Form Mptc 7

What is the Form Mptc 7

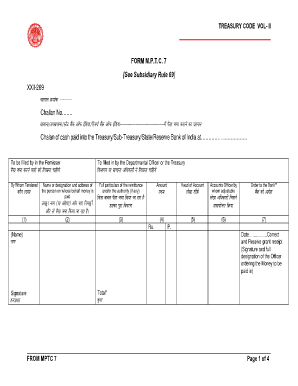

The Form Mptc 7 is a treasury challan form used for various financial transactions, particularly in the context of government payments and tax submissions. This form is essential for individuals and businesses who need to make payments to government entities, ensuring that funds are properly allocated and recorded. It serves as a formal document that outlines the details of the payment, including the amount, purpose, and recipient.

Steps to complete the Form Mptc 7

Completing the Form Mptc 7 involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including your identification details, payment amount, and purpose of the payment.

- Access the treasury challan form online or obtain a physical copy from the relevant government office.

- Fill in the required fields, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form either online or in person, depending on the submission options available.

Legal use of the Form Mptc 7

The legal use of the Form Mptc 7 is crucial for ensuring that payments are recognized and processed by government agencies. When properly filled out and submitted, the form acts as a binding document that confirms the transaction. It is essential to comply with all relevant regulations and guidelines to avoid potential legal issues or penalties associated with improper use.

Key elements of the Form Mptc 7

Understanding the key elements of the Form Mptc 7 is vital for effective completion. Important components include:

- Identification Information: Personal or business details of the payer.

- Payment Amount: The total sum being submitted.

- Payment Purpose: A brief description of what the payment is for.

- Recipient Details: Information about the government agency receiving the payment.

- Date of Payment: The date on which the payment is being made.

Form Submission Methods (Online / Mail / In-Person)

The Form Mptc 7 can typically be submitted through various methods, depending on the specific requirements of the government agency involved. Common submission methods include:

- Online Submission: Many agencies allow for electronic submission through their official websites.

- Mail: Completed forms can often be sent via postal mail to the designated address.

- In-Person: Some forms may need to be submitted directly at a government office.

Who Issues the Form

The Form Mptc 7 is usually issued by government financial departments or treasury offices. These entities are responsible for managing public funds and ensuring that all financial transactions are conducted in accordance with established laws and regulations. It is important to obtain the form from the official source to ensure its validity.

Quick guide on how to complete form mptc 7

Prepare Form Mptc 7 effortlessly on any device

Online document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents quickly and easily. Handle Form Mptc 7 on any device with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest way to alter and eSign Form Mptc 7 with minimal effort

- Find Form Mptc 7 and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information and then click on the Done button to preserve your changes.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form Mptc 7 to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form mptc 7

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a treasury challan form?

A treasury challan form is a document used to make payments to governmental bodies, often required for tax and fee submissions. This form ensures accurate tracking of payments and compliance with financial regulations. Using airSlate SignNow, you can easily create and eSign treasury challan forms quickly.

-

How does airSlate SignNow facilitate the treasury challan form process?

airSlate SignNow streamlines the process of creating and managing treasury challan forms with its intuitive interface. Users can easily fill out, eSign, and send these forms to relevant authorities in a secure and efficient manner. This eliminates the hassle of manual paperwork and enhances compliance.

-

Is there a cost associated with using airSlate SignNow for treasury challan forms?

Yes, airSlate SignNow offers competitive pricing models tailored to fit various business needs. The cost-effective solution allows users to manage and eSign multiple treasury challan forms without incurring high operational costs. You can choose a plan that best suits your organization’s requirements.

-

What features does airSlate SignNow offer for treasury challan forms?

airSlate SignNow provides a suite of features for treasury challan forms, including customizable templates, secure eSigning, and automated workflows. These features simplify the document management process and ensure timely processing of payments. Users can also track the status of their submissions efficiently.

-

Can I integrate airSlate SignNow with other software for treasury challan forms?

Yes, airSlate SignNow supports various integrations with popular business applications. This allows you to seamlessly combine data and streamline processes related to treasury challan forms. Integrating with existing systems enhances overall productivity and ensures smooth operations.

-

What are the benefits of using airSlate SignNow for treasury challan forms?

Using airSlate SignNow for treasury challan forms offers signNow benefits, such as reduced paperwork, faster processing times, and improved accuracy. The platform enhances collaboration among team members, enabling quicker decision-making. Moreover, the security features protect sensitive information during transactions.

-

Is airSlate SignNow user-friendly for creating treasury challan forms?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, allowing users of all tech levels to easily create treasury challan forms. The intuitive drag-and-drop functionality simplifies the form creation process, ensuring quick adoption and minimal training required.

Get more for Form Mptc 7

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts effective 497429938 form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts where 497429939 form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts effective 497429940 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts where 497429941 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts effective 497429942 form

- Washington dissolution form

- Dissolution limited liability form

- Washington temporary order form

Find out other Form Mptc 7

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online