents to be aware of these deadlines to avoid late fees or penalties.

Required Documents for the Missouri Form MO NRI

To complete the Missouri Form MO NRI, certain documents are required:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Documentation of any other income sources.

- Previous year’s tax return for reference.

Having these documents ready will facilitate a smoother completion process and ensure accuracy in reporting income.

Quick guide on how to complete missouri form mo nri missouri nonresident income percentage 2021

Complete Missouri Form MO NRI Missouri Nonresident Income Percentage effortlessly on any gadget

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, alter, and electronically sign your documents swiftly without delays. Handle Missouri Form MO NRI Missouri Nonresident Income Percentage on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to alter and electronically sign Missouri Form MO NRI Missouri Nonresident Income Percentage effortlessly

- Locate Missouri Form MO NRI Missouri Nonresident Income Percentage and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to preserve your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Missouri Form MO NRI Missouri Nonresident Income Percentage and ensure excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 2022 mo nri and how does it relate to airSlate SignNow?

The 2022 mo nri refers to specific regulations and requirements that non-resident individuals must comply with regarding their financial affairs. airSlate SignNow provides an efficient solution for managing and signing documents related to the 2022 mo nri, which can streamline compliance and enhance document handling.

-

How much does airSlate SignNow cost for users dealing with 2022 mo nri?

airSlate SignNow offers flexible pricing plans to cater to diverse needs, including those related to the 2022 mo nri. Our plans are designed to be cost-effective, ensuring you find a solution that fits your budget while still providing essential features to manage your documents efficiently.

-

What features does airSlate SignNow offer for 2022 mo nri document signing?

With airSlate SignNow, you have access to features such as customizable templates, secure eSigning, and in-app collaboration, all of which are essential for handling documents under the 2022 mo nri regulations. This empowers users to streamline their document flow and enhance their operational efficiency.

-

Can airSlate SignNow help me track compliance with the 2022 mo nri rules?

Yes, airSlate SignNow is designed to help you stay compliant with the 2022 mo nri rules through audit trails and security measures. This transparency allows users to track document status and ensure adherence to regulatory requirements without unnecessary hassle.

-

Are there integrations available for managing 2022 mo nri-related documents?

Absolutely! airSlate SignNow integrates seamlessly with popular applications that could assist in managing your 2022 mo nri-related documents. These integrations enhance workflow automation, making your document signing experience smoother and more efficient.

-

How does airSlate SignNow enhance the signing process for 2022 mo nri documents?

airSlate SignNow simplifies the signing process for 2022 mo nri documents by providing an intuitive user interface that eliminates confusion. With easy navigation and secure signing options, users can complete transactions faster while maintaining compliance with necessary regulations.

-

What are the benefits of using airSlate SignNow for 2022 mo nri documentation?

Using airSlate SignNow for 2022 mo nri documentation offers numerous benefits, including improved efficiency, enhanced security, and reduced paperwork. This allows businesses to focus on their core operations while ensuring their documentation process meets regulatory standards.

Get more for Missouri Form MO NRI Missouri Nonresident Income Percentage

Find out other Missouri Form MO NRI Missouri Nonresident Income Percentage

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy