State of Alaska Request for Taxpayer Id# and Information Substitute Form W 9

Understanding the State of Alaska Request for Taxpayer ID Number and Information Substitute Form W-9

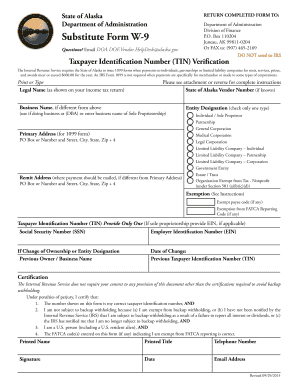

The State of Alaska Request for Taxpayer ID Number and Information Substitute Form W-9 is essential for individuals and businesses that need to provide their taxpayer identification information to the state. This form is particularly relevant for those who are engaged in business transactions or are receiving payments from state agencies. It serves as a means to report income and ensure compliance with tax regulations. By filling out this form, taxpayers can avoid potential issues with the Internal Revenue Service (IRS) and state tax authorities.

Steps to Complete the State of Alaska Request for Taxpayer ID Number and Information Substitute Form W-9

Completing the State of Alaska Request for Taxpayer ID Number and Information Substitute Form W-9 involves several straightforward steps:

- Obtain the form: You can access the form online or request it from the relevant state department.

- Provide your information: Fill in your name, business name (if applicable), and address. Ensure that all information is accurate.

- Enter your taxpayer ID number: This could be your Social Security Number (SSN) or Employer Identification Number (EIN).

- Sign and date the form: Your signature certifies that the information provided is correct and complete.

- Submit the form: Follow the submission guidelines to ensure it reaches the appropriate state agency.

Legal Use of the State of Alaska Request for Taxpayer ID Number and Information Substitute Form W-9

This form is legally binding when filled out correctly and submitted to the appropriate authorities. It helps establish your taxpayer status and is crucial for tax reporting purposes. The information provided on the form must be accurate to avoid penalties or issues with tax compliance. The legal framework surrounding the use of this form aligns with federal and state tax laws, ensuring that both the taxpayer and the state can maintain accurate records.

IRS Guidelines for the State of Alaska Request for Taxpayer ID Number and Information Substitute Form W-9

The IRS has specific guidelines regarding the use of the W-9 form, which includes the State of Alaska Request for Taxpayer ID Number. Taxpayers must ensure that they provide the correct taxpayer identification number and certify that they are not subject to backup withholding. The IRS may require this form for various purposes, including reporting income paid to contractors or freelancers. Understanding these guidelines helps taxpayers comply with federal tax regulations and avoid potential fines.

Required Documents for the State of Alaska Request for Taxpayer ID Number and Information Substitute Form W-9

When completing the State of Alaska Request for Taxpayer ID Number and Information Substitute Form W-9, certain documents may be necessary to verify your identity and taxpayer status. Commonly required documents include:

- Social Security Card: For individuals using their SSN.

- Employer Identification Number (EIN) documentation: For businesses.

- Proof of address: Such as a utility bill or bank statement.

Form Submission Methods for the State of Alaska Request for Taxpayer ID Number and Information Substitute Form W-9

The completed State of Alaska Request for Taxpayer ID Number and Information Substitute Form W-9 can be submitted through various methods, depending on the requirements of the agency requesting it. Common submission methods include:

- Online submission: Many state agencies allow electronic submission through their websites.

- Mail: You can send the form via postal service to the designated address provided by the state agency.

- In-person delivery: Some agencies may accept forms submitted directly at their offices.

Quick guide on how to complete state of alaska request for taxpayer id and information substitute form w 9

Effortlessly Prepare State Of Alaska Request For Taxpayer Id# And Information Substitute Form W 9 on Any Device

The management of documents online has become increasingly favored by both businesses and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed paperwork, as you can obtain the necessary form and securely store it on the internet. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Handle State Of Alaska Request For Taxpayer Id# And Information Substitute Form W 9 on any platform with airSlate SignNow's Android or iOS applications and enhance your document-related tasks today.

How to Alter and Electronically Sign State Of Alaska Request For Taxpayer Id# And Information Substitute Form W 9 with Ease

- Locate State Of Alaska Request For Taxpayer Id# And Information Substitute Form W 9 and click on Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sharing the form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign State Of Alaska Request For Taxpayer Id# And Information Substitute Form W 9 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

How can we pass query params in post API using Angular (I have to fill out the state dropdown based on the country ID)?

Ideally, query parameters are not meant to be passed with URL in POST API, as there is something called body which we already pass in POST request, parameter should be extracted from that. But if anyhow if you need to pass URL query parameters in POST request, you can pass normally how one pass in GET request with URL.For example,Url: “https://xyz.com/postApiUri?param...If you need to pass that query parameter in body then in request after URL parameter, you can pass the query parameter as key value pair(JSON object)For example,Request(url, { param1: value1}, {headers})Hope that helps (:

-

If a calamity were to wipe out the continental United States, how powerful of a nation would Alaska, Hawaii, and the rest of our territories be?

Let's assume for the sake of this question that the calamity is that the entire country just sinks into the ground and is covered in water. Conveniently for Mexico and Canada, this happens exactly at the borders.Now, the question was what the status of the US would be in this case, but we're missing the bigger picture here - the entire world would be in shambles. The #1 superpower, the one that just about every country trades with / gets support from / sells oil to, has just been obliterated, and that'd suck for just about everyone, except for the countries who are able to sustain themselves without trading with the US.Countries who were somewhat peaceful due to US intervention or presence will start wars.Countries whose economy was dependant on the US would collapse.Prices of goods abundant in mainland US would skyrocket.And we, the rest of the world, are supposed to be concerned about Alaska and Hawaii?Now, those two states will be OK militarily, as they get to split the US Navy, but there's no way in hell that they'd re-form the United (two) States of America. Heck, a fair portion of the Hawaiian population already wants to secede from the US as it were.But a global superpower? These states don't have the abundant resources that the mainland USA has, nor do they have the central hubs from which they'd do business. They'd even eventually cut back on the powerful navy they'd have, just because they have so little to protect.So bottom line - the US would lose everything.

Create this form in 5 minutes!

How to create an eSignature for the state of alaska request for taxpayer id and information substitute form w 9

How to generate an eSignature for your State Of Alaska Request For Taxpayer Id And Information Substitute Form W 9 in the online mode

How to create an eSignature for the State Of Alaska Request For Taxpayer Id And Information Substitute Form W 9 in Google Chrome

How to create an electronic signature for putting it on the State Of Alaska Request For Taxpayer Id And Information Substitute Form W 9 in Gmail

How to create an electronic signature for the State Of Alaska Request For Taxpayer Id And Information Substitute Form W 9 straight from your smart phone

How to generate an electronic signature for the State Of Alaska Request For Taxpayer Id And Information Substitute Form W 9 on iOS

How to generate an electronic signature for the State Of Alaska Request For Taxpayer Id And Information Substitute Form W 9 on Android OS

People also ask

-

What is the 'State Of Alaska Request For Taxpayer Id# And Information Substitute Form W 9'?

The 'State Of Alaska Request For Taxpayer Id# And Information Substitute Form W 9' is a form used by taxpayers to provide their taxpayer identification information to the state of Alaska. This form is essential for businesses and individuals who need to report income to the state. By using airSlate SignNow, you can easily fill out and eSign this form, streamlining the submission process.

-

How does airSlate SignNow help with the 'State Of Alaska Request For Taxpayer Id# And Information Substitute Form W 9'?

airSlate SignNow empowers users to efficiently complete and eSign the 'State Of Alaska Request For Taxpayer Id# And Information Substitute Form W 9'. Our platform provides a user-friendly interface that simplifies the form-filling process, ensuring you can submit your information quickly and accurately.

-

Is there a cost associated with using airSlate SignNow for the 'State Of Alaska Request For Taxpayer Id# And Information Substitute Form W 9'?

Yes, there are pricing plans for using airSlate SignNow, but we offer a cost-effective solution for managing documents like the 'State Of Alaska Request For Taxpayer Id# And Information Substitute Form W 9'. Pricing varies based on the features you need, ensuring you only pay for what you use while benefiting from streamlined document management.

-

Can I integrate airSlate SignNow with other software for tax document management?

Absolutely! airSlate SignNow supports various integrations with popular software solutions, which can enhance your workflow for handling the 'State Of Alaska Request For Taxpayer Id# And Information Substitute Form W 9'. This allows you to connect with accounting tools, CRM systems, and other applications to manage your documents seamlessly.

-

What benefits does airSlate SignNow provide for eSigning the 'State Of Alaska Request For Taxpayer Id# And Information Substitute Form W 9'?

Using airSlate SignNow for eSigning the 'State Of Alaska Request For Taxpayer Id# And Information Substitute Form W 9' offers several benefits, including enhanced security, accessibility, and speed. Our platform ensures that your documents are legally binding and securely stored, allowing you to focus on your business without worrying about paperwork.

-

Can I access the 'State Of Alaska Request For Taxpayer Id# And Information Substitute Form W 9' template on airSlate SignNow?

Yes, airSlate SignNow provides access to templates, including the 'State Of Alaska Request For Taxpayer Id# And Information Substitute Form W 9'. This feature allows users to quickly fill out necessary information without starting from scratch, saving you time and ensuring accuracy.

-

Is it easy to share the 'State Of Alaska Request For Taxpayer Id# And Information Substitute Form W 9' with others using airSlate SignNow?

Yes, sharing the 'State Of Alaska Request For Taxpayer Id# And Information Substitute Form W 9' with others is straightforward on airSlate SignNow. You can send documents directly via email or share links, allowing collaborators to review and eSign the form quickly and efficiently.

Get more for State Of Alaska Request For Taxpayer Id# And Information Substitute Form W 9

Find out other State Of Alaska Request For Taxpayer Id# And Information Substitute Form W 9

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed