PDF CAUTION This Tax Return Must Be Filed Electronically Mass Gov Form

What is the PDF CAUTION This Tax Return Must Be Filed Electronically Mass gov

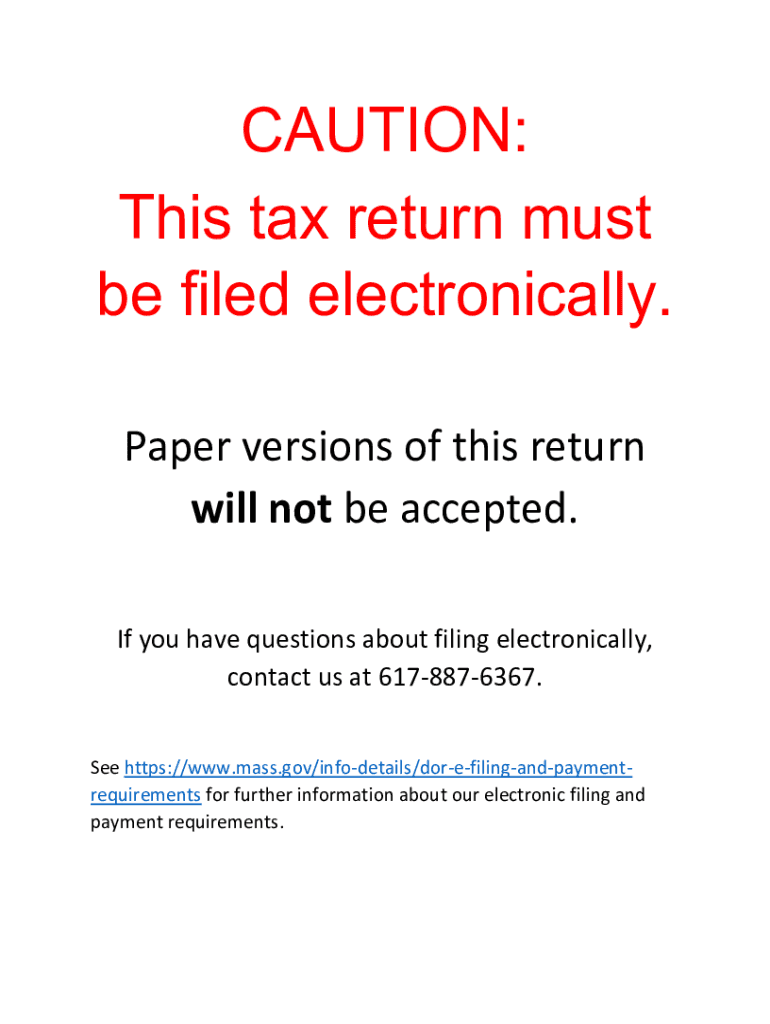

The PDF CAUTION This Tax Return Must Be Filed Electronically Mass gov is a specific tax form mandated by the state of Massachusetts. This form is essential for individuals and businesses required to file their tax returns electronically. It serves as an official notification that the tax return must be submitted using electronic means, ensuring compliance with state regulations. The form is designed to streamline the filing process and enhance accuracy, reducing the likelihood of errors associated with paper submissions.

Steps to complete the PDF CAUTION This Tax Return Must Be Filed Electronically Mass gov

Completing the PDF CAUTION This Tax Return Must Be Filed Electronically Mass gov involves several key steps to ensure accurate and timely submission. Follow these steps:

- Gather all necessary financial documents, including income statements, deductions, and credits.

- Access the official PDF form through the Massachusetts government website or an authorized platform.

- Fill out the form with accurate information, ensuring all fields are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the completed form electronically via the designated e-filing system.

Legal use of the PDF CAUTION This Tax Return Must Be Filed Electronically Mass gov

The legal use of the PDF CAUTION This Tax Return Must Be Filed Electronically Mass gov is governed by state tax laws and regulations. To be considered legally binding, the electronic submission must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). This means that the electronic signature used must meet specific criteria to ensure its validity. Utilizing a reliable eSignature platform can help ensure compliance with these legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the PDF CAUTION This Tax Return Must Be Filed Electronically Mass gov are critical for compliance. Generally, individual tax returns are due on April fifteenth each year, while business tax returns may have different deadlines based on the entity type. It is essential to stay informed about any changes in deadlines that may occur due to state regulations or special circumstances, such as extensions or changes in tax law.

Required Documents

When preparing to file the PDF CAUTION This Tax Return Must Be Filed Electronically Mass gov, several documents are necessary. These typically include:

- W-2 forms from employers

- 1099 forms for other income sources

- Documentation for deductions and credits, such as receipts and statements

- Previous year’s tax return for reference

Form Submission Methods (Online / Mail / In-Person)

The PDF CAUTION This Tax Return Must Be Filed Electronically Mass gov must be submitted electronically. While traditional paper filing methods may still exist, the state emphasizes electronic submission for efficiency and accuracy. This can typically be done through a secure online portal provided by the Massachusetts Department of Revenue. It is important to follow the specific guidelines for electronic submission to ensure successful filing.

Quick guide on how to complete pdf caution this tax return must be filed electronically massgov

Prepare [SKS] seamlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with the airSlate SignNow apps for Android or iOS and enhance any document-based workflow today.

The easiest way to modify and electronically sign [SKS] without hassle

- Obtain [SKS] and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to secure your changes.

- Select how you would like to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pdf caution this tax return must be filed electronically massgov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of 'PDF CAUTION This Tax Return Must Be Filed Electronically Mass gov.'?

The phrase 'PDF CAUTION This Tax Return Must Be Filed Electronically Mass gov.' indicates that certain tax returns must be submitted electronically to the Massachusetts government. This requirement helps streamline the processing of tax documents and ensures compliance. By understanding this necessity, users can avoid penalties and delays in their tax filings.

-

How does airSlate SignNow facilitate electronic filing for 'PDF CAUTION This Tax Return Must Be Filed Electronically Mass gov.'?

airSlate SignNow provides a user-friendly platform that allows businesses to eSign and submit their tax documents electronically. By integrating features specifically designed for compliance with the 'PDF CAUTION This Tax Return Must Be Filed Electronically Mass gov.', our solution ensures that your returns are filed correctly and efficiently. This streamlines the filing process and reduces the risk of errors.

-

Are there any costs associated with using airSlate SignNow for tax filings?

airSlate SignNow offers various pricing plans tailored to the needs of businesses, making it a cost-effective solution for handling documents like 'PDF CAUTION This Tax Return Must Be Filed Electronically Mass gov.'. Each plan provides value through features such as unlimited eSigning and secure storage. Choose a plan that fits your budget and ensures compliance with electronic filing requirements.

-

What features does airSlate SignNow provide for managing tax documents?

airSlate SignNow includes comprehensive features tailored for managing tax documents and eSigning, including templates and automatic reminders. Users can easily create, send, and secure signatures on documents indicated by 'PDF CAUTION This Tax Return Must Be Filed Electronically Mass gov.'. These tools enhance productivity and help users maintain compliance in their tax filing processes.

-

Can airSlate SignNow integrate with other software tools?

Yes, airSlate SignNow integrates seamlessly with various software applications such as CRMs and document management systems. This integration is particularly helpful for managing tax documents marked 'PDF CAUTION This Tax Return Must Be Filed Electronically Mass gov.'. By connecting your existing tools, you can streamline your workflow and improve efficiency.

-

What types of businesses can benefit from using airSlate SignNow?

airSlate SignNow is beneficial for a wide range of businesses, from small startups to large enterprises. Any organization needing to manage electronic tax returns like those labeled 'PDF CAUTION This Tax Return Must Be Filed Electronically Mass gov.' can enhance their efficiency with our solution. It empowers businesses to modernize their document handling processes.

-

How secure is the email communication and document handling with airSlate SignNow?

airSlate SignNow prioritizes security, ensuring that all document handling and email communications are encrypted and compliant with relevant regulations. This applies to all tax documents, including those that state 'PDF CAUTION This Tax Return Must Be Filed Electronically Mass gov.'. With our solution, users can feel confident that their sensitive information remains safe.

Get more for PDF CAUTION This Tax Return Must Be Filed Electronically Mass gov

Find out other PDF CAUTION This Tax Return Must Be Filed Electronically Mass gov

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now