Www Revenue Pa GovDocumentsrev 181 IInstructions for Securing a Tax Clearance Certificate to File Form

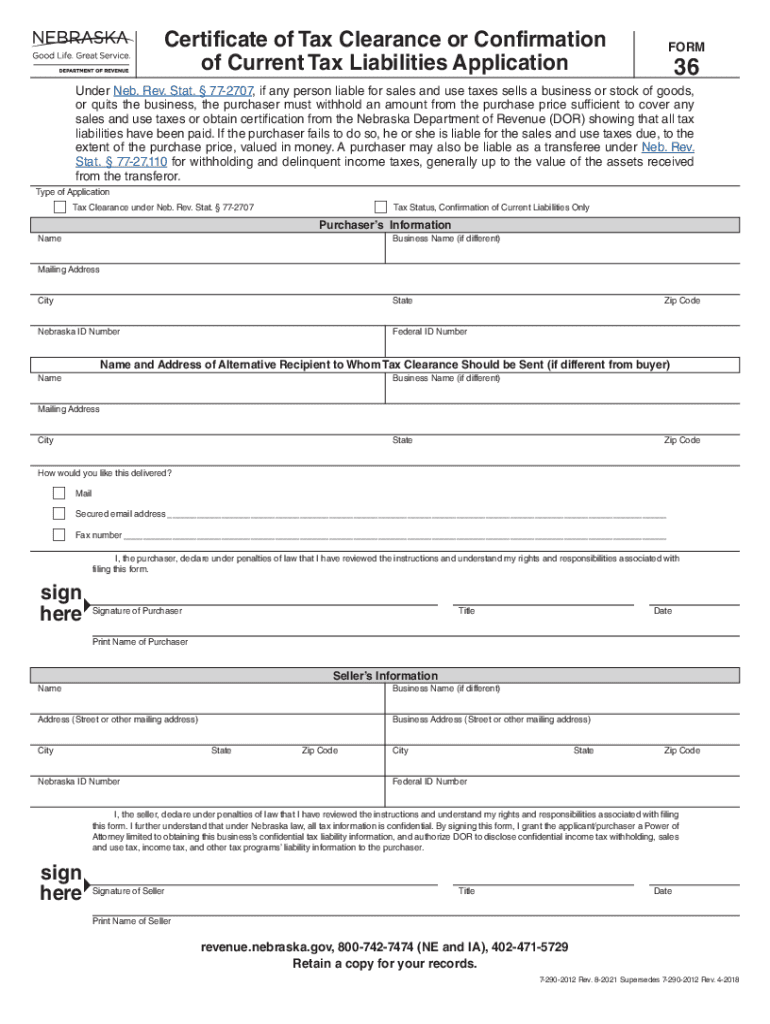

Understanding the Nebraska Tax Clearance Certificate

The Nebraska tax clearance certificate is a crucial document for individuals and businesses seeking to confirm that they have fulfilled their tax obligations. This certificate is often required when applying for loans, permits, or licenses. It serves as proof that the taxpayer is in good standing with the Nebraska Department of Revenue. Obtaining this certificate can help avoid potential legal complications and ensure compliance with state regulations.

Steps to Complete the Nebraska Tax Clearance Certificate

Filling out the Nebraska form tax requires careful attention to detail. Here are the steps to ensure a smooth completion:

- Gather necessary information, including your tax identification number and details of your tax filings.

- Access the Nebraska tax clearance certificate form, which can be found on the Nebraska Department of Revenue website.

- Complete the form by providing accurate information about your tax history.

- Review the form for any errors or omissions before submission.

- Submit the completed form either online or via mail, depending on your preference.

Required Documents for Nebraska Tax Clearance

To obtain the Nebraska tax clearance certificate, you must provide specific documentation. This includes:

- Your completed Nebraska form tax.

- Proof of identity, such as a driver's license or state ID.

- Any relevant tax returns or payment records that demonstrate compliance.

Legal Use of the Nebraska Tax Clearance Certificate

The Nebraska tax clearance certificate is legally recognized and can be used in various situations. It is often required for:

- Business licenses and permits.

- Loan applications from financial institutions.

- Contract bids and agreements with government entities.

Having this certificate can enhance your credibility and facilitate smoother transactions in business and personal matters.

Filing Deadlines and Important Dates

Awareness of filing deadlines is essential to avoid penalties. The Nebraska Department of Revenue typically sets specific due dates for tax filings and clearance certificate requests. It is advisable to check the official website for the most current information on deadlines to ensure timely compliance.

Penalties for Non-Compliance

Failure to obtain a Nebraska tax clearance certificate when required can result in various penalties. These may include:

- Fines imposed by state authorities.

- Delays in obtaining necessary licenses or permits.

- Legal repercussions that could affect business operations.

Staying compliant with tax obligations and obtaining the necessary clearance can help mitigate these risks.

Quick guide on how to complete wwwrevenuepagovdocumentsrev 181 iinstructions for securing a tax clearance certificate to file

Complete Www revenue pa govDocumentsrev 181 iInstructions For Securing A Tax Clearance Certificate To File effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Www revenue pa govDocumentsrev 181 iInstructions For Securing A Tax Clearance Certificate To File on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Www revenue pa govDocumentsrev 181 iInstructions For Securing A Tax Clearance Certificate To File with ease

- Find Www revenue pa govDocumentsrev 181 iInstructions For Securing A Tax Clearance Certificate To File and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), or invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Www revenue pa govDocumentsrev 181 iInstructions For Securing A Tax Clearance Certificate To File and guarantee effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the airSlate SignNow solution for Nebraska form tax?

airSlate SignNow offers a comprehensive eSignature solution that simplifies the process of managing Nebraska form tax documents. With our platform, you can easily create, send, and sign forms online, ensuring compliance with state tax requirements. This user-friendly tool streamlines workflow, helping you save time and reduce errors in your tax documentation.

-

How much does airSlate SignNow cost for handling Nebraska form tax?

airSlate SignNow provides flexible pricing plans that cater to different business needs. Pricing is competitive, and there are options for monthly or annual subscriptions. By choosing airSlate SignNow, you are investing in a cost-effective solution that can enhance your efficiency in managing Nebraska form tax documentation.

-

What features does airSlate SignNow offer for Nebraska form tax management?

Our platform includes various features tailored for Nebraska form tax management, such as customizable templates, automatic reminders, and real-time tracking of document status. Additionally, airSlate SignNow supports multiple file formats and integrates seamlessly with other applications, ensuring your tax processes are as efficient as possible.

-

Is airSlate SignNow secure for handling sensitive Nebraska form tax information?

Yes, airSlate SignNow prioritizes the security of your documents, including sensitive Nebraska form tax information. We utilize advanced encryption methods and comply with industry standards to protect your data. This ensures that your tax documents are safe from unauthorized access while in transit and at rest.

-

Can I integrate airSlate SignNow with other software for Nebraska form tax processes?

Absolutely! airSlate SignNow offers robust integrations with various third-party applications to enhance your Nebraska form tax processes. Whether you use CRM systems, accounting software, or document management tools, our platform can seamlessly connect and improve your workflow.

-

How does airSlate SignNow improve the efficiency of Nebraska form tax submissions?

By using airSlate SignNow, businesses can signNowly enhance the efficiency of Nebraska form tax submissions through automated workflows and instant eSignatures. Our platform eliminates the need for printing and physical signatures, reducing the turnaround time for document completion. This streamlined approach allows you to focus more on your core business activities.

-

What types of businesses can benefit from airSlate SignNow for Nebraska form tax?

airSlate SignNow is suitable for a wide range of businesses, from small startups to large enterprises, that need to manage Nebraska form tax. Organizations in industries such as finance, healthcare, and real estate can particularly benefit from our eSignature solution. The versatility of airSlate SignNow makes it an ideal choice for any business looking to simplify their tax documentation.

Get more for Www revenue pa govDocumentsrev 181 iInstructions For Securing A Tax Clearance Certificate To File

- Letter from landlord to tenant that sublease granted rent paid by subtenant but tenant still liable for rent and damages 497323050 form

- Letter from landlord to tenant that sublease granted rent paid by subtenant old tenant released from liability for rent oklahoma form

- Ok landlord 497323052 form

- Letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by expiration 497323053 form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497323054 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement oklahoma form

- Letter from tenant to landlord about insufficient notice of change in rental agreement for other than rent increase oklahoma form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants oklahoma form

Find out other Www revenue pa govDocumentsrev 181 iInstructions For Securing A Tax Clearance Certificate To File

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online