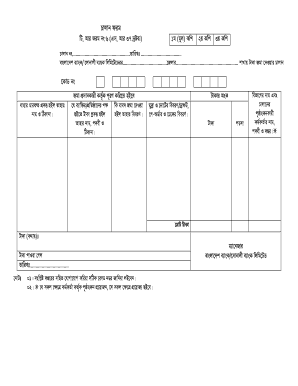

Vat Challan Form

What is the Vat Challan Form

The vat challan form is a crucial document used in the context of value-added tax (VAT) transactions. It serves as a formal request for payment of VAT due, providing essential details about the transaction, including the seller's and buyer's information, the amount of VAT charged, and the nature of the goods or services involved. This form is essential for businesses to maintain compliance with tax regulations and to ensure proper documentation for financial records.

How to use the Vat Challan Form

Using the vat challan form involves several straightforward steps. First, ensure you have the correct version of the form, which can typically be obtained from tax authorities or relevant government websites. Next, fill in the required fields accurately, including your business details, transaction specifics, and the VAT amount. After completing the form, it should be submitted to the appropriate tax authority, either electronically or via mail, depending on local regulations. Maintaining a copy of the completed form is essential for your records.

Steps to complete the Vat Challan Form

Completing the vat challan form requires attention to detail. Follow these steps for accuracy:

- Gather necessary information, including your business name, address, and tax identification number.

- Input transaction details, such as the date of sale, description of goods or services, and total sale amount.

- Calculate the VAT based on the applicable rate and enter it into the designated field.

- Review the entire form for any errors or omissions before submission.

- Submit the form according to the guidelines set by your local tax authority.

Legal use of the Vat Challan Form

The vat challan form is legally binding when filled out correctly and submitted according to established guidelines. It must comply with local tax laws and regulations to be considered valid. This includes ensuring that all required fields are completed and that the VAT amount is calculated accurately. In cases of audits or disputes, having a properly completed vat challan form can serve as crucial evidence of compliance with tax obligations.

Key elements of the Vat Challan Form

Several key elements must be included in the vat challan form to ensure its validity:

- Business Information: Name, address, and tax identification number of the seller and buyer.

- Transaction Details: Date of sale, description of goods or services provided, and total sale amount.

- VAT Amount: The calculated VAT based on the applicable rate.

- Signature: The form must be signed by an authorized representative of the business.

Form Submission Methods

Submitting the vat challan form can typically be done through several methods, depending on local regulations. Common submission methods include:

- Online: Many jurisdictions allow electronic submission via tax authority websites, which can expedite processing.

- Mail: The form can be printed and sent via postal service to the designated tax office.

- In-Person: Some businesses may prefer to submit the form directly at local tax offices for immediate confirmation.

Quick guide on how to complete vat challan form

Complete Vat Challan Form seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and effortlessly. Manage Vat Challan Form on any device using airSlate SignNow apps for Android or iOS and enhance any document-related task today.

The easiest way to edit and eSign Vat Challan Form with ease

- Obtain Vat Challan Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from any device you choose. Edit and eSign Vat Challan Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat challan form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a ভ্যাট চালান ফরম and why is it important?

A ভ্যাট চালান ফরম is a document used in Bangladesh for value-added tax transactions. It is essential for businesses to maintain compliance with tax regulations and to document the collection and payment of VAT. Proper use of a ভ্যাট চালান ফরম helps avoid penalties and ensures transparent financial records.

-

How can airSlate SignNow help with managing ভ্যাট চালান ফরম?

airSlate SignNow offers an efficient platform for creating, signing, and managing your ভ্যাট চালান ফরম digitally. With features like templates and electronic signatures, you can streamline your tax documentation process, saving time and reducing the risk of errors. Utilizing our service ensures you always have the correct version of the form.

-

Is airSlate SignNow cost-effective for handling ভ্যাট চালান ফরম?

Yes, airSlate SignNow provides a budget-friendly solution for businesses of all sizes. Our pricing plans are designed to be flexible, allowing you to choose a plan that fits your needs while efficiently managing your ভ্যাট চালান ফরম. You can save costs by going paperless and reducing operational expenses.

-

What features does airSlate SignNow offer for users of ভ্যাট চালান ফরম?

airSlate SignNow includes features like customizable templates, secure electronic signatures, and cloud storage, making it easier to manage your ভ্যাট চালান ফরম. Additionally, our user-friendly interface allows quick edits and immediate sharing, ensuring your documents are always up to date and easily accessible.

-

Can I integrate airSlate SignNow with my existing software for handling ভ্যাট চালান ফরম?

Absolutely! airSlate SignNow seamlessly integrates with a variety of software solutions, allowing you to import and export your ভ্যাট চালান ফরম with ease. Whether you use accounting software or customer relationship management tools, our integrations enhance efficiency and improve workflow.

-

What are the benefits of using digital ভ্যাট চালান ফরম over paper forms?

Using digital ভ্যাট চালান ফরম through airSlate SignNow offers numerous advantages, such as reduced processing time, improved accuracy, and ease of tracking changes. Digital forms also minimize paper waste and enhance document security, giving businesses peace of mind with their tax documentation.

-

How secure is my data when using airSlate SignNow for ভ্যাট চালান ফরম?

Your data security is our top priority at airSlate SignNow. We implement robust security measures, including encrypted data storage and secure access protocols, to protect your ভ্যাট চালান ফরম. When you trust us with your documents, you can be assured that they are safe and compliant with regulatory standards.

Get more for Vat Challan Form

Find out other Vat Challan Form

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple