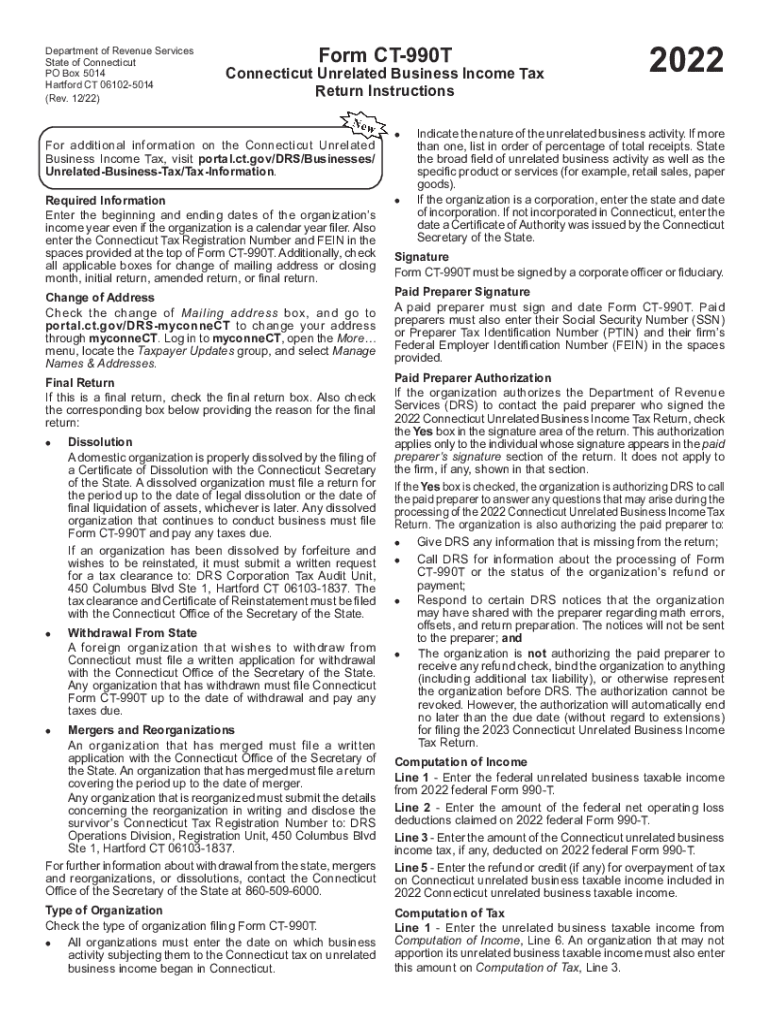

Department of Revenue Services State of Connecticut Form

What is the Department Of Revenue Services State Of Connecticut

The Department Of Revenue Services State Of Connecticut (DRS) is the state agency responsible for the administration of tax laws and the collection of taxes in Connecticut. It oversees various tax programs, including income, sales, and property taxes, ensuring compliance with state regulations. The DRS also provides resources and support for individuals and businesses to understand their tax obligations and rights.

How to use the Department Of Revenue Services State Of Connecticut

Using the Department Of Revenue Services State Of Connecticut involves accessing various forms and resources available on their official website. Taxpayers can find information on tax rates, filing requirements, and deadlines. Additionally, the DRS offers online services for filing taxes, making payments, and checking the status of refunds, which simplifies the process for users.

Steps to complete the Department Of Revenue Services State Of Connecticut

Completing forms from the Department Of Revenue Services State Of Connecticut typically involves several steps:

- Gather necessary documentation, such as income statements and previous tax returns.

- Access the appropriate form on the DRS website, ensuring it is the correct version for your needs.

- Fill out the form accurately, providing all required information.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or by mail, following the specific submission guidelines provided by the DRS.

Legal use of the Department Of Revenue Services State Of Connecticut

The legal use of forms from the Department Of Revenue Services State Of Connecticut is governed by state tax laws. To ensure that submitted forms are legally binding, they must be completed accurately and submitted within the specified deadlines. Electronic submissions are accepted, provided that they comply with eSignature laws and regulations, ensuring that the documents are recognized as valid in legal contexts.

Required Documents

When completing forms for the Department Of Revenue Services State Of Connecticut, several documents may be required, including:

- W-2 forms from employers.

- 1099 forms for additional income.

- Proof of residency for state tax purposes.

- Documentation of deductions or credits claimed.

Having these documents ready can facilitate a smoother filing process and help ensure compliance with state tax laws.

Form Submission Methods

Forms for the Department Of Revenue Services State Of Connecticut can be submitted through various methods:

- Online submission via the DRS website, which is often the fastest option.

- Mailing the completed form to the appropriate DRS address, as specified on the form.

- In-person submission at designated DRS offices, which may be necessary for certain types of forms.

Each method has its own guidelines and deadlines, so it is important to choose the one that best suits your needs.

Quick guide on how to complete department of revenue services state of connecticut

Complete Department Of Revenue Services State Of Connecticut seamlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without interruptions. Manage Department Of Revenue Services State Of Connecticut on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Department Of Revenue Services State Of Connecticut effortlessly

- Find Department Of Revenue Services State Of Connecticut and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your needs in document management with just a few clicks from any device you prefer. Modify and eSign Department Of Revenue Services State Of Connecticut and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the department of revenue services state of connecticut

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the role of the Department Of Revenue Services State Of Connecticut?

The Department Of Revenue Services State Of Connecticut oversees the collection of various state taxes, including income tax, sales tax, and more. They ensure compliance with tax laws and provide resources for businesses and individuals to understand their tax obligations within Connecticut.

-

How can airSlate SignNow assist with documents for the Department Of Revenue Services State Of Connecticut?

airSlate SignNow empowers users to efficiently create, send, and e-sign documents that may be required by the Department Of Revenue Services State Of Connecticut. This includes tax forms, compliance documents, and other essential paperwork, streamlining the submission process and ensuring accuracy.

-

What pricing options are available for airSlate SignNow when dealing with the Department Of Revenue Services State Of Connecticut?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those that require interactions with the Department Of Revenue Services State Of Connecticut. Pricing is competitive and designed to provide a cost-effective solution for businesses that need to manage documentation efficiently.

-

Are there any specific features of airSlate SignNow that benefit those engaging with the Department Of Revenue Services State Of Connecticut?

Yes, airSlate SignNow includes features such as custom templates, secure e-signatures, and in-app integrations that simplify the management of documents for the Department Of Revenue Services State Of Connecticut. These tools enhance workflow efficiency and ensure that your documents are compliant and easily accessible.

-

How does airSlate SignNow enhance compliance with the Department Of Revenue Services State Of Connecticut?

With airSlate SignNow's secure e-signature capabilities, users can easily ensure compliance with the Department Of Revenue Services State Of Connecticut regulations. Automated tracking and storage of signed documents provide a clear audit trail, which is crucial for meeting state requirements and avoiding potential penalties.

-

What integrations does airSlate SignNow offer for those working with the Department Of Revenue Services State Of Connecticut?

airSlate SignNow integrates seamlessly with various third-party applications that businesses commonly use when dealing with the Department Of Revenue Services State Of Connecticut. These integrations help centralize document management and streamline the workflow, enhancing overall productivity.

-

Can small businesses benefit from using airSlate SignNow in relation to the Department Of Revenue Services State Of Connecticut?

Absolutely! Small businesses can signNowly benefit from using airSlate SignNow to manage their documentation related to the Department Of Revenue Services State Of Connecticut. The platform's user-friendly interface and affordability make it an ideal choice for small businesses looking to stay organized and compliant.

Get more for Department Of Revenue Services State Of Connecticut

- Special or limited power of attorney for real estate sales transaction by seller tennessee form

- Real estate transaction document form

- Limited power of attorney where you specify powers with sample powers included tennessee form

- Limited power of attorney for stock transactions and corporate powers tennessee form

- Tn poa form

- Tennessee business form

- Tennessee property management package tennessee form

- Tennessee annual corporation form

Find out other Department Of Revenue Services State Of Connecticut

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document