Liberty Tax Client Data Sheet Form

What is the Liberty Tax Client Data Sheet

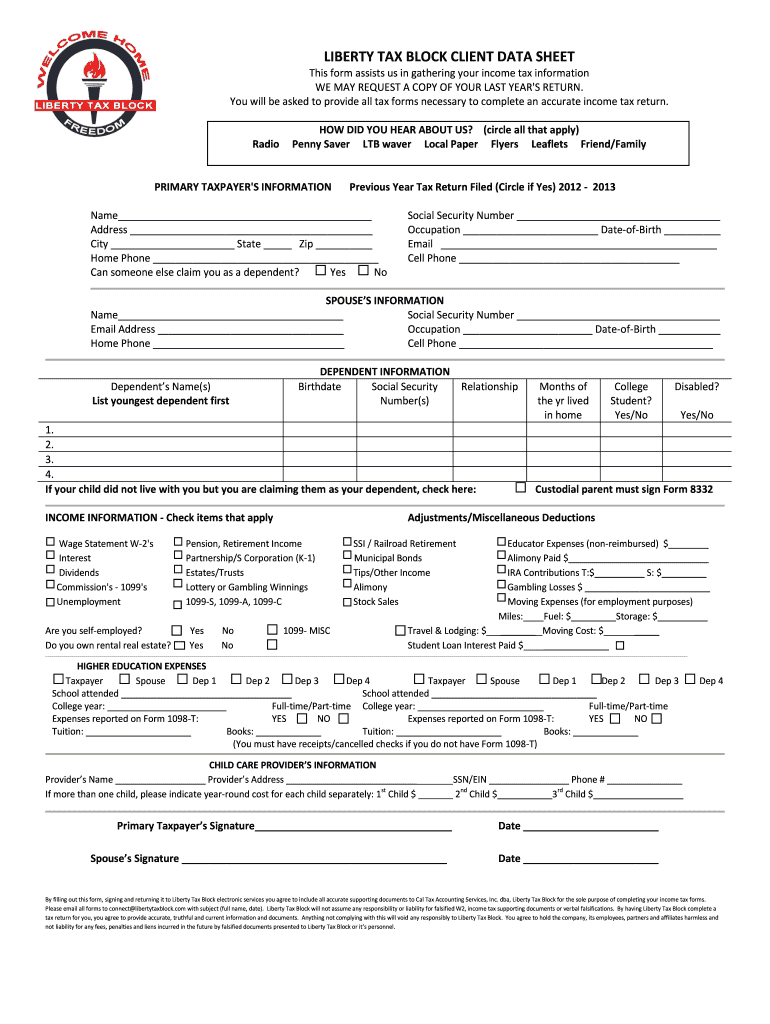

The Liberty Tax Client Data Sheet is a crucial document used by tax professionals to collect essential information from clients. This form serves as a comprehensive record of a client's financial details, ensuring that all necessary data is gathered for accurate tax preparation. It includes sections for personal information, income sources, deductions, and credits, making it an indispensable tool for both clients and tax preparers. Properly completing this form helps facilitate a smooth tax filing process and ensures compliance with IRS regulations.

How to Use the Liberty Tax Client Data Sheet

Using the Liberty Tax Client Data Sheet involves several straightforward steps. First, clients should access the form through the Liberty Tax Client Portal or request a physical copy from their tax professional. Once obtained, clients need to fill in their personal details, including name, address, Social Security number, and income information. It is important to provide accurate and complete information to avoid delays in processing. After filling out the form, clients can submit it electronically or in person, depending on their tax preparer's preferences.

Steps to Complete the Liberty Tax Client Data Sheet

Completing the Liberty Tax Client Data Sheet requires careful attention to detail. Here are the steps to follow:

- Access the form through the Liberty Tax Client Portal or request a hard copy.

- Fill in your personal information, including full name, address, and Social Security number.

- Provide details about your income sources, such as wages, self-employment income, and investment earnings.

- List any deductions or credits you may qualify for, including mortgage interest, student loan interest, and education credits.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or deliver it to your tax preparer.

Legal Use of the Liberty Tax Client Data Sheet

The Liberty Tax Client Data Sheet is legally recognized as a valid document for tax preparation purposes. To ensure its legal standing, it must be filled out accurately and submitted in accordance with applicable tax laws. The use of electronic signatures through a reliable platform, such as airSlate SignNow, can enhance the document's legality, provided it complies with the ESIGN and UETA acts. This compliance assures clients that their electronic submissions are secure and legally binding.

Key Elements of the Liberty Tax Client Data Sheet

Several key elements must be included in the Liberty Tax Client Data Sheet to ensure thoroughness and compliance. These elements typically consist of:

- Personal Information: Name, address, Social Security number, and contact details.

- Income Sources: Details of wages, self-employment income, rental income, and other earnings.

- Deductions and Credits: Information on eligible deductions, such as mortgage interest and education expenses.

- Filing Status: Indication of whether the client is filing as single, married, head of household, etc.

- Signature: A section for the client’s signature, which may be completed electronically for added convenience.

Required Documents for the Liberty Tax Client Data Sheet

To complete the Liberty Tax Client Data Sheet accurately, clients should gather several key documents beforehand. These documents typically include:

- W-2 Forms: Received from employers, detailing annual earnings and taxes withheld.

- 1099 Forms: For reporting income from freelance work, interest, dividends, and other sources.

- Receipts: For deductible expenses, such as medical costs, charitable contributions, and business expenses.

- Previous Year’s Tax Return: Useful for reference and ensuring consistency in reporting.

Quick guide on how to complete liberty tax client data sheet

Manage Liberty Tax Client Data Sheet effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Handle Liberty Tax Client Data Sheet on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The easiest way to edit and eSign Liberty Tax Client Data Sheet smoothly

- Locate Liberty Tax Client Data Sheet and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize crucial sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that task.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing additional document copies. airSlate SignNow attends to all your document management needs in just a few clicks from any device you prefer. Edit and eSign Liberty Tax Client Data Sheet and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the liberty tax client data sheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a liberty tax client data sheet?

A liberty tax client data sheet is a document that enables tax professionals to collect and organize essential client information efficiently. By using airSlate SignNow, you can easily create, customize, and manage these sheets while ensuring they are securely eSigned. This aids in a streamlined process for tax filing and client management.

-

How can airSlate SignNow improve my liberty tax client data sheet management?

airSlate SignNow enhances your management of the liberty tax client data sheet by offering seamless electronic signature capabilities. With our platform, you can automate the collection and processing of these sheets, ensuring accuracy and saving time, which is crucial during the busy tax season.

-

Is airSlate SignNow cost-effective for managing liberty tax client data sheets?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing liberty tax client data sheets. Our pricing plans are tailored to fit businesses of all sizes, allowing you to save on operational costs while accessing powerful features that streamline document workflows.

-

What features does airSlate SignNow offer for liberty tax client data sheets?

airSlate SignNow offers several features specifically for managing liberty tax client data sheets, including customizable templates, secure eSigning, and real-time tracking. These features ensure that you can create professional documents, gather client signatures quickly, and monitor the status of your sheets at any time.

-

Can I integrate airSlate SignNow with other tools for managing liberty tax client data sheets?

Absolutely! airSlate SignNow provides integration capabilities with various CRM and accounting software tailored for tax professionals. This means you can sync your liberty tax client data sheets with your existing tools, improving collaboration and efficiency in your workflow.

-

How secure is airSlate SignNow when handling liberty tax client data sheets?

Security is a top priority at airSlate SignNow. We comply with industry standards and regulations to ensure that your liberty tax client data sheets are protected with encryption and secure storage. You can confidently manage sensitive client information knowing that it is safeguarded against unauthorized access.

-

How can I get started with airSlate SignNow for my liberty tax client data sheets?

Getting started with airSlate SignNow for your liberty tax client data sheets is simple. You can sign up for a free trial on our website, allowing you to explore our features and create your first client data sheet. Our user-friendly interface ensures that you will be up and running in no time.

Get more for Liberty Tax Client Data Sheet

Find out other Liberty Tax Client Data Sheet

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document