Manatee County Homestead Exemption Form

What is the Manatee County Homestead Exemption

The Manatee County Homestead Exemption is a tax benefit designed to reduce the taxable value of a primary residence in Manatee County, Florida. This exemption can significantly lower property taxes for homeowners by providing a reduction in the assessed value of their home, which directly impacts the amount owed in property taxes. In Florida, the exemption can provide a reduction of up to twenty-five thousand dollars on the assessed value of a primary residence. This benefit is especially valuable for those who are permanent residents of the county, as it helps promote homeownership and community stability.

Eligibility Criteria for the Manatee County Homestead Exemption

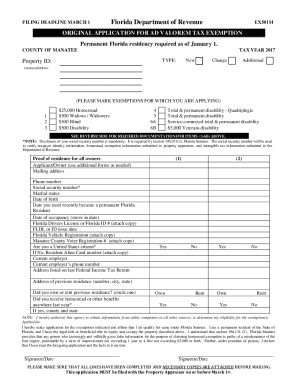

To qualify for the Manatee County Homestead Exemption, applicants must meet several criteria. First, the property must be the applicant's primary residence as of January first of the tax year. Additionally, the homeowner must be a legal resident of Florida and must provide proof of residency. This may include documentation such as a Florida driver's license, voter registration, or utility bills. Furthermore, the applicant must not have claimed a homestead exemption on any other property in the state. Meeting these eligibility requirements is essential for successfully obtaining the exemption.

Steps to Complete the Manatee County Homestead Exemption Application

Completing the Manatee County Homestead Exemption application involves several straightforward steps. First, gather all necessary documentation, including proof of residency and identification. Next, access the Manatee County Homestead Exemption application form, which can be completed online or printed for submission. Fill out the form accurately, ensuring all required information is provided. Once the application is completed, submit it to the Manatee County Property Appraiser's Office by the established deadline. It is advisable to keep a copy of the submitted application for personal records.

Required Documents for the Manatee County Homestead Exemption

When applying for the Manatee County Homestead Exemption, several documents are typically required to verify eligibility. These documents may include:

- Proof of Florida residency, such as a Florida driver's license or state identification card.

- Voter registration information.

- Utility bills showing the applicant's name and address.

- Social Security numbers for all owners of the property.

Providing accurate and complete documentation is crucial for a successful application process.

Form Submission Methods for the Manatee County Homestead Exemption

The Manatee County Homestead Exemption application can be submitted through various methods to accommodate different preferences. Homeowners can complete the application online via the Manatee County Property Appraiser's website, which offers a convenient and efficient way to apply. Alternatively, applicants can print the form and submit it by mail or deliver it in person to the Property Appraiser's Office. Each method ensures that homeowners can choose the option that best suits their needs and circumstances.

Filing Deadlines for the Manatee County Homestead Exemption

Filing deadlines for the Manatee County Homestead Exemption are crucial for homeowners to observe. Applications must be submitted by March first of the tax year for which the exemption is being requested. Late applications may not be considered, and homeowners could miss out on potential tax savings. It is important for applicants to mark their calendars and ensure that all necessary paperwork is submitted on time to take full advantage of the exemption.

Quick guide on how to complete manatee county homestead exemption

Effortlessly prepare Manatee County Homestead Exemption on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly and without delay. Manage Manatee County Homestead Exemption on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to modify and eSign Manatee County Homestead Exemption with ease

- Locate Manatee County Homestead Exemption and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight relevant sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choosing. Modify and eSign Manatee County Homestead Exemption and ensure excellent communication at every stage of your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the manatee county homestead exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a homestead exemption in Manatee County?

A homestead exemption in Manatee County is a property tax benefit that reduces the taxable value of a primary residence. This exemption can save homeowners signNow amounts on their property taxes, making it an essential aspect of financial planning for residents.

-

How can I apply for the homestead exemption in Manatee County?

You can apply for the homestead exemption in Manatee County by submitting an application to the local property appraiser's office. Ensure to provide the necessary documentation, such as proof of residency and ownership, to qualify for the exemption and maximize your benefits.

-

What are the benefits of the homestead exemption in Manatee County?

The primary benefits of the homestead exemption in Manatee County include lower property tax rates and protection from creditors in case of bankruptcy. Homeowners also enjoy an increase in property assessment limits, making it easier to manage growing financial responsibilities.

-

Is there a deadline for applying for the homestead exemption in Manatee County?

Yes, there is a deadline for applying for the homestead exemption in Manatee County. Applications must be submitted by March 1st of the tax year in which you want the exemption to take effect, so it's essential to act promptly to secure your benefits.

-

Can I still qualify for the homestead exemption in Manatee County if I rent my property?

No, to qualify for the homestead exemption in Manatee County, the property must be your primary residence. If you rent out your property, you may not be eligible for this tax benefit as it is designed for homeowners living on the premises.

-

Are there any income limitations for the homestead exemption in Manatee County?

There are no specific income limitations for qualifying for the general homestead exemption in Manatee County. However, certain additional exemptions, such as the senior citizen exemption, may have income restrictions, so be sure to review all applicable criteria.

-

What happens if I sell my home with a homestead exemption in Manatee County?

If you sell your home that has a homestead exemption in Manatee County, you will need to cancel the existing exemption and potentially reapply for a new exemption on your next primary residence. It's important to understand the implications of selling to maintain your tax advantages.

Get more for Manatee County Homestead Exemption

Find out other Manatee County Homestead Exemption

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast