Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions

What is the Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions

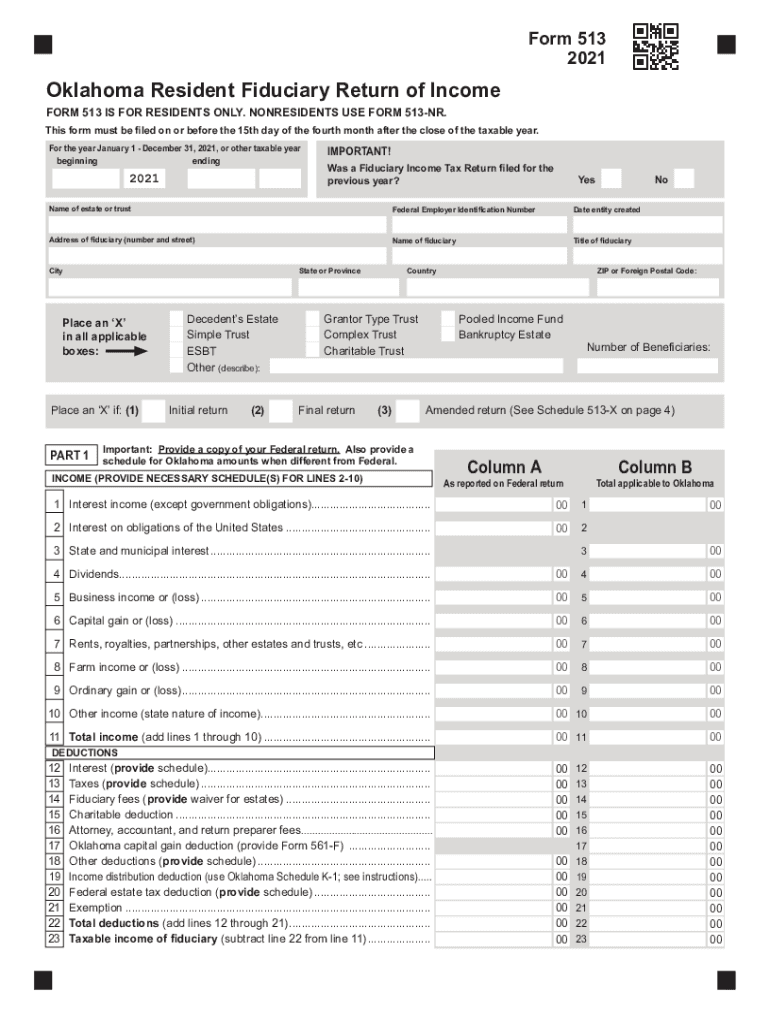

The Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet serves as a comprehensive document for fiduciaries managing the income tax responsibilities of estates or trusts in Oklahoma. This form is specifically designed for fiduciaries who are required to report income earned by the estate or trust on behalf of beneficiaries. It includes detailed instructions for completing the return, ensuring that fiduciaries comply with state tax regulations. The packet encompasses all necessary forms and guidelines to facilitate accurate reporting and filing.

Steps to complete the Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions

Completing the Form 513 involves several systematic steps:

- Gather all relevant financial documents, including income statements, deductions, and credits applicable to the estate or trust.

- Download or obtain the Form 513 packet, ensuring you have the latest version.

- Fill out the form accurately, providing detailed information about the income earned, expenses incurred, and any applicable deductions.

- Review the completed form for accuracy, ensuring all calculations are correct and all required fields are filled.

- Sign and date the form, as required, to validate the submission.

- Submit the form by the designated deadline, either electronically or via mail, as per the instructions provided in the packet.

How to obtain the Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions

The Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet can be obtained through multiple channels. Individuals can visit the official Oklahoma Tax Commission website to download the form directly. Additionally, physical copies may be available at local tax offices or libraries. It is essential to ensure that you are accessing the most current version of the form to comply with any recent changes in tax regulations.

Legal use of the Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions

The legal use of Form 513 is crucial for fiduciaries who are responsible for managing and reporting the income of estates or trusts. This form must be completed in accordance with Oklahoma tax laws to ensure compliance and avoid penalties. The information provided on the form must be accurate and truthful, as any discrepancies could lead to legal repercussions. Utilizing a reliable electronic signature solution can further enhance the legitimacy of the document, ensuring that it meets all necessary legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the Form 513 are critical for fiduciaries to observe. Typically, the form must be submitted by the 15th day of the fourth month following the close of the estate's or trust's tax year. For estates or trusts operating on a calendar year, this means the form is due by April 15. It is advisable to check for any specific extensions or changes in deadlines that may apply, particularly in light of any new tax legislation or state announcements.

Form Submission Methods (Online / Mail / In-Person)

The Form 513 can be submitted through various methods to accommodate different preferences. Fiduciaries have the option to file the form electronically through the Oklahoma Tax Commission's online portal, which offers a streamlined process. Alternatively, the completed form can be mailed to the appropriate tax office address indicated in the instructions. In-person submissions may also be possible at designated tax offices, providing an opportunity for immediate assistance if needed.

Quick guide on how to complete 2021 form 513 oklahoma resident fiduciary income tax return packet ampamp instructions

Complete Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions effortlessly on any device

Managing documents online has become widely accepted by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools you require to create, edit, and eSign your documents swiftly without delays. Handle Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions with ease

- Obtain Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed for that by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Edit and eSign Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 513 oklahoma resident fiduciary income tax return packet ampamp instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions?

The Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions is a comprehensive tool designed for fiduciaries managing income tax returns in Oklahoma. This packet includes detailed forms and guidelines to assist in compliance with state tax regulations, ensuring accuracy and efficiency in tax filings.

-

How much does the Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions cost?

The cost of the Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions varies based on the provider you choose. However, with airSlate SignNow, you can access an affordable solution that simplifies the eSigning and document management process without hidden fees or extra charges.

-

What features are included in the Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions?

The Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions includes user-friendly templates, step-by-step instructions, and eSigning capabilities. These features enhance the efficiency of completing and submitting tax returns, leading to a smoother filing experience.

-

How can the Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions benefit my business?

Utilizing the Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions can greatly benefit your business by ensuring compliance with Oklahoma tax laws, minimizing errors, and speeding up the filing process. Moreover, airSlate SignNow provides a cost-effective way to manage and sign documents securely.

-

Can I integrate the Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions with other software?

Yes, the Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions from airSlate SignNow can be integrated with various software applications. This allows for seamless data transfer and enhances your workflow, making it easier to manage your documents and tax filing process.

-

Is there support available for using the Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions?

Absolutely! With airSlate SignNow, you receive access to dedicated customer support when using the Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions. Our support team is ready to assist you with any questions or issues, ensuring you can navigate your tax processes smoothly.

-

How do I complete the Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions?

To complete the Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions, follow the step-by-step guidelines included in the packet. airSlate SignNow also provides intuitive tools to help you fill out, review, and eSign the forms with ease, making the process straightforward.

Get more for Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions

Find out other Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet & Instructions

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement