IRS E File Signature Authorization for Form 1120 2022-2026

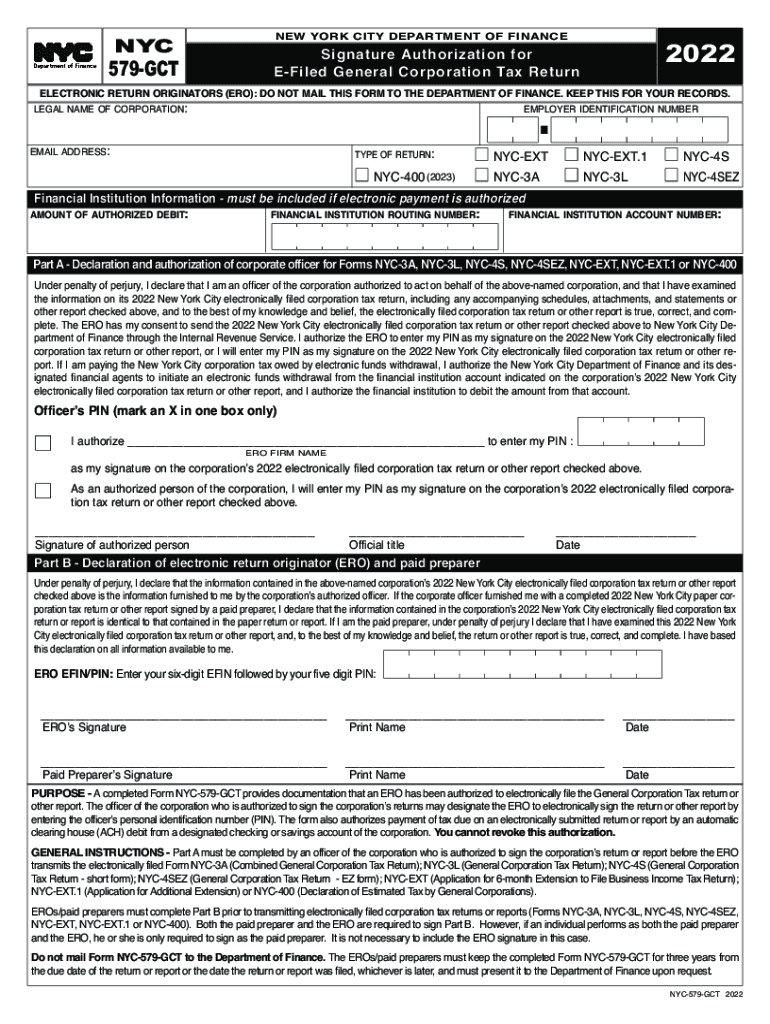

Understanding the NYC 579 GCT Form

The NYC 579 GCT form is a crucial document for businesses operating in New York City that are subject to the General Corporation Tax (GCT). This form is used to report and calculate the tax owed by corporations and certain unincorporated businesses. It is essential for ensuring compliance with local tax regulations and for accurately determining the tax liability based on the business's income and activities within the city.

Steps to Complete the NYC 579 GCT Form

Completing the NYC 579 GCT form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form by entering your business's gross income, deductions, and any applicable credits. It is important to double-check all calculations to avoid errors that could lead to penalties. Finally, submit the form by the specified deadline to avoid late fees.

Filing Deadlines for the NYC 579 GCT Form

Timely filing of the NYC 579 GCT form is essential to avoid penalties. The due date for filing is typically the fifteenth day of the fourth month following the end of your fiscal year. For most businesses operating on a calendar year, this means the form is due on April 15. It is advisable to mark your calendar and prepare your documents well in advance of this deadline to ensure a smooth filing process.

Required Documents for the NYC 579 GCT Form

To complete the NYC 579 GCT form, several documents are required. These include:

- Financial statements, including profit and loss statements.

- Records of all income and expenses related to the business.

- Documentation of any tax credits or deductions you plan to claim.

- Prior year tax returns, if applicable, for reference.

Having these documents ready will facilitate a more efficient completion of the form.

Legal Use of the NYC 579 GCT Form

The NYC 579 GCT form must be used in accordance with New York City tax laws. It is legally binding and must accurately reflect the business's financial activities. Falsifying information or failing to file can result in severe penalties, including fines and interest on unpaid taxes. Therefore, it is crucial to ensure that all information reported is truthful and complete.

Penalties for Non-Compliance with the NYC 579 GCT Form

Failure to comply with the filing requirements of the NYC 579 GCT form can result in significant penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on any unpaid taxes, which compounds daily.

- Potential audits by the New York City Department of Finance.

Understanding these penalties underscores the importance of timely and accurate filing.

Quick guide on how to complete irs e file signature authorization for form 1120

Effortlessly Prepare IRS E file Signature Authorization For Form 1120 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to quickly create, modify, and eSign your documents without delays. Manage IRS E file Signature Authorization For Form 1120 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

How to Revise and eSign IRS E file Signature Authorization For Form 1120 with Ease

- Find IRS E file Signature Authorization For Form 1120 and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form – via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, time-consuming form searches, or mistakes that require reprinting new copies. airSlate SignNow simplifies your document management needs in just a few clicks from any device you choose. Revise and eSign IRS E file Signature Authorization For Form 1120 and guarantee excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs e file signature authorization for form 1120

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is NYC 579 GCT and how does airSlate SignNow relate to it?

NYC 579 GCT, or General Corporation Tax, is a tax imposed on corporations operating in New York City. airSlate SignNow offers businesses an efficient solution for managing documents related to tax filings, including those for NYC 579 GCT. By using our eSignature platform, you can streamline the process and ensure timely submissions.

-

How much does airSlate SignNow cost for businesses handling NYC 579 GCT?

Pricing for airSlate SignNow is designed to be cost-effective for businesses, including those dealing with NYC 579 GCT. We offer various subscription plans tailored to different business needs, ensuring that you can find the best fit for your document management and eSigning requirements.

-

What features does airSlate SignNow provide that can assist with NYC 579 GCT documentation?

airSlate SignNow includes a variety of features such as customizable templates, automated workflows, and robust security measures that are essential for handling NYC 579 GCT documentation. These features simplify the signing process, reduce errors, and enhance compliance for your tax-related documents.

-

Can airSlate SignNow help with tracking NYC 579 GCT document statuses?

Yes, airSlate SignNow provides users with the ability to track the status of NYC 579 GCT documents in real time. You can easily monitor who has signed, who needs to sign, and receive notifications when actions are completed, ensuring that all your tax documents are processed promptly.

-

How does airSlate SignNow ensure the security of NYC 579 GCT documents?

The security of your NYC 579 GCT documents is a top priority for airSlate SignNow. Our platform uses advanced encryption methods and compliance with industry standards to safeguard your sensitive information throughout the document signing process, giving you peace of mind.

-

Does airSlate SignNow integrate with other tools for better management of NYC 579 GCT?

Indeed, airSlate SignNow integrates seamlessly with various business tools that can enhance the management of NYC 579 GCT. Whether you use accounting software or project management tools, our integrations help create a unified system for handling your documents and tax filings efficiently.

-

What are the benefits of using airSlate SignNow for NYC 579 GCT filings?

Using airSlate SignNow for NYC 579 GCT filings offers numerous benefits including faster document turnaround, reduced paperwork, and improved accuracy. Our solution not only simplifies the eSigning process but also enables easier collaboration among team members handling tax documents.

Get more for IRS E file Signature Authorization For Form 1120

- Transfer death tod form

- Mo company llc form

- Missouri mechanic lien 497313086 form

- Missouri lien form

- Quitclaim deed by two individuals to llc missouri form

- Warranty deed from two individuals to llc missouri form

- Mo deed beneficiary form

- Quitclaim deed husband and wife to three individuals missouri form

Find out other IRS E file Signature Authorization For Form 1120

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease