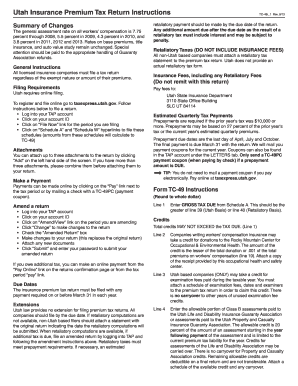

TC 49 Utah Insurance Premium Tax Return Instructions Tax Utah Form

What is the TC 49 Utah Insurance Premium Tax Return?

The TC 49 Utah Insurance Premium Tax Return is a specific form used by insurance companies operating in Utah to report and pay the insurance premium tax. This tax is assessed on the gross premiums collected by insurers for policies issued in the state. The form is essential for compliance with state tax regulations and ensures that insurance providers fulfill their financial obligations to the state government.

Steps to Complete the TC 49 Utah Insurance Premium Tax Return

Completing the TC 49 Utah Insurance Premium Tax Return involves several key steps:

- Gather necessary financial records, including gross premiums collected during the reporting period.

- Access the TC 49 form, which can be obtained from the Utah State Tax Commission website or other authorized sources.

- Fill in the required fields accurately, ensuring all figures reflect the correct amounts.

- Calculate the total tax owed based on the applicable tax rate for insurance premiums.

- Review the completed form for accuracy and completeness before submission.

Legal Use of the TC 49 Utah Insurance Premium Tax Return

The TC 49 form serves a legal purpose in the context of state tax compliance. When filed correctly, it provides a formal record of the insurance premiums collected and the corresponding tax owed. This documentation is crucial for audits and can be used as evidence of compliance with state tax laws. Electronic submissions of the form are legally recognized, provided they meet all necessary requirements for eSignature and data integrity.

Filing Deadlines and Important Dates

Timely filing of the TC 49 Utah Insurance Premium Tax Return is critical to avoid penalties. The usual deadline for submission is typically set for the end of the month following the close of the reporting period. Insurance companies should keep track of these deadlines to ensure compliance and avoid any late fees that may be imposed by the state.

Required Documents for the TC 49 Utah Insurance Premium Tax Return

To successfully complete the TC 49 form, certain documents are necessary:

- Financial statements detailing gross premiums collected.

- Previous tax returns for reference and consistency.

- Documentation of any deductions or credits applicable to the insurance premiums.

Form Submission Methods

The TC 49 Utah Insurance Premium Tax Return can be submitted through various methods, including:

- Online submission via the Utah State Tax Commission's e-filing system.

- Mailing a physical copy of the completed form to the designated tax office.

- In-person submission at local tax offices, if preferred.

Quick guide on how to complete tc 49 utah insurance premium tax return instructions tax utah

Complete TC 49 Utah Insurance Premium Tax Return Instructions Tax Utah effortlessly on any device

Online file management has become popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your files swiftly without delays. Manage TC 49 Utah Insurance Premium Tax Return Instructions Tax Utah on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to edit and eSign TC 49 Utah Insurance Premium Tax Return Instructions Tax Utah without hassle

- Obtain TC 49 Utah Insurance Premium Tax Return Instructions Tax Utah and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all details and then click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign TC 49 Utah Insurance Premium Tax Return Instructions Tax Utah and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tc 49 utah insurance premium tax return instructions tax utah

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the TC 49 Utah Insurance Premium Tax Return Instructions?

The TC 49 Utah Insurance Premium Tax Return Instructions provide detailed guidelines on how to complete the tax return for insurance premiums in Utah. It outlines necessary forms, deadlines, and relevant tax rates, ensuring compliance with state regulations.

-

How can airSlate SignNow assist with TC 49 Utah Insurance Premium Tax Return Instructions?

airSlate SignNow streamlines the process of preparing and submitting your TC 49 Utah Insurance Premium Tax Return Instructions. Our user-friendly platform allows you to easily eSign and send essential documents, reducing the time spent on paperwork.

-

What are the benefits of following the TC 49 Utah Insurance Premium Tax Return Instructions?

Following the TC 49 Utah Insurance Premium Tax Return Instructions ensures that your tax submissions are accurate and timely, which helps avoid penalties. Using the guidelines strengthens your compliance efforts and can optimize your tax obligations.

-

Can I integrate airSlate SignNow with other accounting software for TC 49 Utah Insurance Premium Tax Return?

Yes, airSlate SignNow seamlessly integrates with various accounting software, making it easier to access TC 49 Utah Insurance Premium Tax Return Instructions directly within your accounting tools. This facilitates streamlined document management related to tax processes.

-

Is there a cost associated with using airSlate SignNow for TC 49 Utah Insurance Premium Tax Return Instructions?

airSlate SignNow provides cost-effective solutions tailored for businesses of all sizes. Our pricing plans offer access to essential features for managing the TC 49 Utah Insurance Premium Tax Return Instructions without breaking the bank.

-

What features does airSlate SignNow offer that are relevant to TC 49 Utah Insurance Premium Tax Return Instructions?

airSlate SignNow offers features such as document templates, automated workflows, and secure eSigning which are essential when dealing with TC 49 Utah Insurance Premium Tax Return Instructions. These tools enhance efficiency and compliance for your tax submissions.

-

How do I ensure compliance with TC 49 Utah Insurance Premium Tax Return Instructions using airSlate SignNow?

Using airSlate SignNow helps ensure compliance with TC 49 Utah Insurance Premium Tax Return Instructions by providing clear document tracking, reminders for deadlines, and easy access to eSigned documents. This enhances accuracy and reliability for your tax submissions.

Get more for TC 49 Utah Insurance Premium Tax Return Instructions Tax Utah

- Mpumalanga unemployed educators database form

- Job completion form 47466802

- Aa signature form

- Speech form

- Certificate of purchase sample form

- Peru visa application form pdf

- Application for regular pioneer service s 205 form

- Zoning verification permit ministerial meteorological testing met facility form

Find out other TC 49 Utah Insurance Premium Tax Return Instructions Tax Utah

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word