How to Get Nssf Loan Form

Understanding the NSSF Loan Application Process

The NSSF loan application process is designed to provide financial assistance to eligible members. To begin, applicants must ensure they meet the eligibility criteria, which typically include being a registered member of the NSSF and having made a certain number of contributions. Understanding these requirements is crucial for a successful application.

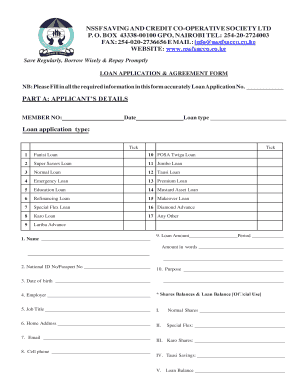

Key Elements of the NSSF Loan Application Form

When filling out the NSSF loan application form, certain key elements must be included. These typically consist of personal identification details, employment information, and financial statements. Providing accurate and complete information is essential to avoid delays in processing.

Required Documents for NSSF Loan Application

Applicants must prepare specific documents to accompany their NSSF loan application. Commonly required documents include:

- Proof of identity, such as a government-issued ID

- Recent pay slips or proof of income

- Bank statements for the last three months

- Any additional documentation as specified by the NSSF

Having these documents ready can streamline the application process and enhance the chances of approval.

Steps to Complete the NSSF Loan Application Form

Completing the NSSF loan application form involves several steps:

- Gather all required documents.

- Fill out the application form accurately, ensuring all sections are completed.

- Review the form for any errors or missing information.

- Submit the application form along with the required documents, either online or in person.

Following these steps can help ensure a smooth application experience.

Form Submission Methods for NSSF Loan Applications

The NSSF loan application can typically be submitted through various methods. These include:

- Online submission via the NSSF portal

- Mailing the completed form to the designated NSSF office

- In-person submission at local NSSF branches

Choosing the most convenient submission method can help expedite the application process.

Legal Use of the NSSF Loan Application Form

The NSSF loan application form is a legally binding document. It is essential to ensure that all information provided is truthful and accurate. Misrepresentation or submission of false information can lead to penalties, including denial of the loan or legal action.

Quick guide on how to complete how to get nssf loan

Complete How To Get Nssf Loan effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage How To Get Nssf Loan on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign How To Get Nssf Loan with ease

- Find How To Get Nssf Loan and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, laborious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and eSign How To Get Nssf Loan and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to get nssf loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NSSF loan application form and why is it important?

The NSSF loan application form is a crucial document that allows you to apply for loans provided by the National Social Security Fund. Completing this form accurately is important to ensure that your application is processed efficiently and you receive the funds you need. airSlate SignNow provides a seamless way to fill out and eSign this form online, enhancing convenience and speed.

-

How can I access the NSSF loan application form?

You can easily access the NSSF loan application form through the airSlate SignNow platform. Our easy-to-use interface allows you to find and fill out the form conveniently from any device. Once completed, you can send it directly for approval with just a few clicks.

-

Is there a cost associated with using the NSSF loan application form through airSlate SignNow?

Using airSlate SignNow to process your NSSF loan application form is cost-effective. We offer different pricing plans to suit your needs, allowing you to manage your documents affordably while benefiting from our advanced eSigning features. Consider our plans to determine the best option for you.

-

What features does airSlate SignNow offer for the NSSF loan application form?

airSlate SignNow includes a variety of features designed to enhance your experience with the NSSF loan application form. Key features include document templates, customizable workflows, and real-time tracking of your application's status. These tools streamline your process and keep you organized from submission to approval.

-

Can I save and edit my NSSF loan application form in airSlate SignNow?

Yes, airSlate SignNow allows you to save and edit your NSSF loan application form as needed. Once you begin filling out the form, you can easily return to it at any time, ensuring that you have the flexibility to input and update your information at your convenience.

-

What are the benefits of using airSlate SignNow for my NSSF loan application form?

Using airSlate SignNow for your NSSF loan application form offers numerous benefits, including increased efficiency and document security. Our platform ensures that your application is handled with the utmost confidentiality while enabling quick turnaround times for your loan processing. Additionally, you can eSign documents securely, saving you time and eliminating the need for physical paperwork.

-

Does airSlate SignNow integrate with other applications for processing the NSSF loan application form?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, which can enhance the workflow for your NSSF loan application form. By integrating with other tools you already use, we help you maintain efficiency and keep all your documents within a central system for easier access and management.

Get more for How To Get Nssf Loan

- Nlc application form

- Earn rs 10 000 per day without investment form

- Nspo form 1 download

- Sample of courtesy visit letter to the governor form

- State form 55018fill out and use this pdf

- Tx unps school nutrition programs claims form sites duke sites duke

- Sco clc pbt 21 4 consent to change name consent to change name form

- Dv 125 request for service of protective order douments one petitioner form

Find out other How To Get Nssf Loan

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF