Air Conditioning Contractor License Texas Form

What is the Air Conditioning Contractor License Texas Form

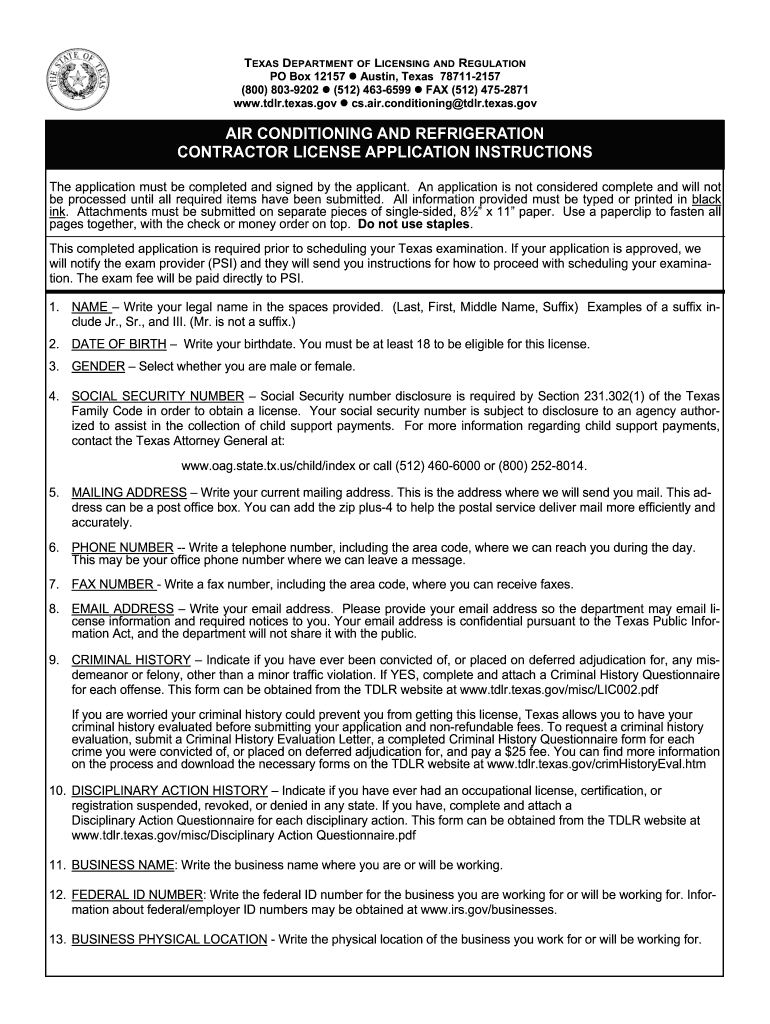

The Air Conditioning Contractor License Texas Form is a critical document required for individuals or businesses intending to operate as HVAC contractors in Texas. This form is issued by the Texas Department of Licensing and Regulation (TDLR) and ensures that contractors meet the necessary qualifications and adhere to state regulations. The form includes essential information such as the applicant's personal details, business structure, and proof of required experience or education in HVAC systems.

How to obtain the Air Conditioning Contractor License Texas Form

To obtain the Air Conditioning Contractor License Texas Form, applicants can visit the official TDLR website. The form is available for download in a PDF format, allowing for easy access. Additionally, applicants can request a physical copy of the form by contacting the TDLR directly. It is important to ensure that the most current version of the form is used, as outdated versions may not be accepted.

Steps to complete the Air Conditioning Contractor License Texas Form

Completing the Air Conditioning Contractor License Texas Form involves several steps:

- Download the form from the TDLR website or obtain a physical copy.

- Fill out the form with accurate personal and business information.

- Provide documentation that verifies your qualifications, such as proof of experience or education.

- Include any necessary fees, which can vary based on the type of license being applied for.

- Review the completed form for accuracy before submission.

Required Documents

When applying for the Air Conditioning Contractor License in Texas, several documents are required to support the application:

- Proof of identity, such as a driver’s license or state ID.

- Documentation of relevant work experience in HVAC systems.

- Proof of completion of any required training or certification programs.

- Payment for the application fee, which must be included with the submission.

Eligibility Criteria

To be eligible for the Air Conditioning Contractor License in Texas, applicants must meet specific criteria set by the TDLR. This includes:

- Being at least eighteen years old.

- Possessing a valid Social Security number or an individual taxpayer identification number.

- Having the required experience or education in HVAC systems, typically at least four years of experience under a licensed contractor.

- Passing any required examinations, if applicable.

Form Submission Methods (Online / Mail / In-Person)

The Air Conditioning Contractor License Texas Form can be submitted through various methods to accommodate different preferences:

- Online: Applicants can submit the form electronically through the TDLR online portal, which is often the fastest method.

- Mail: Completed forms can be mailed to the TDLR office. Ensure that all required documents and fees are included.

- In-Person: Applicants may also choose to submit their forms in person at designated TDLR offices, where staff can assist with the process.

Quick guide on how to complete air conditioning contractor license texas form

Effortlessly Prepare Air Conditioning Contractor License Texas Form on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Handle Air Conditioning Contractor License Texas Form on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to Edit and Electronically Sign Air Conditioning Contractor License Texas Form with Ease

- Locate Air Conditioning Contractor License Texas Form and click on Get Form to begin.

- Employ the tools available to finish your document.

- Emphasize important sections of your documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Air Conditioning Contractor License Texas Form to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do you fill out a W2 tax form if I'm an independent contractor?

Thanks for asking.If you are asking how to report your income as an independent contractor, then you do not fill out a W-2. You will report your income on your federal tax return on Schedule C which will have on which you list all of your non-employee income and associated expenses. The resulting net income, transferred to Schedule A is what you will pay self-employment and federal income tax on. If this too confusing, either get some good tax reporting software or get a tax professional to help you with it.If you are asking how to fill out a W-2 for someone that worked for you, either get some good tax reporting software or get a tax professional to help you with it.This is not tax advice, it is only my opinion on how to answer this question.

-

Does a NAFTA TN Management consultant in the U.S. still need to fill out an i-9 form even though they are an independent contractor?

Yes.You must still prove work authorization even though you are a contractor. You will fill out the I9 and indicate that you are an alien authorized to work, and provide the relevant details of your TN visa in support of your application.Hope this helps.

-

When you start working as an independent contractor for companies like Leapforce/Appen, how do you file for taxes? Do you fill out the W-8BEN form?

Austin Martin’s answer is spot on. When you are an independent contractor, you are in business for yourself. In other words, you are the business! That means you must pay taxes, and since you aren’t an employee of someone else, you have to make estimated tax payments, which will be “squared up” at year end when you file your tax return

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

If you pay a contractor (in the US) do you need to fill out tax forms? Is it different if I am in the US paying contractors outside the US?

If you are paying contractors in the U.S. in connection with a trade or business, and you pay any one of them in aggregate in excess of $600, you are required to prepare a 1099 form. In aggregate means that if you paid someone $ 400, and then later paid them $ 201, you’d be liable to prepare the 1099.If you pay persons that are not in the U.S., then your only requirement is to ascertain that they are not U.S. citizens or U.S. permanent residents. If either of those situations apply, then the $ 600 rule applies.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

Create this form in 5 minutes!

How to create an eSignature for the air conditioning contractor license texas form

How to generate an eSignature for the Air Conditioning Contractor License Texas Form online

How to create an eSignature for your Air Conditioning Contractor License Texas Form in Google Chrome

How to make an eSignature for putting it on the Air Conditioning Contractor License Texas Form in Gmail

How to generate an electronic signature for the Air Conditioning Contractor License Texas Form straight from your smartphone

How to generate an eSignature for the Air Conditioning Contractor License Texas Form on iOS

How to make an electronic signature for the Air Conditioning Contractor License Texas Form on Android

People also ask

-

Do you need a HVAC license in Texas to install air conditioning systems?

Yes, you do need a HVAC license in Texas to install air conditioning systems legally. This ensures that the installation meets safety and quality standards. Obtaining a license verifies your knowledge and competency in HVAC practices, which is essential for compliance with state regulations.

-

What qualifications must I meet to apply for a HVAC license in Texas?

To apply for a HVAC license in Texas, you typically need to possess relevant work experience and complete the necessary training courses. Additionally, passing the state licensing exam is required. These qualifications help ensure that all licensed professionals are equipped to handle HVAC systems safely and effectively.

-

How does having a HVAC license in Texas benefit my business?

Having a HVAC license in Texas can signNowly enhance your business reputation and credibility. It demonstrates to clients that you are qualified and adhere to industry standards. Furthermore, being licensed can increase your marketability and allow you to bid on larger projects that require licensed professionals.

-

What is the cost associated with obtaining a HVAC license in Texas?

The cost to obtain a HVAC license in Texas can vary based on several factors, including application fees and exam costs. On average, you should budget several hundred dollars for the entire process. Additionally, ongoing renewal fees may apply, but the investment is worthwhile for the opportunities it opens up in the HVAC industry.

-

Can I eSign HVAC contracts if I don’t have a license in Texas?

While you can technically eSign HVAC contracts without a license in Texas, doing so may expose you to legal liability and penalties. It is always advisable to ensure that you hold the necessary licensing when engaging in HVAC work. airSlate SignNow simplifies the eSigning process, but responsible practices must still be maintained.

-

What features does airSlate SignNow offer for HVAC professionals?

airSlate SignNow provides HVAC professionals with a user-friendly platform to send, sign, and manage contracts electronically. Key features include customizable templates, automated workflows, and secure storage. These features streamline the paperwork process, allowing you to focus more on your HVAC services while ensuring compliance with licensing requirements.

-

How can I integrate airSlate SignNow with my existing systems as a HVAC contractor?

airSlate SignNow offers robust integration capabilities with various CRM and project management systems, making it easy for HVAC contractors to incorporate it into their current workflow. This allows for seamless data transfer and better management of customer contracts. With these integrations, you can improve efficiency while maintaining compliance with licensing obligations.

Get more for Air Conditioning Contractor License Texas Form

- Oklahoma mineral deed form

- Quitclaim deed one individual to four individuals oklahoma form

- Oklahoma warranty deed 497322820 form

- Oklahoma life estate form

- Special warranty deed limited liability company to limited liability company oklahoma form

- Transfer of deed on death oklahoma form

- Child support in oklahoma form

- Quitclaim deed trust to an individual oklahoma form

Find out other Air Conditioning Contractor License Texas Form

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement