Office Expenses List PDF Form

What is the Business Expenses List PDF

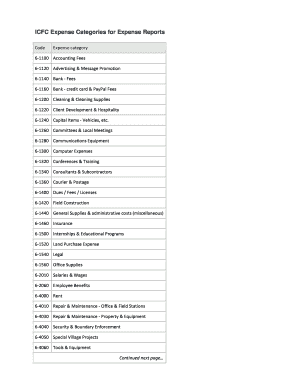

The business expenses list PDF is a structured document designed to help businesses track and categorize their expenses. It typically includes various categories such as office supplies, travel expenses, utilities, and employee salaries. This document serves as a crucial tool for financial management, enabling businesses to maintain accurate records for budgeting, tax preparation, and financial analysis. The format allows for easy sharing and storage, ensuring that important financial data is readily accessible when needed.

How to Use the Business Expenses List PDF

Using the business expenses list PDF involves several straightforward steps. First, download the PDF from a reliable source. Next, open the document using a PDF reader that supports form filling. Begin by entering your business information at the top of the form. Then, systematically fill in each expense category with the relevant details, including the date, description, amount, and payment method. Once completed, review the entries for accuracy. The final step is to save the document securely, ensuring that it is easily retrievable for future reference or submission.

Key Elements of the Business Expenses List PDF

A comprehensive business expenses list PDF typically includes several key elements. These elements ensure that all necessary information is captured for effective financial tracking. Common components include:

- Date: The date when the expense was incurred.

- Description: A brief explanation of the expense.

- Category: The type of expense (e.g., travel, supplies).

- Amount: The total cost of the expense.

- Payment Method: How the expense was paid (e.g., credit card, cash).

- Notes: Any additional comments or details relevant to the expense.

Steps to Complete the Business Expenses List PDF

Completing the business expenses list PDF involves a systematic approach to ensure accuracy and completeness. Follow these steps:

- Download the business expenses list PDF from a trusted source.

- Open the PDF in a compatible reader that allows for editing.

- Fill in your business name and contact information at the top.

- Enter each expense in the designated fields, ensuring to categorize them appropriately.

- Double-check all entries for accuracy, including amounts and dates.

- Save the completed document securely, using a clear file name for easy identification.

Legal Use of the Business Expenses List PDF

The business expenses list PDF is legally recognized when it is filled out accurately and maintained according to established regulations. For the document to be considered valid, it should include all necessary details and comply with financial reporting standards. Additionally, retaining this document can be beneficial during audits or tax assessments, as it provides a clear record of business expenditures. Utilizing a reliable platform for electronic signatures can further enhance the document's legal standing, ensuring that all parties involved are properly authenticated.

Examples of Using the Business Expenses List PDF

Businesses can utilize the business expenses list PDF in various scenarios, including:

- Tracking monthly operating expenses to assess financial health.

- Preparing for tax season by organizing deductible expenses.

- Budgeting for upcoming projects by analyzing past spending patterns.

- Providing documentation for loan applications or financial reviews.

Quick guide on how to complete office expenses list pdf

Complete Office Expenses List Pdf effortlessly on any device

Digital document management has become a favorite among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Office Expenses List Pdf on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to modify and eSign Office Expenses List Pdf with ease

- Locate Office Expenses List Pdf and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Office Expenses List Pdf to ensure excellent communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the office expenses list pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a business expenses list PDF?

A business expenses list PDF is a document format that allows businesses to categorize and track their expenses in a structured way. By using this type of document, organizations can easily manage their financial records, making it easier to analyze spending and prepare for tax season.

-

How can I create a business expenses list PDF with airSlate SignNow?

With airSlate SignNow, you can easily create a business expenses list PDF by utilizing our customizable templates. This allows you to input your expenses, categorize them, and generate a professional PDF ready for distribution. Our platform simplifies the process, saving you time and ensuring accuracy.

-

Are there any costs associated with downloading a business expenses list PDF?

No, airSlate SignNow offers free templates for creating a business expenses list PDF. You can easily download and use these templates at no cost, and our pricing plans are designed to provide cost-effective solutions for document management and eSigning needs.

-

Can I integrate other tools with airSlate SignNow for managing a business expenses list PDF?

Yes, airSlate SignNow offers several integrations with popular business tools, which can enhance your experience in managing a business expenses list PDF. By connecting with accountancy software or project management platforms, you can streamline process workflows and keep your financial records organized.

-

What benefits does using airSlate SignNow provide for managing a business expenses list PDF?

Using airSlate SignNow for your business expenses list PDF enhances collaboration and improves document accuracy. Our platform allows multiple users to edit and review expenses in real-time, ensuring everyone is on the same page and reducing the likelihood of errors in your financial reporting.

-

Can I share a business expenses list PDF with my team using airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily share your business expenses list PDF with your team members through secure links. Our eSigning and document-sharing features enable seamless collaboration and review processes, helping your business stay organized and efficient.

-

Is the business expenses list PDF customizable?

Yes, the business expenses list PDF templates provided by airSlate SignNow are fully customizable. You can add or remove expense categories, include company logos, and tailor the document to meet your specific business needs, making the tracking of expenses more personalized and effective.

Get more for Office Expenses List Pdf

- How to file a motion in the special civil part form

- Wwwlacourtorg forms pdfcivil case cover sheet addendum and statement of location

- Order appointing court approved reporter as official reporter pro form

- Cbp form 3229

- Application form for renew driver license

- Bank clearance certificate format pdf

- Vtdi programmes 2021 2022 form

- Dengue report positive pdf download form

Find out other Office Expenses List Pdf

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free