NC DoR B C 775 Form

What is the NC DoR B C 775 Form

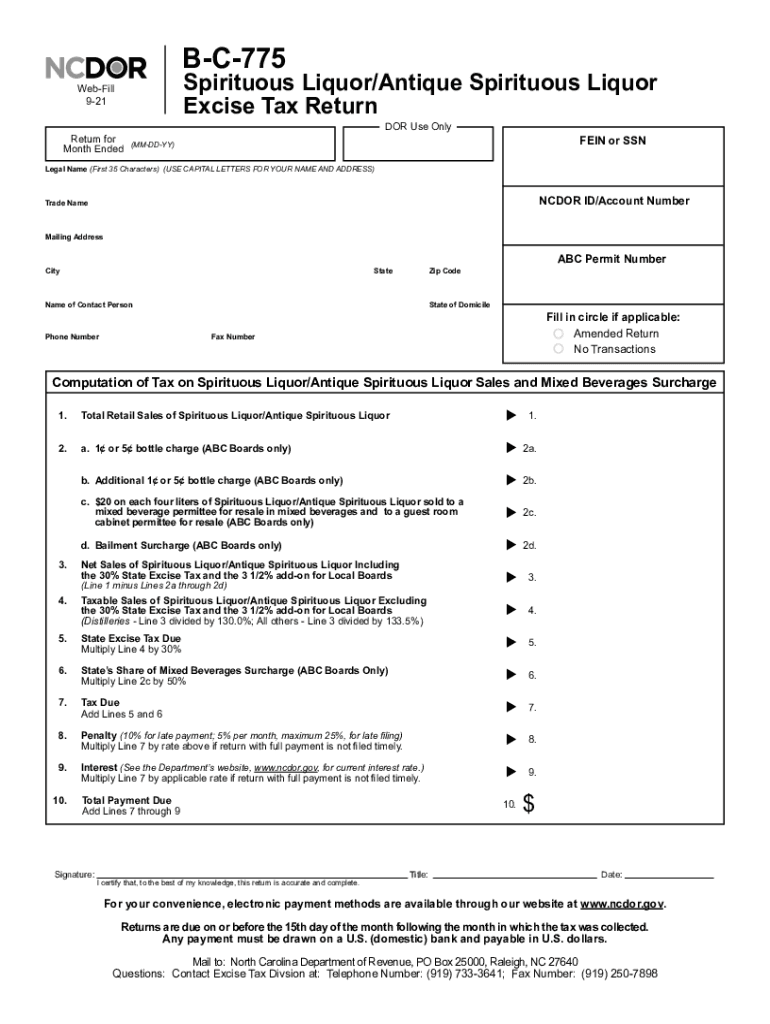

The NC DoR B C 775 form is a specific document used for reporting and remitting the North Carolina spirituous liquor tax. This form is essential for businesses that engage in the sale of alcoholic beverages, ensuring compliance with state tax regulations. The form collects information on the quantity of liquor sold, the applicable tax rates, and the total tax due. Proper completion of this form is crucial for maintaining good standing with the North Carolina Department of Revenue.

How to use the NC DoR B C 775 Form

Using the NC DoR B C 775 form involves several key steps. First, businesses must accurately record their sales data, including the types and amounts of liquor sold during the reporting period. Next, the applicable tax rate must be calculated based on the sales figures. Once the totals are determined, the information is entered into the form. It is important to review the form for accuracy before submission to avoid penalties or delays in processing.

Steps to complete the NC DoR B C 775 Form

Completing the NC DoR B C 775 form requires careful attention to detail. Follow these steps:

- Gather sales records for the reporting period.

- Identify the types of spirituous liquor sold and their quantities.

- Calculate the total sales and applicable taxes based on current rates.

- Fill out the form with the required information, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the form by the designated deadline, either online or via mail.

Legal use of the NC DoR B C 775 Form

The NC DoR B C 775 form is legally binding when completed and submitted in accordance with North Carolina tax laws. It serves as an official record of sales and tax liabilities, and failure to submit this form can result in penalties. Businesses must ensure that they comply with all relevant regulations when using this form, including maintaining accurate records and adhering to filing deadlines.

Form Submission Methods (Online / Mail / In-Person)

The NC DoR B C 775 form can be submitted through various methods to accommodate different business needs. Options include:

- Online Submission: Businesses can complete and submit the form electronically through the North Carolina Department of Revenue's online portal.

- Mail Submission: The completed form can be printed and mailed to the appropriate address provided by the Department of Revenue.

- In-Person Submission: Businesses may also choose to deliver the form in person at designated Department of Revenue offices.

Filing Deadlines / Important Dates

Timely filing of the NC DoR B C 775 form is critical to avoid penalties. The filing deadlines are typically set on a monthly basis, requiring businesses to submit the form by the end of the month following the reporting period. It is essential to stay informed about any changes in deadlines or requirements, which can be found on the North Carolina Department of Revenue's official website or through official communications.

Quick guide on how to complete nc dor b c 775 form

Effortlessly prepare NC DoR B C 775 Form on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute to conventional printed and signed paperwork, as you can access the appropriate form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage NC DoR B C 775 Form on any device using airSlate SignNow's Android or iOS applications and streamline your document processes today.

The simplest way to modify and electronically sign NC DoR B C 775 Form with ease

- Find NC DoR B C 775 Form and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Mark important sections of the documents or obscure confidential information with tools specifically available from airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislocated documents, tedious form searches, and errors necessitating the printing of new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign NC DoR B C 775 Form and maintain excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nc dor b c 775 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is b c 775 in relation to airSlate SignNow?

The b c 775 designation refers to a specific feature set available in airSlate SignNow that streamlines the eSigning process. By leveraging b c 775, businesses can ensure compliance and enhance their document management flow. This feature is ideal for organizations looking to simplify signature collection and document workflows.

-

How does airSlate SignNow's b c 775 compare to other eSigning solutions?

airSlate SignNow's b c 775 offers unique advantages over competing eSigning solutions, including user-friendly interfaces and robust security features. These benefits not only improve user efficiency but also safeguard sensitive information. Choosing b c 775 ensures that your documents are processed seamlessly and securely.

-

What are the pricing options for using airSlate SignNow's b c 775 features?

airSlate SignNow offers flexible pricing tiers for users of the b c 775 features. Depending on your business needs, you can choose from various plans that provide different levels of access to these capabilities. This allows you to select a pricing plan that best fits your budget while maximizing your document signing potential.

-

Can I integrate b c 775 features with existing software?

Yes, airSlate SignNow's b c 775 features easily integrate with a wide range of existing software solutions. This allows companies to enhance their current workflows without a complete overhaul of existing systems. With these integrations, businesses can streamline their operations and simplify their eSigning processes.

-

What are the main benefits of using airSlate SignNow with b c 775?

The primary benefits of utilizing airSlate SignNow with b c 775 include improved efficiency, better compliance, and enhanced security. By automating the eSigning process, businesses can save time and reduce errors. Additionally, the compliance features ensure that your organization adheres to legal standards when handling documents.

-

How user-friendly is the b c 775 feature of airSlate SignNow?

The b c 775 feature of airSlate SignNow is designed with user experience in mind, making it exceptionally easy to navigate and utilize. Users can quickly learn how to send and eSign documents without extensive technical training. This focus on user-friendliness helps improve adoption rates within organizations.

-

Is support available for users of the b c 775 features?

Absolutely! airSlate SignNow provides comprehensive customer support for users of the b c 775 features. This includes tutorials, live chat, and dedicated account managers to assist with any inquiries. Customers can rely on this support to maximize their usage and address any challenges they may face.

Get more for NC DoR B C 775 Form

Find out other NC DoR B C 775 Form

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template