Form 1099 INT Rev January IRS Tax Forms

Understanding Form 5498 for 2022

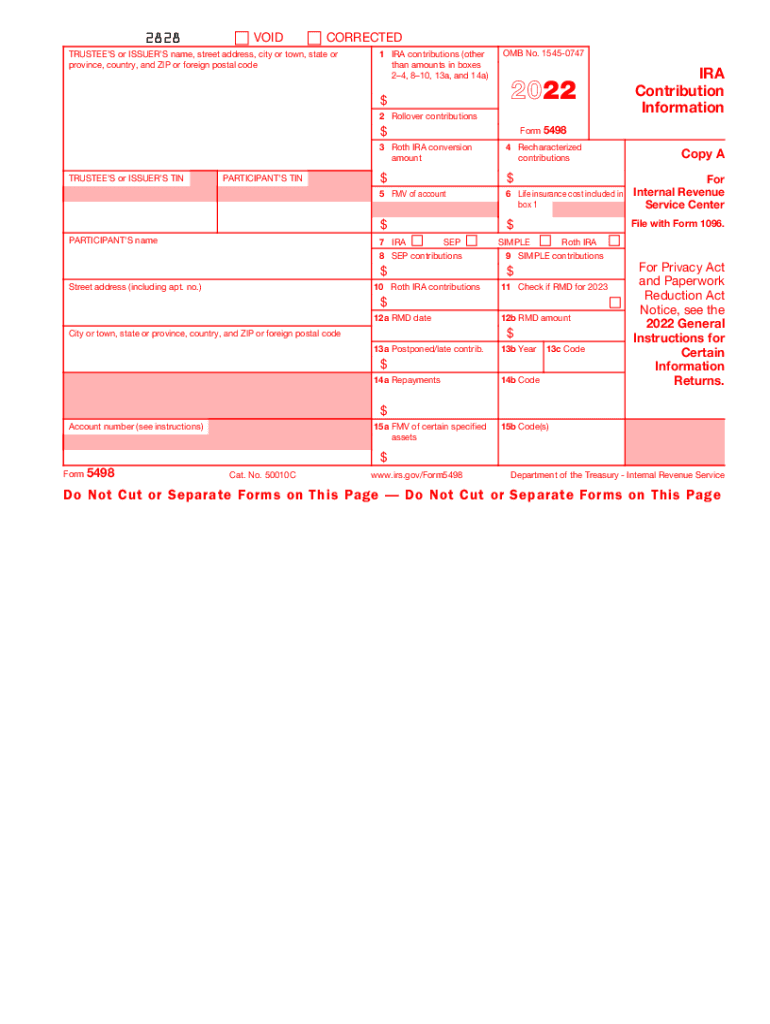

The 2022 Form 5498 is an important tax document used to report contributions to various retirement accounts, including IRAs, HSAs, and Coverdell ESAs. This form is typically issued by financial institutions to the IRS and the account holder. It provides essential information regarding the contributions made during the tax year, including the type of account and the total amount contributed. Understanding the details of this form is crucial for accurate tax reporting and compliance.

Key Elements of the 2022 Form 5498

Form 5498 contains several key sections that provide valuable information:

- Box 1: Reports contributions made to traditional IRAs.

- Box 2: Lists contributions to Roth IRAs.

- Box 3: Indicates rollover contributions.

- Box 4: Details recharacterizations.

- Box 5: Shows fair market value of the account.

Each box serves a specific purpose and helps both the IRS and taxpayers understand the status of retirement accounts.

Filing Deadlines for Form 5498

Form 5498 is typically due to the IRS by May 31 of the year following the tax year in question. For contributions made during 2022, the form must be filed by May 31, 2023. It is important to note that while the form is due at this time, taxpayers do not need to attach it to their tax return. However, keeping it for personal records is advisable, as it contains important information for tax filing.

Steps to Complete Form 5498

Completing Form 5498 involves several straightforward steps:

- Gather all necessary documents related to your retirement accounts.

- Fill in your personal information, including your name, address, and Social Security number.

- Report the contributions made to each type of account in the appropriate boxes.

- Ensure that the total contributions reported match your records.

- Submit the form to your financial institution by the deadline.

Following these steps can help ensure that your Form 5498 is accurate and complete.

Legal Use of Form 5498

Form 5498 is legally required for reporting retirement contributions and is recognized by the IRS as an official document. It serves as proof of contributions made to retirement accounts, which can affect tax deductions and credits. Failing to file or inaccurately reporting information on this form can lead to penalties or issues with your tax return. Therefore, it is essential to handle this form with care and ensure compliance with IRS regulations.

Who Issues Form 5498?

Form 5498 is issued by financial institutions, such as banks, credit unions, and brokerage firms, that manage retirement accounts. These institutions are responsible for providing accurate information regarding contributions made by account holders. If you have multiple retirement accounts at different institutions, you may receive multiple copies of Form 5498, each detailing the contributions for that specific account.

Quick guide on how to complete form 1099 int rev january 2022 irs tax forms

Complete Form 1099 INT Rev January IRS Tax Forms seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as it allows you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 1099 INT Rev January IRS Tax Forms on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to alter and eSign Form 1099 INT Rev January IRS Tax Forms with ease

- Locate Form 1099 INT Rev January IRS Tax Forms and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Form 1099 INT Rev January IRS Tax Forms and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1099 int rev january 2022 irs tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 5498 2022 and why is it important?

Form 5498 2022 is an IRS form used to report contributions to various retirement accounts, including IRAs. It provides essential information for both the account holder and the IRS, ensuring proper reporting and compliance. By understanding Form 5498 2022, users can better manage their retirement savings.

-

How can airSlate SignNow help with Form 5498 2022?

airSlate SignNow streamlines the process of preparing and signing Form 5498 2022 electronically. With its user-friendly interface, businesses can efficiently gather signatures and maintain compliance with IRS regulations. This saves time and reduces the need for paper-based processes.

-

Is there a cost associated with using airSlate SignNow for Form 5498 2022?

Yes, airSlate SignNow offers competitive pricing plans that accommodate various business sizes and needs. Customers can choose a plan that includes features for managing Form 5498 2022 efficiently. It's an affordable solution compared to traditional methods.

-

What features does airSlate SignNow offer for handling Form 5498 2022?

airSlate SignNow provides features such as document templates, cloud storage, and e-signature capabilities specifically designed for Form 5498 2022 and other documents. Users can easily customize templates and track the status of their forms, enhancing productivity.

-

Can I integrate airSlate SignNow with other software for Form 5498 2022?

Yes, airSlate SignNow offers integrations with popular software applications that can assist in managing Form 5498 2022. This seamless integration allows users to import data from financial software, simplifying the reporting process.

-

What are the benefits of using airSlate SignNow for Form 5498 2022 submissions?

Using airSlate SignNow for Form 5498 2022 provides numerous benefits, including increased efficiency, reduced error rates, and improved tracking of signatures. Organizations can also ensure that their documentation practices comply with IRS requirements without the hassle of physical paperwork.

-

How secure is airSlate SignNow when processing Form 5498 2022?

airSlate SignNow prioritizes security, employing advanced encryption and compliance with industry standards when handling Form 5498 2022. Users can rest assured that their sensitive information is protected throughout the document signing process.

Get more for Form 1099 INT Rev January IRS Tax Forms

Find out other Form 1099 INT Rev January IRS Tax Forms

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later