Orthrus Real Estate Enterprises Forms Georgia

What are Orthrus Real Estate Enterprises Forms in Georgia?

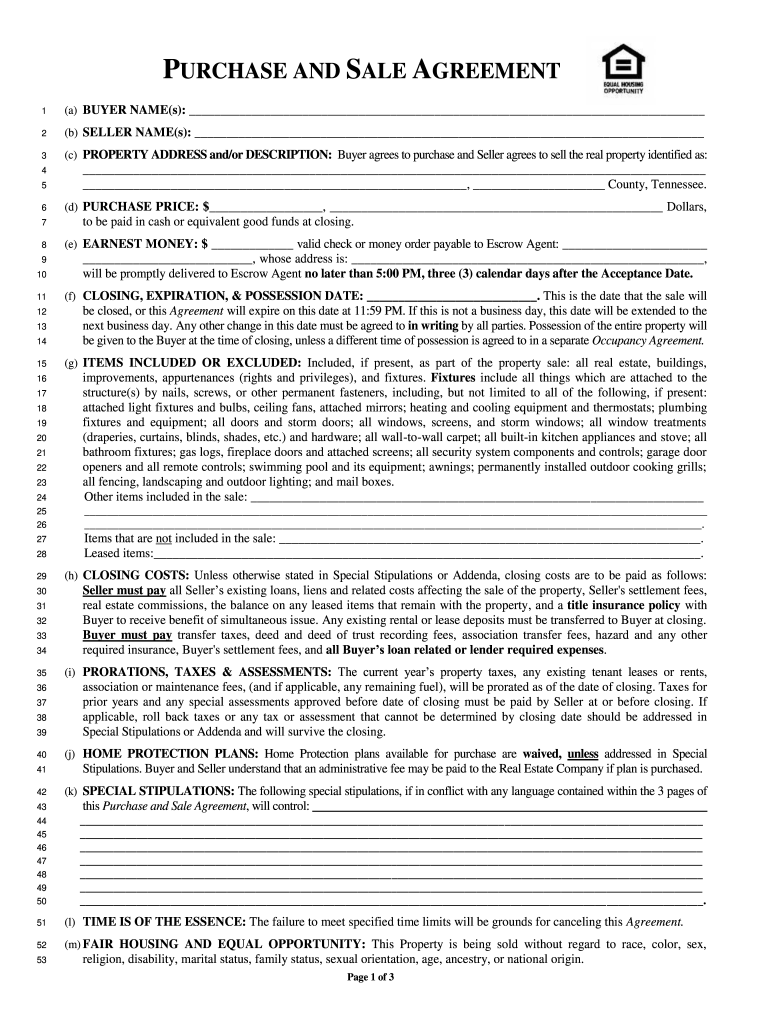

The Orthrus Real Estate Enterprises forms are essential documents used in various real estate transactions within Georgia. These forms facilitate the legal process of buying, selling, or leasing property, ensuring compliance with state regulations. Common types of forms include the Georgia real estate contract, purchase and sale agreements, and other related documents necessary for real estate dealings. Each form is designed to protect the rights of all parties involved and to provide a clear framework for the transaction.

How to Use the Orthrus Real Estate Enterprises Forms in Georgia

Using the Orthrus Real Estate Enterprises forms requires careful attention to detail. Start by selecting the appropriate form based on your specific transaction needs. Once you have the correct document, fill it out completely, ensuring that all required fields are addressed. It's vital to review the form for accuracy before submitting it. Digital solutions like signNow can streamline this process, allowing you to fill out and eSign documents securely and efficiently.

Steps to Complete the Orthrus Real Estate Enterprises Forms in Georgia

Completing the Orthrus Real Estate Enterprises forms involves several key steps:

- Identify the specific form required for your transaction.

- Gather all necessary information, such as property details and parties involved.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions.

- eSign the document using a secure platform like signNow to ensure compliance.

- Submit the completed form as per the guidelines provided.

Legal Use of the Orthrus Real Estate Enterprises Forms in Georgia

The legal use of Orthrus Real Estate Enterprises forms is governed by Georgia state law. These forms must meet specific legal standards to be considered valid. For instance, signatures must be obtained from all parties involved, and the forms must adhere to the requirements outlined in the Georgia real estate code. Utilizing a trusted eSignature solution helps ensure that all legal aspects are covered, providing peace of mind during the transaction process.

Key Elements of the Orthrus Real Estate Enterprises Forms in Georgia

Key elements of Orthrus Real Estate Enterprises forms typically include:

- Identification of the parties involved in the transaction.

- Detailed description of the property being bought or sold.

- Terms of sale, including purchase price and payment methods.

- Contingencies that may affect the transaction.

- Signatures of all parties, indicating agreement to the terms.

State-Specific Rules for the Orthrus Real Estate Enterprises Forms in Georgia

Georgia has specific rules governing the use of real estate forms, including the Orthrus Real Estate Enterprises forms. These rules dictate how forms must be completed, submitted, and maintained. Familiarity with state laws ensures compliance and protects the interests of all parties involved. It is advisable to consult with a real estate professional or attorney to navigate these regulations effectively.

Quick guide on how to complete contract for the purchase and sale of residential real property orthrus real estate form

Effortlessly Prepare Orthrus Real Estate Enterprises Forms Georgia on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an excellent environmentally-friendly substitute for conventional printed and signed paperwork, allowing you to easily locate the right template and securely keep it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents promptly without any hold-ups. Manage Orthrus Real Estate Enterprises Forms Georgia on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric processes today.

How to Modify and eSign Orthrus Real Estate Enterprises Forms Georgia with Ease

- Obtain Orthrus Real Estate Enterprises Forms Georgia and then click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive details using the specialized tools provided by airSlate SignNow.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose your preferred distribution method for the form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Pocket the hassle of lost files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Orthrus Real Estate Enterprises Forms Georgia to ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

If two or more people jointly own a real estate property and one wants out, can that person force a sale of the property?

Typically, yes, by filing a petition with the court for a Forced Sale. There are a number of different forms of ownership, some of which treat the whole property as one thing, others of which treat each owner's interest separately. If you own property as Tenants in Common, you can sell your interest in the property to someone else without the permission of the other owner(s), absent a separate agreement between you prohibiting such a sale. If you want to sell the whole property and the other owners disagree, you can go to court to petition for a sale. Here is a brief discussion on ownership, from The Pennsylvania Law Monitor, and see the article above from Wikipedia on forced sales.Real Estate Tenancies ExplainedThere are three principal types of tenancies related to the ownership of real estate. Perhaps the most popular, and most familiar, is the joint tenancy. If two persons own a property as joint tenants, upon one person’s death, the other person automatically owns all of the interest in the property. There is no limit on the number of persons that can hold property as joint tenants. If a husband and wife own a property together and add their child to the deed, each will own a one-third interest in the property. Upon one of their deaths, the two surviving persons will each own a one-half interest in the property.In the event that a joint tenancy owner is sued, and a judgment is entered against that owner, the owner’s interest in the property is subject to attachment by the creditor. In addition, any co-owners can bring an action to divide the interest in the property, and attempt to force the other owners to sell their interest.A tenancy in common is where each owner of the property has an undivided interest in the whole of the property. However, upon the death of any owner, his or her share will pass to his or her decedents by will or by intestacy. Unlike a joint tenancy where each owner owns an equal portion of the property, tenancies in common do not require equal ownership. For example, in a tenancy in common, there could be three owners with one owing 50%, one owning 30% and one owning 20%.A form of ownership allowed in many states is the tenancy by the entirety. In this type of ownership, only a husband and wife may own the property. The advantage of a tenancy by the entirety is that, in the event that either the husband or wife is sued (individually), a creditor may not take action against the property while it is held jointly by the husband and wife. In addition, neither the husband nor the wife may divide the ownership by deeding his or her interest to another person. Further, in order for a mortgage to be placed on the property, both the husband and wife must sign the loan documentation.In some states, if there is no tenancy stated, there is a presumption that the owners are tenants in common, and if one person dies, then his or her interest in the property will need to be probated, even if the decedent desired for the property to pass to the surviving co-owner (including the spouse).As you can see from the above, tenancy should not be taken lightly. We recommend a careful review of all property deeds on a regular basis to ensure that the properties are properly held in accordance with your desires.

-

How do I evaluate real estate properties to reduce risk for purchase on a tax sale list? software or formula.

That would depend upon your financial position, access to the right professionals to do the repair/updates needed, legal assistance to straighten out any title or other legal challenges. You'll also need some feet on the ground to look at what the local municipality has on the property. Then you'll need to figure out any tenant issues. You'd be best advised to go to work for someone or some company that already does this and learn from them on their dime rather than yours. You'll learn valuable insight on local customs, laws, procedures etc. as well as contacts with the right people to work with to be profitable.

-

How can I get out of a real estate contract when I priced the property too low and really feel it is a mistake to sell it?

Number one thing is to step back and think objectively talking to your listing agent. Hopefully, you did use an experienced Realtor to help you set the price. If a home is priced correctly, you should expect to have interest and offers early. You may have to wait a while before you get another similar offer. When a home first goes on the market, you get both the people who’ve been looking for possibly weeks or more plus new buyers just starting.If you truly want to get out of the contract talk to a real estate attorney. As a seller contracts really don’t give you much out unless a buyer defaults. If this your homesteaded home, you may be able to avoid being forced to sell but could be held liable for buyers costs and possibly damages. Your home may even be held up from being sold to someone else. If you have a listing agreement, you may be responsible for commissions.Think carefully, then talk to an attorney.

-

Who makes the purchase and sale agreement, plus a contingency to buy a real estate property?

Who makes the purchase and sale agreement:A Purchase and Sale (P&S) understanding is an authoritative archive that has been arranged and consented to by lawyers speaking to the buyer and seller in a land exchange. In Massachusetts, it must be marked by a purchaser and dealer after both sides have gone to a concurrence on an offer on a bit of land. The P&S will incorporate the last deal cost and all terms of the buy, and it covers the weeks between when a property is removed the market and shutting; a few conditions stretch out past the end date.takes after is a rundown of normal possibilities that can be found in most home buy understandings.Contingency to buy a real estate property:Financing/Loan ContingencyAll home deal contracts will be dependent upon you, the Buyer, having the capacity to secure a credit or other wellspring of financing with which to buy the house. This possibility may put a day and age amongst marking and shutting in which the purchaser must secure this financing. For a first time purchaser, the a lot of cash included can appear to be very overwhelming, however remember this is quite normal. In the event that you can pay money in advance for the offer of the home, then you will have the capacity to discard this possibility.2. Home InspectionA typical possibility inside a home deal assention contract is one that gives the purchaser the privilege to no less than one home review before a specific date. This possibility ought to likewise give the purchaser the chance to escape the agreement, or request repairs, if the purchaser is not, in compliance with common decency, happy with the state of the house.3. ProtectionMost property holders will need to ensure that their new buy has home protection before moving in. Be that as it may, insurance agencies have turned out to be increasingly hesitant to protect properties and homes in specific parts of the nation.4. TitleThis can be a standout amongst the most imperative possibilities for you as the purchaser. This possibility will permit you to leave the agreement if the dealer of the home can't demonstrate that he or she has substantial legitimate title to the property that is available to be purchased.What to do nextSubsequent to considering what sorts of possibilities you need in your home deal understanding, set them in motion as a feature of your offer to purchase the house.

-

Are there any upcoming U.S. real estate regulatory reforms that will make it easier for domestic and international buyers to purchase residential real estate property in the U.S.?

You will have to educate me on what current restriction exist that hinder anyone from purchasing property in the U.S., as I am unaware of any restrictions in need of reform. Many see a major problem in allowing anyone to purchase anything anywhere.

-

In residential real estate wholesaling, where and how is the best way to learn about contracts?

This is not legal advice. Seek local counsel.This is just my take on what your objective is as wholesaler: find great deals off market for folks that want to flip houses. Therefore I am going to clue you into most of what you need to know about contacts:Offer plus acceptance supported by consideration ($10.00?)=ContractContracts for real estate must be in writing.Your welcome.Marketing, marketing and marketing is all you need to work on. Go to The Real Estate Investing Social Network for much more in-depth information from successful investors.

-

In Washington state, are contracts for the sale of real estate not only are required to be in writing, but must usually also contain the legal description for the real property that is the subject of the contract?

You would be best served to ask this of a qualified Washington state attorney. Real estate professionals can answer what is common and policy procedure but cannot give a legal answer.

-

What are some best practices for forming a syndicate for the purpose of investing in residential real estate (as rental properties)?

You can use the structure of a holding company. Every investor will get shares in proportion to the invested amount. I am assuming that investment objectives will be the same for all. In case some investors want to exit earlier, they can sell the shares at the valuation of portfolio at that time to existing investors or new ones. A fund structure can also do this, in case the number of investors is large. However setup and running costs of funds are higher. There needs to be clearly defined documents for treatment of rental amounts if applicable, payouts and reinvestments.

-

How much leverage is too much, for a real estate investor who buys and holds residential properties while renting them out?

The easiest way to answer this question is to ask “by how much would rents need to fall or expenses need to rise before I could not pay my mortgage”.At the asset level, lenders use a formula called debt service coverage ratio to try to answer this question. DSCR is: (annual rent - annual expenses) / annual debt service payments.Annual debt service is your total annual mortgage payments, including interest and principal (in any).Since annual rent - annual expenses = Net operating income, another way of saying this is just Net Operating Income / Annual Debt Service.Lenders generally want to see the ratio at something like 1.25, which is to say $1.25 of NOI for each $1 of debt service.Here’s a real world example:Rent $100kExpenses $30kAnnual debt service $55kSo, DSCR = (100k - 30k) / 55k = 1.27Now, imagine expenses stay constant but rents come dow 15% to $85k. NOI is $85k - $30k = $55k. At that point, there is literally no margin for error… every last dollar of NOI is going to service the mortgage.So, if you want to be safe at the asset level, I would suggest keeping your DSCR to more like 1.3–1.4… eg keeping your mortgage small enough that you have $1.30 or $1.40 for each $1 of mortgage payments.One final note: DSCR works at the asset level. But it’s also worthwhile to consider your whole portfolio. After all, if rents fall but you have lots of other income coming in from stable sources (say, a stock portfolio, other properties, good jobs, etc.), you might be willing / able to subsidize the mortgage on your income property. So, in that scenario, if borrowing against the income property is the cheapest path, it may make sense for you to take a larger-than-normally-prudent loan against the property.

Create this form in 5 minutes!

How to create an eSignature for the contract for the purchase and sale of residential real property orthrus real estate form

How to make an eSignature for the Contract For The Purchase And Sale Of Residential Real Property Orthrus Real Estate Form in the online mode

How to generate an electronic signature for your Contract For The Purchase And Sale Of Residential Real Property Orthrus Real Estate Form in Chrome

How to create an eSignature for putting it on the Contract For The Purchase And Sale Of Residential Real Property Orthrus Real Estate Form in Gmail

How to make an eSignature for the Contract For The Purchase And Sale Of Residential Real Property Orthrus Real Estate Form from your smartphone

How to generate an eSignature for the Contract For The Purchase And Sale Of Residential Real Property Orthrus Real Estate Form on iOS devices

How to create an electronic signature for the Contract For The Purchase And Sale Of Residential Real Property Orthrus Real Estate Form on Android devices

People also ask

-

What are the key features of Orthrus Real Estate Enterprises?

Orthrus Real Estate Enterprises offers an array of features, including digital signatures, document templates, and automated workflows. These tools help streamline business operations and ensure compliance, making the entire process efficient and user-friendly.

-

How does pricing work for Orthrus Real Estate Enterprises?

Orthrus Real Estate Enterprises provides flexible pricing plans to accommodate businesses of all sizes. You can choose from monthly or annual subscriptions, and there are options for unlimited eSignatures and document templates, ensuring you get the best value for your investment.

-

Can I integrate Orthrus Real Estate Enterprises with other software?

Yes, Orthrus Real Estate Enterprises easily integrates with various popular software solutions such as CRM systems, cloud storage services, and project management tools. This integration helps enhance workflow efficiency and improve collaboration across your organization.

-

What are the benefits of using Orthrus Real Estate Enterprises for document signing?

Using Orthrus Real Estate Enterprises signNowly speeds up the document signing process while maintaining security and compliance. It allows for real-time tracking and reminders, ensuring that all parties are kept in the loop and that documents are signed promptly.

-

Is Orthrus Real Estate Enterprises user-friendly?

Absolutely! Orthrus Real Estate Enterprises is designed with the user in mind, featuring an intuitive interface that makes it easy for anyone to navigate. Whether you're tech-savvy or not, you can quickly learn how to send and eSign documents without any hassle.

-

How secure is the data with Orthrus Real Estate Enterprises?

Orthrus Real Estate Enterprises prioritizes data security, employing advanced encryption protocols to safeguard all documents and user information. Additionally, regular security audits are conducted to comply with industry standards, providing peace of mind to users.

-

Does Orthrus Real Estate Enterprises offer customer support?

Yes, Orthrus Real Estate Enterprises offers comprehensive customer support through various channels, including email, live chat, and phone. Their dedicated support team is available to assist with any questions or technical issues you may encounter.

Get more for Orthrus Real Estate Enterprises Forms Georgia

- Rhode island notice form

- Quitclaim deed from individual to husband and wife rhode island form

- Warranty deed from individual to husband and wife rhode island form

- Quitclaim deed from corporation to husband and wife rhode island form

- Warranty deed from corporation to husband and wife rhode island form

- Quitclaim deed from corporation to individual rhode island form

- Rhode island corporation 497325018 form

- Quitclaim deed from corporation to llc rhode island form

Find out other Orthrus Real Estate Enterprises Forms Georgia

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe