Florida Hotel Tax Exempt Form PDF

What is the Florida Hotel Tax Exempt Form PDF?

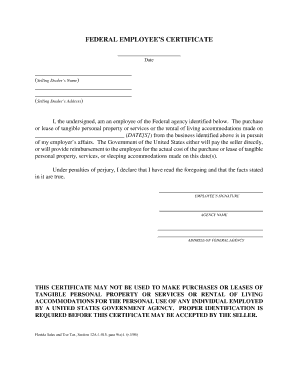

The Florida Hotel Tax Exempt Form PDF is a document used by qualifying organizations to claim exemption from state hotel taxes when booking accommodations in Florida. This form is essential for entities such as government agencies, nonprofit organizations, and certain educational institutions that are eligible for tax exemptions under Florida law. By submitting this form, organizations can avoid unnecessary tax charges, ensuring compliance with state regulations while managing their travel budgets effectively.

How to Use the Florida Hotel Tax Exempt Form PDF

To use the Florida Hotel Tax Exempt Form, organizations must first ensure they meet the eligibility criteria for tax exemption. Once eligibility is confirmed, the form should be completed with accurate information, including the organization’s name, address, and the purpose of the stay. After filling out the form, it must be presented to the hotel at the time of check-in. Hotels typically require a copy of the form along with a valid ID to process the tax exemption correctly.

Steps to Complete the Florida Hotel Tax Exempt Form PDF

Completing the Florida Hotel Tax Exempt Form involves several key steps:

- Download the form from a reliable source.

- Fill in the organization’s name and contact details accurately.

- Specify the dates of stay and the purpose of the visit.

- Include any relevant tax exemption numbers or codes.

- Review the completed form for accuracy before printing.

Once the form is complete, it should be signed by an authorized representative of the organization to validate the claim.

Legal Use of the Florida Hotel Tax Exempt Form PDF

The legal use of the Florida Hotel Tax Exempt Form PDF is governed by state tax laws. Organizations must ensure that they are genuinely eligible for tax exemption to avoid penalties. Misuse of the form, such as submitting it when not entitled to an exemption, can lead to legal repercussions, including fines or back taxes owed. It is crucial for users to understand the specific criteria that qualify them for this exemption to ensure compliance and maintain good standing with tax authorities.

Key Elements of the Florida Hotel Tax Exempt Form PDF

The Florida Hotel Tax Exempt Form PDF includes several key elements that must be accurately filled out:

- Organization Name: The full legal name of the entity claiming the exemption.

- Contact Information: Address, phone number, and email of the organization.

- Tax Exemption Number: A unique identifier that verifies the organization’s tax-exempt status.

- Purpose of Stay: A brief description of the reason for the hotel stay.

- Authorized Signature: Signature of an individual authorized to represent the organization.

Eligibility Criteria for the Florida Hotel Tax Exempt Form PDF

To be eligible for the Florida Hotel Tax Exempt Form, organizations must typically fall into specific categories defined by state law. These may include:

- Government agencies at the federal, state, or local level.

- Nonprofit organizations recognized under Section 501(c)(3) of the Internal Revenue Code.

- Educational institutions that are tax-exempt.

It is essential for organizations to verify their eligibility before submitting the form to ensure compliance and avoid potential tax liabilities.

Quick guide on how to complete florida hotel tax exempt form pdf

Prepare Florida Hotel Tax Exempt Form Pdf effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the right form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage Florida Hotel Tax Exempt Form Pdf on any platform using airSlate SignNow's Android or iOS apps and simplify your document-related processes today.

The easiest way to edit and eSign Florida Hotel Tax Exempt Form Pdf with ease

- Locate Florida Hotel Tax Exempt Form Pdf and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign tool, which only takes seconds and holds the same legal validity as an ink signature.

- Verify the information and select the Done button to save your changes.

- Decide how you want to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs within a few clicks from any device you prefer. Edit and eSign Florida Hotel Tax Exempt Form Pdf and maintain excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the florida hotel tax exempt form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Florida tax exempt form hotel and how do I obtain it?

The Florida tax exempt form hotel is a document that allows qualifying entities to exempt themselves from paying sales tax on hotel accommodations. You can obtain this form from the Florida Department of Revenue's website or directly from your hotel upon request. To ensure a smooth process, make sure your organization qualifies for tax exemption.

-

How can airSlate SignNow help me manage my Florida tax exempt form hotel submissions?

airSlate SignNow simplifies the process of managing your Florida tax exempt form hotel submissions by allowing you to create, send, and eSign documents effortlessly. With our easy-to-use interface, you can quickly ensure compliance and keep track of all tax-exempt forms from one centralized location. This minimizes paperwork and speeds up the approval process for your hotel's accommodations.

-

Is there a cost associated with using airSlate SignNow for Florida tax exempt form hotel?

airSlate SignNow offers competitive pricing, starting with a free trial, then affordable subscription plans tailored to your needs. This cost-effective solution makes it easy to manage your Florida tax exempt form hotel without breaking the bank. Transparent pricing ensures you know what you're paying for, with no hidden fees.

-

What features does airSlate SignNow offer for managing Florida tax exempt forms?

With airSlate SignNow, you get features like custom document templates, automated workflows, and secure cloud storage for your Florida tax exempt forms hotel. Additionally, our platform enables real-time collaboration, so multiple stakeholders can review and sign documents efficiently. These features enhance productivity and ensure your tax exempt forms are processed quickly.

-

Can I integrate airSlate SignNow with other tools to process the Florida tax exempt form hotel?

Yes, airSlate SignNow offers seamless integrations with various business tools, including CRMs and accounting software, to streamline your Florida tax exempt form hotel processing. These integrations allow you to enhance your workflow and keep your finance and documentation processes interconnected. This leads to improved accuracy and reduced administrative burden.

-

What are the benefits of using airSlate SignNow for my Florida tax exempt form hotel?

Using airSlate SignNow for your Florida tax exempt form hotel provides benefits such as increased efficiency, reduced paperwork, and enhanced security for sensitive documents. Our platform not only saves time by automating workflows but also ensures compliance with state regulations. Additionally, the ease of obtaining eSignatures makes securing approvals hassle-free.

-

Is airSlate SignNow compliant with Florida tax laws regarding tax exempt forms?

Yes, airSlate SignNow complies with Florida tax laws and regulations regarding tax exempt forms, including the Florida tax exempt form hotel. We ensure that our platform is updated with the latest legal requirements to help you maintain compliance. This commitment provides peace of mind when handling sensitive tax-exempt documents.

Get more for Florida Hotel Tax Exempt Form Pdf

- Complaint to vacate and or alter a recorded plat and for other relief mississippi 497314778 form

- Entry of appearance and no objection mississippi 497314779 form

- Judgment vacating plat in part removing protective covenants in part and granting other relief mississippi form

- Order correcting final judgment mississippi 497314782 form

- Voir dire sample form

- Motion sell form

- Executorship form

- Inforce illustration request form

Find out other Florida Hotel Tax Exempt Form Pdf

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online