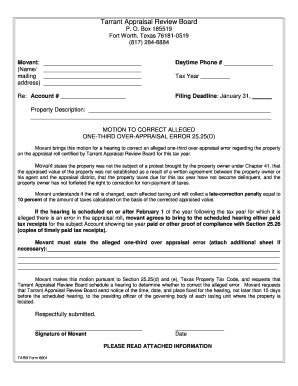

Form 2525d

What is the Form 2525d

The Form 2525d is a document used primarily within the context of legal and administrative proceedings. It serves specific purposes depending on the nature of the request or the entity involved. Understanding the function of this form is essential for individuals and organizations that need to comply with regulatory requirements or engage in formal processes. The 2525d motion is particularly relevant for those navigating legal frameworks, ensuring that the process adheres to established protocols.

How to use the Form 2525d

Using the Form 2525d involves a series of steps that ensure proper completion and submission. First, identify the specific requirements associated with the form, as these can vary based on the context in which it is used. Next, gather all necessary information and documentation that may be required to fill out the form accurately. Once completed, the form should be submitted according to the guidelines provided by the issuing authority, whether that be online, by mail, or in person.

Steps to complete the Form 2525d

Completing the Form 2525d requires careful attention to detail. Here are the key steps:

- Review the form thoroughly to understand all sections that need to be filled out.

- Gather any supporting documents that may be required, such as identification or proof of eligibility.

- Fill out the form accurately, ensuring that all information is complete and correct.

- Sign the form where indicated, as a signature is often necessary for validation.

- Submit the form following the specified submission methods outlined by the relevant authority.

Legal use of the Form 2525d

The legal use of the Form 2525d is governed by specific regulations that ensure its validity. For a form to be considered legally binding, it must meet certain criteria, including proper execution and adherence to relevant laws. Utilizing a reliable eSignature solution can further enhance the legitimacy of the form, providing a secure method for signing and submitting documents. Compliance with laws such as the ESIGN Act and UETA is crucial for ensuring that the form holds up in legal contexts.

Key elements of the Form 2525d

Understanding the key elements of the Form 2525d is vital for effective use. The form typically includes sections for personal information, the purpose of the submission, and any necessary declarations or signatures. Each of these elements plays a critical role in ensuring that the form serves its intended purpose and complies with legal standards. It is important to pay close attention to each section to avoid errors that could delay processing or lead to non-compliance.

Form Submission Methods

The Form 2525d can be submitted through various methods, depending on the requirements set by the issuing authority. Common submission methods include:

- Online submission through a designated portal, which often provides immediate confirmation of receipt.

- Mailing the completed form to the appropriate address, ensuring that it is sent with sufficient time to meet any deadlines.

- In-person submission at designated locations, which may allow for immediate feedback or assistance if needed.

Examples of using the Form 2525d

Examples of using the Form 2525d can vary widely based on the context. For instance, it may be utilized in legal proceedings to document specific motions or requests. Additionally, businesses may use the form to comply with regulatory requirements or to facilitate transactions that require formal documentation. Understanding these examples can help individuals and organizations recognize when and how to effectively use the form in their specific situations.

Quick guide on how to complete form 2525d

Complete Form 2525d effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly and without delays. Manage Form 2525d on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to alter and electronically sign Form 2525d with ease

- Find Form 2525d and click on Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, through email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Alter and eSign Form 2525d and guarantee effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2525d

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 2525 and how does it work?

Form 2525 is a crucial document used for various business processes, and airSlate SignNow simplifies its management. By leveraging our platform, users can easily fill out, send, and eSign Form 2525 in a secure and efficient manner. This streamlines your workflow, reducing the time spent on paperwork, and ensures compliance with regulatory standards.

-

What features does airSlate SignNow offer for handling Form 2525?

airSlate SignNow provides several features tailored for Form 2525, including customizable templates, real-time tracking, and robust security options. These features enhance your ability to manage documents efficiently while maintaining the integrity of sensitive information. Whether accessing the form on desktop or mobile, our platform ensures a seamless experience.

-

Is there a cost associated with using airSlate SignNow for Form 2525?

Yes, airSlate SignNow offers different pricing plans to accommodate various business needs for managing Form 2525. We provide a cost-effective solution that scales with your requirements, whether you're a small business or a large enterprise. Our pricing is transparent, with no hidden fees, ensuring you receive value for your investment.

-

Can I integrate Form 2525 with other software using airSlate SignNow?

Absolutely! airSlate SignNow offers integration capabilities with various applications to streamline your workflow when handling Form 2525. This means you can easily connect our platform with tools you already use, such as CRMs or project management software, making document management more efficient and cohesive.

-

What are the benefits of using airSlate SignNow for Form 2525?

Using airSlate SignNow for Form 2525 offers multiple benefits, including enhanced efficiency, reduced errors, and improved collaboration. Our intuitive interface allows you to manage your forms effortlessly, while eSigning reduces delays associated with traditional paper processes. Ultimately, this leads to faster turnaround times and greater productivity for your team.

-

Is it secure to send and sign Form 2525 through airSlate SignNow?

Yes, security is a top priority for airSlate SignNow when it comes to handling Form 2525. Our platform employs advanced encryption for data protection, ensuring that all documents are secure during transmission and storage. Additionally, we comply with industry-standard security protocols to safeguard your sensitive information.

-

Can multiple users collaborate on Form 2525 using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on Form 2525 seamlessly. You can invite team members to review, edit, and sign the document, facilitating efficient teamwork and communication. This collaborative feature helps ensure that all necessary parties can contribute to the process in real time.

Get more for Form 2525d

Find out other Form 2525d

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT