Offer in Compromise of Tax LiabilityDepartment of Revenue ColoradoOffer in Compromise Instruction BookletOffer in Compromise of Form

Understanding the Offer In Compromise

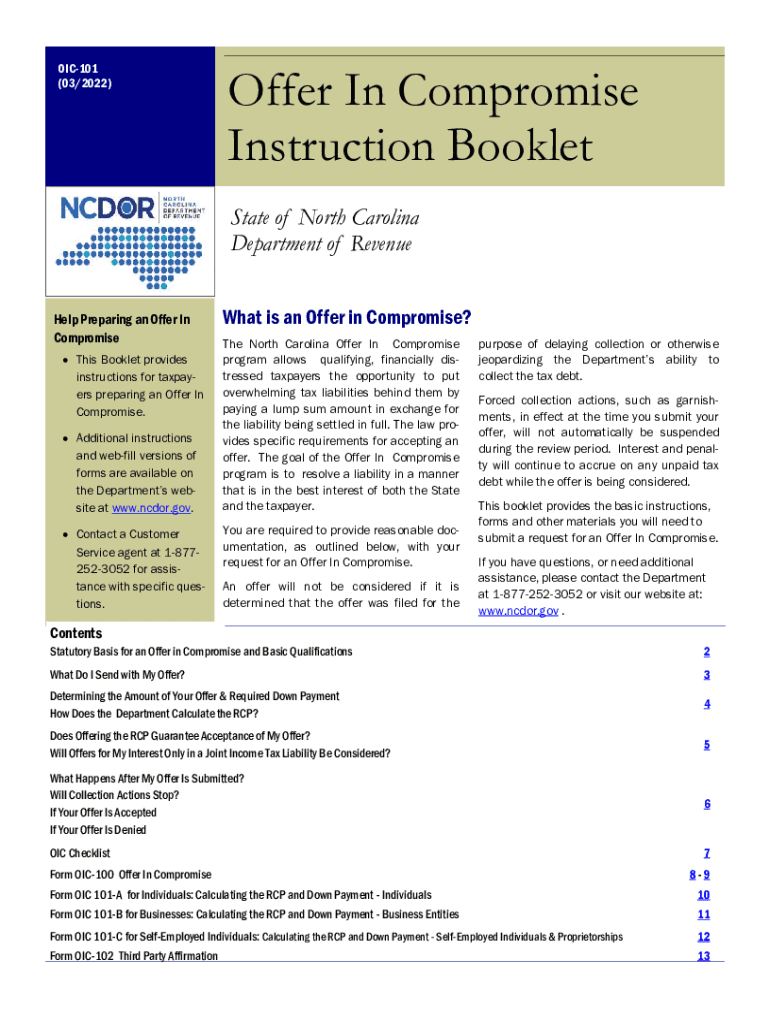

The Offer In Compromise (OIC) is a program that allows taxpayers to settle their tax liabilities for less than the full amount owed. It is designed for individuals who are unable to pay their tax debts due to financial hardship. The OIC can provide a fresh start for those struggling with tax obligations, making it a valuable option for many taxpayers. To qualify, individuals must demonstrate that paying the full tax liability would create an undue financial burden.

Steps to Complete the Offer In Compromise

Completing the Offer In Compromise involves several key steps:

- Gather necessary financial documentation, including income statements, expenses, and asset information.

- Determine eligibility by assessing your financial situation against the IRS criteria.

- Fill out the required forms, including Form 656 and Form 433-A (OIC) or Form 433-B (OIC) for businesses.

- Submit the forms along with the required application fee and initial payment, if applicable.

- Await a decision from the IRS, which may take several months.

Eligibility Criteria for the Offer In Compromise

To qualify for an Offer In Compromise, taxpayers must meet specific eligibility criteria set by the IRS. These include:

- Being current on all tax filings.

- Not being in an open bankruptcy proceeding.

- Demonstrating an inability to pay the full tax liability through financial documentation.

Each case is evaluated on its own merits, and the IRS considers various factors, including income, expenses, and asset equity.

Required Documents for Submission

When applying for an Offer In Compromise, certain documents must be submitted to support your application. These typically include:

- Form 656: Offer In Compromise.

- Form 433-A (OIC) for individuals or Form 433-B (OIC) for businesses.

- Proof of income, such as pay stubs or tax returns.

- Documentation of monthly expenses, including bills and other financial obligations.

Providing complete and accurate documentation is crucial for a successful application.

Form Submission Methods

Taxpayers can submit their Offer In Compromise application through various methods:

- Online submission via the IRS website, if eligible.

- Mailing the completed forms and documentation to the appropriate IRS address.

- In-person submission at designated IRS offices, if necessary.

Choosing the right submission method can help streamline the process and ensure timely processing of your application.

IRS Guidelines for Offer In Compromise

The IRS has established guidelines for the Offer In Compromise program to ensure fair evaluation and processing. These guidelines outline the necessary steps for submission, eligibility criteria, and the review process. Taxpayers are encouraged to familiarize themselves with these guidelines to enhance their understanding of the process and improve their chances of acceptance.

Quick guide on how to complete offer in compromise of tax liabilitydepartment of revenue coloradooffer in compromise instruction bookletoffer in compromise of

Execute Offer In Compromise Of Tax LiabilityDepartment Of Revenue ColoradoOffer In Compromise Instruction BookletOffer In Compromise Of seamlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to generate, modify, and electronically sign your documents quickly without delays. Manage Offer In Compromise Of Tax LiabilityDepartment Of Revenue ColoradoOffer In Compromise Instruction BookletOffer In Compromise Of on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to modify and electronically sign Offer In Compromise Of Tax LiabilityDepartment Of Revenue ColoradoOffer In Compromise Instruction BookletOffer In Compromise Of with ease

- Obtain Offer In Compromise Of Tax LiabilityDepartment Of Revenue ColoradoOffer In Compromise Instruction BookletOffer In Compromise Of and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Offer In Compromise Of Tax LiabilityDepartment Of Revenue ColoradoOffer In Compromise Instruction BookletOffer In Compromise Of and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an nc offer compromise?

An nc offer compromise is a tax relief solution offered by the North Carolina Department of Revenue. It allows taxpayers to settle their tax debts for less than the full amount owed, making it a viable option for those facing financial hardship. With airSlate SignNow, you can easily eSign and manage your nc offer compromise documents securely.

-

How does airSlate SignNow assist with the nc offer compromise process?

airSlate SignNow simplifies the nc offer compromise process by providing an intuitive platform for document preparation and eSigning. You can quickly create, send, and sign all necessary forms, ensuring your application is submitted efficiently. This streamlines your experience, allowing you to focus on resolving your tax issues.

-

What are the costs associated with using airSlate SignNow for my nc offer compromise?

airSlate SignNow offers flexible pricing plans to accommodate different business needs. Whether you require a monthly subscription or an annual plan, you'll find that using airSlate SignNow for your nc offer compromise is both cost-effective and valuable. Explore our pricing options to determine the best fit for your budget.

-

Is airSlate SignNow secure for handling my nc offer compromise documents?

Yes, airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your nc offer compromise documents. You can confidently eSign and manage sensitive information without worrying about data bsignNowes. Compliance with industry standards further assures you of our commitment to security.

-

Can I integrate airSlate SignNow with other tools for my nc offer compromise?

Absolutely! airSlate SignNow offers integrations with various applications, making it easier to manage your nc offer compromise alongside other business operations. Integrate with CRM systems, cloud storage solutions, and more to streamline your workflow and enhance productivity.

-

What features does airSlate SignNow offer for applicants of an nc offer compromise?

airSlate SignNow provides features designed to facilitate the nc offer compromise application process, such as customizable templates, real-time tracking, and audit trails. These tools help ensure that you remain organized and compliant throughout your application journey. Seamless collaboration with your tax advisor is also made easy.

-

How quickly can I complete my nc offer compromise using airSlate SignNow?

Using airSlate SignNow can signNowly expedite the completion of your nc offer compromise. Our user-friendly interface allows you to fill out and send documents quickly, while electronic signatures eliminate mailing delays. With efficient processing, you can submit your offer compromise application in a timely manner.

Get more for Offer In Compromise Of Tax LiabilityDepartment Of Revenue ColoradoOffer In Compromise Instruction BookletOffer In Compromise Of

- Buyers home inspection checklist nevada form

- Sellers information for appraiser provided to buyer nevada

- Handbook real estate 497320476 form

- Subcontractors agreement nevada form

- Nv domestic violence 497320478 form

- Option to purchase addendum to residential lease lease or rent to own nevada form

- Nevada prenuptial premarital agreement uniform premarital agreement act with financial statements nevada

- Nv without form

Find out other Offer In Compromise Of Tax LiabilityDepartment Of Revenue ColoradoOffer In Compromise Instruction BookletOffer In Compromise Of

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online

- How To eSign Connecticut Quitclaim Deed

- How To eSign Florida Quitclaim Deed

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free

- How Do I eSign New York Quitclaim Deed

- eSign New Hampshire Warranty Deed Fast

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure