How to Get Registered under Sec 34ab of Wealth Tax Act 1957 Online Form

What is the registration under section 34AB of the Wealth Tax Act 1957?

The registration under section 34AB of the Wealth Tax Act 1957 pertains to the process by which valuers can be officially recognized to assess the value of assets for wealth tax purposes. This section mandates that individuals wishing to act as valuers must undergo a formal registration process to ensure compliance with legal standards. The registration is crucial for maintaining the integrity of asset valuations and ensuring that all valuations are conducted by qualified professionals.

Steps to complete the registration under section 34AB online

Completing the registration under section 34AB online involves several key steps:

- Gather necessary documentation, including proof of qualifications and experience.

- Access the official online portal designated for wealth tax registrations.

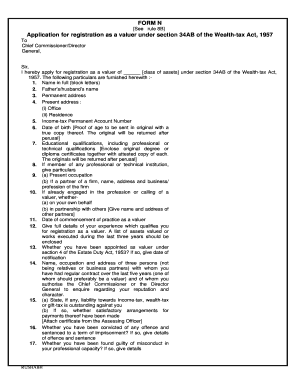

- Fill out the 34AB registration of valuers form accurately, ensuring all required fields are completed.

- Upload supporting documents as specified in the form instructions.

- Review the application for accuracy before submission.

- Submit the registration form electronically.

- Await confirmation of registration from the relevant authority.

Required documents for registration under section 34AB

To successfully register under section 34AB, applicants need to provide several key documents, which typically include:

- A completed application form for registration as a valuer.

- Proof of educational qualifications relevant to valuation.

- Evidence of work experience in the field of asset valuation.

- Any additional documents as specified by the registration authority.

Eligibility criteria for registration under section 34AB

Eligibility for registration under section 34AB is determined by specific criteria that applicants must meet. Generally, these include:

- Possession of a relevant degree or professional qualification in valuation.

- A minimum number of years of experience in asset valuation.

- Compliance with any additional requirements set forth by the registration authority.

Legal use of the registration under section 34AB

The legal use of registration under section 34AB ensures that only qualified valuers can perform asset valuations for wealth tax purposes. This legal framework is essential for maintaining transparency and accountability in the valuation process. Registered valuers are recognized by the authorities, which adds credibility to their assessments and protects the interests of taxpayers and the government alike.

Form submission methods for registration under section 34AB

Applicants can submit their registration forms under section 34AB through various methods, including:

- Online submission via the designated government portal.

- Mailing the completed form and supporting documents to the relevant authority.

- In-person submission at designated offices, if applicable.

Quick guide on how to complete how to get registered under sec 34ab of wealth tax act 1957 online

Accomplish How To Get Registered Under Sec 34ab Of Wealth Tax Act 1957 Online effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents swiftly without any hold-ups. Manage How To Get Registered Under Sec 34ab Of Wealth Tax Act 1957 Online on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign How To Get Registered Under Sec 34ab Of Wealth Tax Act 1957 Online with ease

- Obtain How To Get Registered Under Sec 34ab Of Wealth Tax Act 1957 Online and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to store your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about misplaced or lost files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Adjust and eSign How To Get Registered Under Sec 34ab Of Wealth Tax Act 1957 Online and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to get registered under sec 34ab of wealth tax act 1957 online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is wealth tax 34ab?

Wealth tax 34ab refers to a specific form of taxation targeted at wealthier individuals and entities. Understanding how wealth tax 34ab impacts your financial obligations can help you navigate your documents effectively. With airSlate SignNow, you can eSign tax documents related to wealth tax 34ab seamlessly.

-

How can airSlate SignNow help with managing wealth tax 34ab forms?

airSlate SignNow provides easy-to-use tools for sending and eSigning documents related to wealth tax 34ab. Our platform ensures that you can efficiently manage and securely store all your tax-related documents. This saves time and allows you to focus on compliance rather than paperwork.

-

What features does airSlate SignNow offer for wealth tax 34ab documentation?

With airSlate SignNow, you gain access to a variety of features that simplify the handling of wealth tax 34ab documents. Our platform allows for document templates, real-time tracking, and secure sharing options. These features enhance your ability to manage wealth tax documentation efficiently and effectively.

-

Is airSlate SignNow affordable for small businesses dealing with wealth tax 34ab?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our pricing plans accommodate various budgets, making it easier for small businesses to manage their wealth tax 34ab requirements without breaking the bank. You get advanced features at a competitive price point.

-

How does airSlate SignNow ensure the security of wealth tax 34ab documents?

The security of your wealth tax 34ab documents is a top priority at airSlate SignNow. We use state-of-the-art encryption methods and secure servers to protect your sensitive information. Additionally, our platform is compliant with relevant regulations, ensuring your tax documents are safe.

-

Can airSlate SignNow integrate with accounting software for wealth tax 34ab?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software solutions. This allows you to streamline the process of preparing and submitting documents related to wealth tax 34ab while ensuring that all relevant data is maintained accurately across platforms.

-

What are the benefits of using airSlate SignNow for wealth tax 34ab filings?

Using airSlate SignNow for wealth tax 34ab filings offers numerous benefits. It enhances the speed and efficiency of document management, reduces the risk of errors, and ensures compliance with tax regulations. These advantages can save you both time and money during tax season.

Get more for How To Get Registered Under Sec 34ab Of Wealth Tax Act 1957 Online

- Shareholders buy sell agreement of stock in a close corporation with noncompetition provisions form

- Request records form

- Closure estate form

- Stock option agreement form

- Sample letter for aptitude test request form

- Sample letter waiver form

- Shareholders buy sell agreement of stock in a close corporation with agreement of spouse and stock transfer restrictions 497333374 form

- Sample letter workplace form

Find out other How To Get Registered Under Sec 34ab Of Wealth Tax Act 1957 Online

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation