Schedule S 540 Other State Tax Credit Instructions Form

What is the Schedule S 540 Other State Tax Credit Instructions

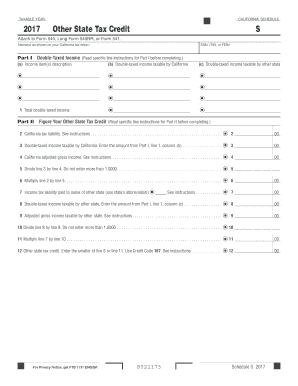

The Schedule S 540 is a crucial form used by California taxpayers to claim a credit for taxes paid to other states. This form is designed for individuals who have earned income in multiple states and wish to avoid double taxation. By completing the Schedule S 540, taxpayers can report the amount of tax they paid to another state and calculate the credit they are eligible to receive on their California tax return. This process ensures that residents are not penalized for earning income outside of California while still contributing to state taxes.

Steps to Complete the Schedule S 540 Other State Tax Credit Instructions

Completing the Schedule S 540 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including W-2 forms and tax returns from the other states where income was earned. Next, follow these steps:

- Fill out your personal information at the top of the form, including your name, address, and Social Security number.

- Report the total income earned in the other state(s) on the appropriate lines of the form.

- Calculate the tax paid to the other state(s) and enter this amount in the designated section.

- Determine the allowable credit based on California's tax laws and the amount paid to the other state.

- Review all entries for accuracy before submitting the form with your California tax return.

Eligibility Criteria for the Schedule S 540 Other State Tax Credit Instructions

To qualify for the Schedule S 540 credit, certain eligibility criteria must be met. Taxpayers must have:

- Earned income in another state that is also subject to California state tax.

- Paid taxes to that other state on the income earned.

- Filed a tax return in the other state for the income in question.

Additionally, the credit is only available for taxes paid to states that have a reciprocal agreement with California. It is essential for taxpayers to verify these agreements to ensure they meet the requirements for claiming the credit.

Legal Use of the Schedule S 540 Other State Tax Credit Instructions

The Schedule S 540 is legally recognized as a valid method for claiming tax credits for taxes paid to other states. Compliance with the instructions outlined in the form is necessary to ensure that the credit is applied correctly. This form adheres to state tax laws and regulations, providing a legal framework for taxpayers to avoid double taxation. Utilizing this form correctly can help taxpayers maintain compliance with California tax laws while maximizing their tax benefits.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial for taxpayers using the Schedule S 540. Generally, California tax returns are due on April fifteenth of each year. If taxpayers are claiming the Schedule S 540, they must ensure that the form is submitted along with their California tax return by this deadline. Extensions may be available, but it is important to confirm specific dates and requirements to avoid penalties.

Required Documents for the Schedule S 540 Other State Tax Credit Instructions

To successfully complete the Schedule S 540, taxpayers need to gather several key documents:

- W-2 forms from employers in both California and the other state(s).

- Tax returns filed in the other state(s) to verify the tax paid.

- Any other documentation that supports income earned and taxes paid to the other state(s).

Having these documents on hand will streamline the completion process and help ensure that all information reported is accurate and complete.

Quick guide on how to complete 2017 schedule s 540 other state tax credit instructions

Effortlessly Prepare Schedule S 540 Other State Tax Credit Instructions on Any Device

Digital document handling has gained popularity among companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents swiftly without any holdups. Manage Schedule S 540 Other State Tax Credit Instructions on any device with airSlate SignNow’s Android or iOS applications and enhance any document-focused task today.

The easiest method to modify and electronically sign Schedule S 540 Other State Tax Credit Instructions effortlessly

- Locate Schedule S 540 Other State Tax Credit Instructions and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize signNow sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the concerns of lost or misfiled documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Schedule S 540 Other State Tax Credit Instructions and guarantee exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before signNowing AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

-

According to instructions, if you earn less than $1,500, say $15 in interest, you don't have to fill out a Schedule B--if it's ordinary income, where do you put it on the new forms? (I know the government won't give up a penny in tax.)

If you have less than $1500 in interest income, and do not attach Schedule B, you should report your total taxable interest directly on Form 1040, Line 2b.

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Create this form in 5 minutes!

How to create an eSignature for the 2017 schedule s 540 other state tax credit instructions

How to generate an electronic signature for the 2017 Schedule S 540 Other State Tax Credit Instructions online

How to generate an eSignature for your 2017 Schedule S 540 Other State Tax Credit Instructions in Chrome

How to generate an electronic signature for signing the 2017 Schedule S 540 Other State Tax Credit Instructions in Gmail

How to create an eSignature for the 2017 Schedule S 540 Other State Tax Credit Instructions right from your smartphone

How to generate an eSignature for the 2017 Schedule S 540 Other State Tax Credit Instructions on iOS

How to generate an electronic signature for the 2017 Schedule S 540 Other State Tax Credit Instructions on Android

People also ask

-

What are the key features of airSlate SignNow for managing Schedule S 540 Other State Tax Credit Instructions?

airSlate SignNow provides a user-friendly interface for sending and eSigning documents, making it ideal for managing Schedule S 540 Other State Tax Credit Instructions. Features like customizable templates and real-time tracking ensure that you can efficiently handle your tax documents. Additionally, the platform integrates seamlessly with popular applications for a streamlined experience.

-

How does airSlate SignNow simplify the process of submitting Schedule S 540 Other State Tax Credit Instructions?

With airSlate SignNow, you can easily prepare and submit Schedule S 540 Other State Tax Credit Instructions by utilizing our intuitive document workflow. The platform allows you to collect electronic signatures quickly, reducing the time spent on paperwork. This means you can focus more on your business rather than the complexities of tax filing.

-

Is there a free trial available for airSlate SignNow to help with Schedule S 540 Other State Tax Credit Instructions?

Yes, airSlate SignNow offers a free trial that allows you to explore its capabilities for managing Schedule S 540 Other State Tax Credit Instructions. This trial gives you access to all the features, so you can see firsthand how our solution can enhance your document signing and management processes.

-

What kind of customer support does airSlate SignNow offer for Schedule S 540 Other State Tax Credit Instructions?

airSlate SignNow provides comprehensive customer support to assist you with any questions related to Schedule S 540 Other State Tax Credit Instructions. Our support team is available via chat, email, and phone, ensuring that you receive timely assistance whenever you need help with your tax document management.

-

Can I integrate airSlate SignNow with my existing accounting software for Schedule S 540 Other State Tax Credit Instructions?

Absolutely! airSlate SignNow can be easily integrated with various accounting software, allowing you to manage Schedule S 540 Other State Tax Credit Instructions seamlessly. This integration helps in syncing your financial data and automating document workflows, making your tax filing process more efficient.

-

What pricing plans are available for using airSlate SignNow for Schedule S 540 Other State Tax Credit Instructions?

airSlate SignNow offers flexible pricing plans tailored to different business needs, including options for handling Schedule S 540 Other State Tax Credit Instructions. You can choose from individual, team, or enterprise plans, ensuring you find the right fit based on your document signing volume and required features.

-

Are there any limitations when using airSlate SignNow for Schedule S 540 Other State Tax Credit Instructions?

While airSlate SignNow is a powerful tool for Schedule S 540 Other State Tax Credit Instructions, some limitations may include the number of documents you can send under certain plans. However, the platform's scalability allows you to upgrade your plan as your needs grow, ensuring you can always manage your tax documents effectively.

Get more for Schedule S 540 Other State Tax Credit Instructions

Find out other Schedule S 540 Other State Tax Credit Instructions

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now