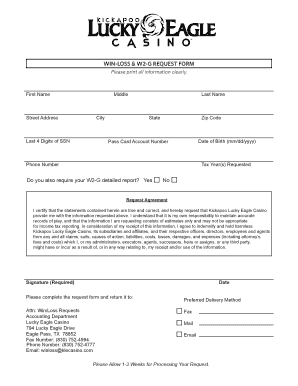

Lucky Eagle Win Loss Statement Form

What makes the lucky eagle win loss statement form legally valid?

Because the society ditches office working conditions, the completion of paperwork more and more happens online. The lucky eagle win loss statement form isn’t an exception. Handling it using digital means differs from doing this in the physical world.

An eDocument can be viewed as legally binding given that particular requirements are met. They are especially critical when it comes to stipulations and signatures associated with them. Typing in your initials or full name alone will not guarantee that the institution requesting the form or a court would consider it performed. You need a trustworthy tool, like airSlate SignNow that provides a signer with a digital certificate. Furthermore, airSlate SignNow keeps compliance with ESIGN, UETA, and eIDAS - key legal frameworks for eSignatures.

How to protect your lucky eagle win loss statement form when filling out it online?

Compliance with eSignature laws is only a fraction of what airSlate SignNow can offer to make form execution legitimate and secure. It also offers a lot of possibilities for smooth completion security smart. Let's rapidly run through them so that you can stay assured that your lucky eagle win loss statement form remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are established to protect online user data and payment information.

- FERPA, CCPA, HIPAA, and GDPR: key privacy regulations in the USA and Europe.

- Two-factor authentication: provides an extra layer of security and validates other parties identities via additional means, like an SMS or phone call.

- Audit Trail: serves to catch and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: sends the information safely to the servers.

Filling out the lucky eagle win loss statement form with airSlate SignNow will give greater confidence that the output document will be legally binding and safeguarded.

Quick guide on how to complete lucky eagle win loss statement

Complete Lucky Eagle Win Loss Statement effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your files swiftly and without hold-ups. Manage Lucky Eagle Win Loss Statement on any system with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Lucky Eagle Win Loss Statement with ease

- Obtain Lucky Eagle Win Loss Statement and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow has specifically designed for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred delivery method for your form: via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your requirements in document management with just a few clicks from your chosen device. Edit and electronically sign Lucky Eagle Win Loss Statement while ensuring outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lucky eagle win loss statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of kickapoo lucky eagle win loss in sports betting?

The kickapoo lucky eagle win loss records are crucial for evaluating the performance of teams or players. These records help bettors make informed decisions by analyzing past results, ensuring they can strategize effectively. Understanding these statistics can enhance your betting experience and increase your chances of a successful wager.

-

How can I easily track kickapoo lucky eagle win loss statistics?

You can track kickapoo lucky eagle win loss statistics through various sports betting platforms and services that provide real-time updates. Many websites and applications offer user-friendly interfaces where you can quickly access the latest information. This allows you to monitor performance and adjust your betting strategies accordingly.

-

What are the implications of kickapoo lucky eagle win loss for team performance?

The kickapoo lucky eagle win loss statistics reflect a team's performance over a season, which can indicate trends and inform coaching decisions. A consistent win-loss record can signify a strong team dynamic, while fluctuating results may highlight areas needing improvement. Analyzing these metrics can be pivotal in shaping future matches.

-

Are there any tools for analyzing kickapoo lucky eagle win loss trends?

Yes, there are numerous analytical tools and software designed for evaluating kickapoo lucky eagle win loss trends. Many of these tools provide visualizations and in-depth reports that help users identify patterns over time. Utilizing such resources can enhance your understanding and decision-making in sports betting.

-

How often do kickapoo lucky eagle win loss statistics get updated?

Kickapoo lucky eagle win loss statistics are typically updated in real time or shortly after each game. This ensures that bettors and fans have the most current data available for analysis. Staying up-to-date with these statistics is essential for making informed betting choices and understanding team dynamics.

-

What features should I look for in tools that track kickapoo lucky eagle win loss?

When looking for tools that track kickapoo lucky eagle win loss, prioritize features such as real-time updates, detailed historical data, and customizable reports. Additional features like predictive analytics can further enhance your analysis. Choosing the right tool ensures you have all the information needed to make strategic betting decisions.

-

How do kickapoo lucky eagle win loss records affect betting odds?

Kickapoo lucky eagle win loss records play a signNow role in determining betting odds set by sportsbooks. A team's win-loss record influences its perceived strength and affects the odds offered to bettors. Understanding this relationship helps bettors capitalize on favorable odds when betting on games.

Get more for Lucky Eagle Win Loss Statement

Find out other Lucky Eagle Win Loss Statement

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney