7216 Form

What is the 7216 Form

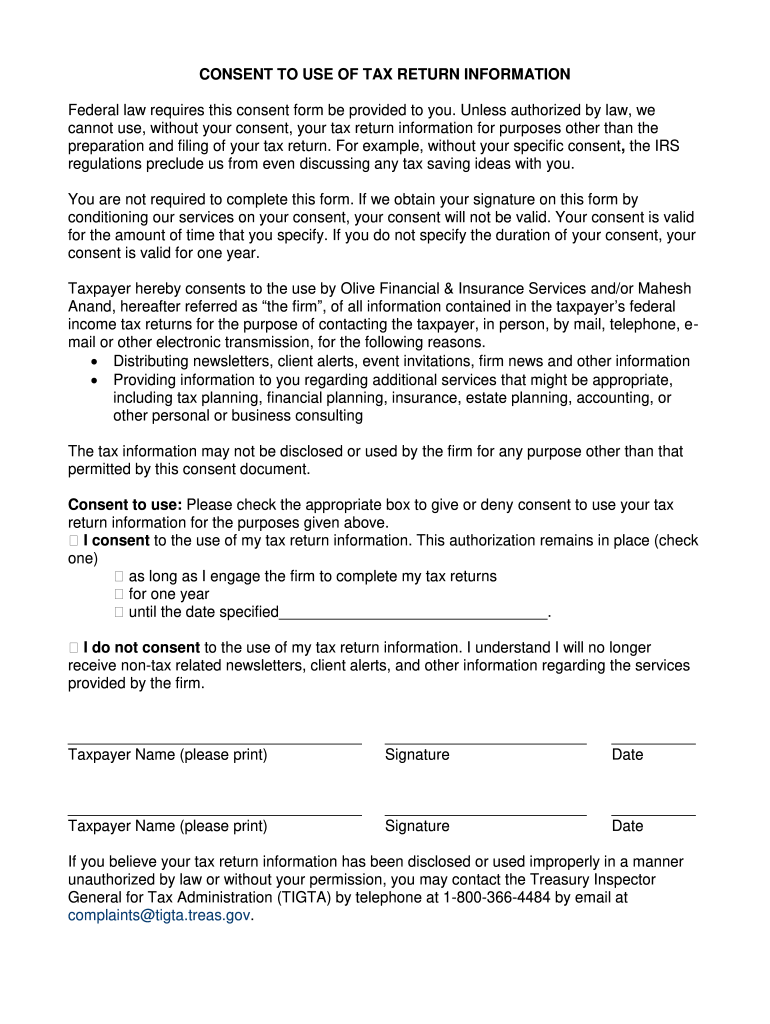

The 7216 form, also known as the taxpayer consent form, is a document used by tax professionals to obtain consent from clients before disclosing their tax return information to third parties. This form is essential for ensuring compliance with the Internal Revenue Service (IRS) regulations regarding the confidentiality of taxpayer information. By signing the 7216 consent form, clients authorize tax preparers to share specific details about their tax filings, which can be necessary for various purposes, such as applying for loans or other financial services.

How to use the 7216 Form

To use the 7216 form effectively, tax professionals must first ensure that clients understand the purpose and implications of the consent. The form should clearly outline what information will be shared, with whom, and for what duration. Clients should be given ample time to review the document and ask questions before signing. Once signed, the form should be securely stored and referenced whenever there is a need to disclose the client's tax information, ensuring that all disclosures comply with the terms outlined in the consent.

Steps to complete the 7216 Form

Completing the 7216 form involves several straightforward steps:

- Obtain the form: Download the form from a reliable source or request it from your tax professional.

- Fill in client information: Enter the client's name, address, and Social Security number accurately.

- Specify the disclosures: Clearly indicate what information will be shared and with which third parties.

- Set the duration: Define the time frame during which the consent is valid.

- Client signature: Have the client read the form carefully and sign it to confirm their consent.

- Store the form: Keep a secure copy of the signed form for your records.

Legal use of the 7216 Form

The legal use of the 7216 form is governed by IRS regulations that protect taxpayer information. Tax professionals must use this form to ensure that they are compliant with the law when sharing sensitive information. The consent must be obtained prior to any disclosure, and it must be specific about the information being shared and the parties involved. Failure to obtain proper consent can lead to significant penalties for tax preparers, including fines and legal repercussions.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the 7216 form. Tax professionals must adhere to these guidelines to maintain compliance and protect client information. Key points include:

- The form must be signed by the taxpayer before any information is disclosed.

- Tax preparers must retain a copy of the signed form for at least three years.

- Clear language must be used to describe the information being disclosed and the purpose of the disclosure.

Penalties for Non-Compliance

Non-compliance with the regulations surrounding the 7216 form can result in severe penalties for tax professionals. These may include:

- Fines imposed by the IRS for unauthorized disclosures.

- Loss of professional credentials or licenses.

- Legal action from clients whose information was disclosed without proper consent.

It is crucial for tax preparers to understand these risks and ensure that they are using the 7216 consent form correctly to protect both their clients and themselves.

Quick guide on how to complete 7216 form

Effortlessly Prepare 7216 Form on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without any hold-ups. Manage 7216 Form on any system with airSlate SignNow mobile applications for Android or iOS and enhance any document-related process today.

The Easiest Way to Modify and eSign 7216 Form with Ease

- Locate 7216 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, and errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any chosen device. Modify and eSign 7216 Form and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 7216 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 7216 form and how is it used?

The 7216 form is a document used by tax professionals to authorize the IRS to disclose confidential information. It allows for the secure electronic transmission of tax-related data, making it essential for compliance. Understanding how to complete the 7216 form can streamline your business’s tax processes.

-

How does airSlate SignNow simplify the signing process for the 7216 form?

airSlate SignNow provides a user-friendly platform to electronically sign the 7216 form quickly and securely. With features like document tracking and reminders, you can ensure timely submissions. This ease of use can signNowly enhance your operational efficiency.

-

What are the pricing options for using airSlate SignNow to manage the 7216 form?

airSlate SignNow offers flexible pricing plans to cater to different business needs, including options for managing the 7216 form. You can choose a plan that suits your volume of document processing or opt for monthly or annual subscriptions. Pricing is competitive and designed to provide a cost-effective solution.

-

What features does airSlate SignNow offer for the 7216 form?

Key features of airSlate SignNow include eSignature capabilities, document storage, and collaboration tools specifically for the 7216 form. These features help ensure your documents are signed correctly and stored securely. The platform’s intuitive interface also facilitates easy navigation and usage.

-

Can I integrate airSlate SignNow with other applications for the 7216 form?

Yes, airSlate SignNow supports integration with various applications, making it easier to manage the 7216 form alongside your existing tools. Whether you're using CRM systems or document management software, seamless integration enhances workflow efficiency. This means you can automate your processes and reduce manual errors.

-

What are the benefits of using airSlate SignNow for the 7216 form?

Using airSlate SignNow for the 7216 form offers numerous benefits, including improved speed and flexibility in document handling. The cost-effective pricing and user-friendly experience make it a prime choice for businesses aiming to expedite their document processes. Additionally, enhanced security measures ensure the confidentiality of sensitive information.

-

Is airSlate SignNow suitable for small businesses processing the 7216 form?

Absolutely! airSlate SignNow is designed to be accessible for businesses of all sizes, including small businesses that need to process the 7216 form. Its intuitive interface and scalable pricing make it a great solution regardless of your business size. Moreover, small businesses benefit from the ability to streamline their document processes professionally.

Get more for 7216 Form

Find out other 7216 Form

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe