Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions 2022-2026

What is the Oklahoma Form 513 Resident Fiduciary Income Tax Return?

The Oklahoma Form 513 is designed for fiduciaries responsible for managing the income tax obligations of estates and trusts in Oklahoma. This form allows fiduciaries to report income, deductions, and credits related to the estate or trust for the tax year. It is essential for ensuring compliance with state tax regulations and for the accurate calculation of tax liabilities. Proper completion of this form is vital to avoid penalties and ensure that the fiduciary meets their legal responsibilities.

Steps to Complete the Oklahoma Form 513 Instructions

Completing the Oklahoma Form 513 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents related to the estate or trust, including income statements, expense records, and any applicable deductions. Follow these steps:

- Fill out the identifying information, including the name of the estate or trust and the fiduciary's details.

- Report all sources of income received by the estate or trust during the tax year.

- Detail any deductions that the estate or trust is eligible for, such as administrative expenses and distributions to beneficiaries.

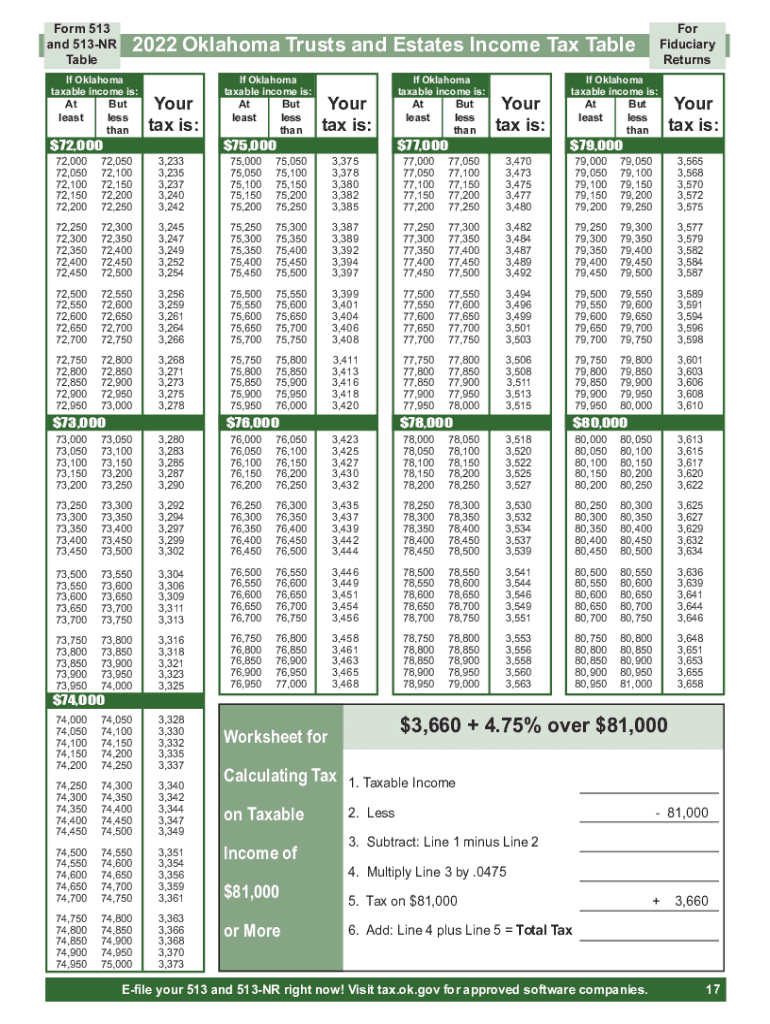

- Calculate the total tax liability based on the reported income and deductions.

- Review the completed form for accuracy before submission.

Legal Use of the Oklahoma Form 513 Instructions

The Oklahoma Form 513 must be used in accordance with state tax laws to ensure it is legally binding. The form must be completed accurately to reflect the fiduciary's responsibilities. Failure to comply with the legal requirements can result in penalties or legal issues for the fiduciary. It is important to understand the legal implications of the information reported on the form, as it may be subject to audits by the Oklahoma Tax Commission.

Filing Deadlines for the Oklahoma Form 513

Timely filing of the Oklahoma Form 513 is crucial to avoid penalties. The filing deadline generally aligns with the federal tax return due date, which is typically April fifteenth. However, if the fiduciary requires an extension, it is essential to file the appropriate extension request to avoid late fees. Keeping track of these deadlines ensures compliance and maintains the fiduciary's good standing with the state tax authorities.

Required Documents for the Oklahoma Form 513

To complete the Oklahoma Form 513, several documents are necessary. These typically include:

- Income statements for the estate or trust, such as interest and dividends.

- Records of expenses incurred in managing the estate or trust.

- Documentation of distributions made to beneficiaries.

- Any prior year tax returns that may be relevant for comparison.

Having these documents ready will facilitate a smoother completion process.

How to Obtain the Oklahoma Form 513

The Oklahoma Form 513 can be obtained through the Oklahoma Tax Commission's website or by contacting their office directly. It is available in a downloadable format, allowing fiduciaries to print and complete the form at their convenience. Ensuring you have the most recent version of the form is important, as tax laws and requirements may change from year to year.

Quick guide on how to complete 2022 form 513 oklahoma resident fiduciary income tax return packet ampamp instructions

Easily Prepare Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions on any device

The management of documents online has become increasingly favored by both companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, enabling you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without delays. Manage Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to edit and electronically sign Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions effortlessly

- Obtain Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important portions of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to store your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions to maintain excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2022 form 513 oklahoma resident fiduciary income tax return packet ampamp instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the oklahoma form 513 instructions 2023?

The oklahoma form 513 instructions 2023 provide comprehensive guidelines for completing the form accurately. This document helps ensure that all information required for submission is properly filled out and filed on time. Understanding these instructions can signNowly simplify the filing process for businesses and individuals.

-

How can airSlate SignNow help with oklahoma form 513 instructions 2023?

AirSlate SignNow simplifies the electronic signing of documents related to the oklahoma form 513 instructions 2023. With its user-friendly interface, users can easily prepare, send, and eSign their documents without the need for physical paperwork. This streamlines the submission process and reduces the reliance on printing and mailing.

-

What are the benefits of using airSlate SignNow for oklahoma form 513 instructions 2023?

Using airSlate SignNow for the oklahoma form 513 instructions 2023 allows for faster processing times and increased efficiency. The platform provides templates and reusable fields, enabling quick document preparation. Additionally, electronic signatures are legally valid, ensuring your submissions are accepted without delay.

-

Is airSlate SignNow compatible with other software for filing the oklahoma form 513 instructions 2023?

Yes, airSlate SignNow integrates seamlessly with various software platforms to facilitate the completion of the oklahoma form 513 instructions 2023. Whether you're using accounting tools or document management systems, airSlate SignNow enhances your workflow by allowing data to flow easily between applications. This interoperability saves time and reduces errors.

-

What pricing plans does airSlate SignNow offer for users handling oklahoma form 513 instructions 2023?

AirSlate SignNow offers several pricing plans tailored to different business needs, making it a budget-friendly option for managing the oklahoma form 513 instructions 2023. Users can choose from individual, business, or enterprise plans that offer varying features and levels of support. The competitive pricing ensures that organizations of all sizes can access essential eSignature tools.

-

How secure is the airSlate SignNow platform for submitting oklahoma form 513 instructions 2023?

AirSlate SignNow prioritizes security and compliance, making it a trusted solution for submitting the oklahoma form 513 instructions 2023. The platform utilizes advanced encryption to protect data and ensure that all electronic signatures are legally compliant. This commitment to security builds confidence in the submission process.

-

Can I track the status of my documents related to oklahoma form 513 instructions 2023 with airSlate SignNow?

Absolutely! AirSlate SignNow allows users to track the status of their documents related to the oklahoma form 513 instructions 2023 in real-time. Users receive notifications at each stage of the signing process, ensuring they are always informed about the progress and completion of their submissions.

Get more for Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions

- South carolina small business startup package south carolina form

- South carolina property management form

- New resident guide south carolina form

- South carolina employer form

- South carolina satisfaction mortgage form

- Sc satisfaction mortgage 497325966 form

- Partial release of property from mortgage for corporation south carolina form

- Partial release of property from mortgage by individual holder south carolina form

Find out other Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement