Profit and Loss Statement for Self Employed Hairdresser 2017

What is the profit and loss statement for self employed hairdresser

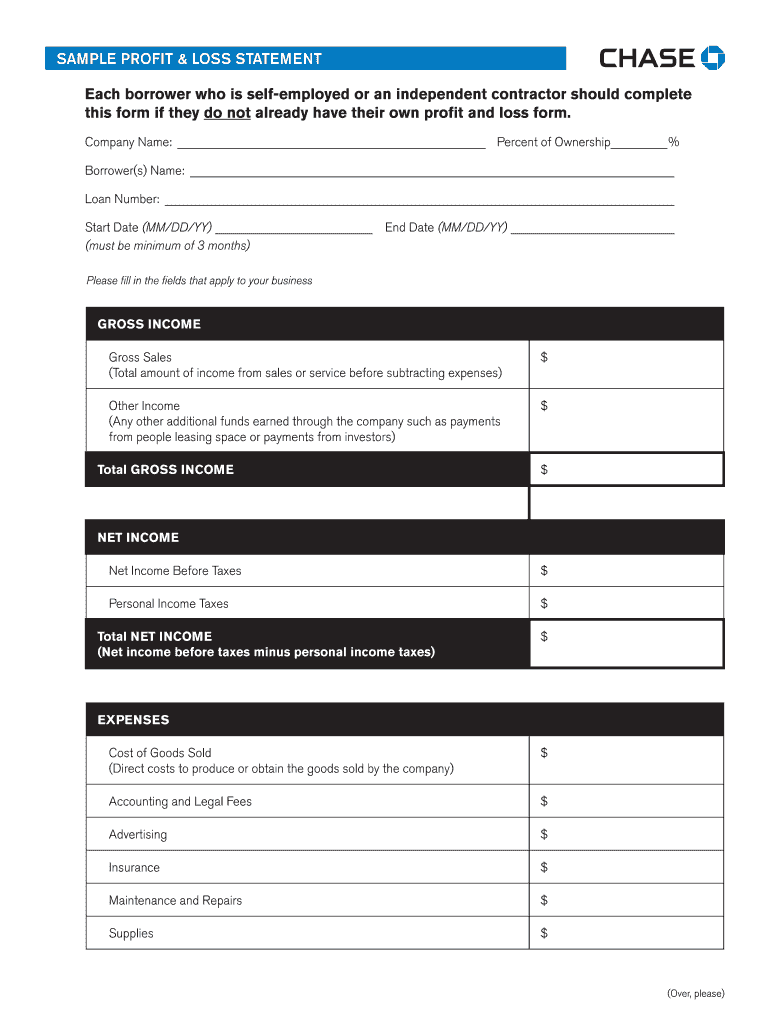

The profit and loss statement for a self employed hairdresser is a financial report that summarizes the revenues, costs, and expenses incurred during a specific period. This document provides an overview of the salon's financial performance, helping hair stylists understand their profitability. It typically includes sections for total income from services and products sold, as well as various operating expenses such as rent, supplies, and wages. By analyzing this statement, hairdressers can make informed decisions regarding their business operations and financial planning.

Key elements of the profit and loss statement for self employed hairdresser

Several key elements are essential for a comprehensive profit and loss statement for a self employed hairdresser. These include:

- Total Income: This section lists all earnings from hair services, product sales, and any additional revenue streams.

- Cost of Goods Sold (COGS): This includes direct costs associated with products sold, such as hair color and styling products.

- Operating Expenses: This encompasses all indirect costs, including rent, utilities, insurance, and marketing expenses.

- Net Profit or Loss: This figure is calculated by subtracting total expenses from total income, indicating whether the business is profitable or operating at a loss.

Steps to complete the profit and loss statement for self employed hairdresser

Completing a profit and loss statement involves several straightforward steps. Begin by gathering all necessary financial records, including receipts and invoices. Next, follow these steps:

- Calculate Total Income: Sum all revenue generated from services and product sales.

- Determine COGS: Identify and total the costs directly related to the products sold.

- List Operating Expenses: Document all indirect costs incurred during the reporting period.

- Calculate Net Profit or Loss: Subtract total expenses from total income to find the net profit or loss.

Legal use of the profit and loss statement for self employed hairdresser

The profit and loss statement for a self employed hairdresser serves not only as a financial tool but also as a legal document. It can be used for various purposes, including tax filing and securing loans. To ensure its legal validity, it is crucial to maintain accurate records and adhere to relevant regulations. This includes compliance with IRS guidelines and any state-specific requirements regarding financial reporting for self employed individuals.

How to use the profit and loss statement for self employed hairdresser

Using the profit and loss statement effectively can enhance a hairdresser's business management. Here are some practical applications:

- Financial Analysis: Review the statement regularly to assess profitability and identify trends over time.

- Budgeting: Use the data to create realistic budgets for future periods, ensuring that expenses do not exceed income.

- Tax Preparation: Utilize the statement to prepare for tax filings, ensuring all income and expenses are accurately reported.

- Business Decisions: Inform decisions regarding pricing, service offerings, and potential areas for cost reduction based on financial performance.

Examples of using the profit and loss statement for self employed hairdresser

Examples of practical uses for the profit and loss statement include:

- Loan Applications: Presenting the statement to lenders can demonstrate financial health and support loan requests.

- Partnership Discussions: Sharing the statement with potential business partners can provide insight into the financial viability of the salon.

- Investment Opportunities: Investors may request this statement to evaluate the business's profitability before committing funds.

Quick guide on how to complete profit and loss statement for self employed hairdresser

Effortlessly Complete Profit And Loss Statement For Self Employed Hairdresser on Any Device

The management of online documents has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Profit And Loss Statement For Self Employed Hairdresser on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and eSign Profit And Loss Statement For Self Employed Hairdresser with Ease

- Obtain Profit And Loss Statement For Self Employed Hairdresser and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize signNow sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device of your choice. Edit and eSign Profit And Loss Statement For Self Employed Hairdresser and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the profit and loss statement for self employed hairdresser

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a profit and loss statement for hair stylist?

A profit and loss statement for hair stylist is a financial report that summarizes revenue, costs, and expenses incurred during a specific period. It helps hair stylists evaluate their business performance by indicating how much profit or loss they made. Understanding this statement is essential for making informed decisions about pricing and services.

-

How can airSlate SignNow help me create a profit and loss statement for hair stylist?

airSlate SignNow provides tools that enable you to draft and eSign your profit and loss statement for hair stylist quickly. You can import financial data, customize the document layout, and ensure secure sharing with stakeholders. This streamlines the creation and management of important business documents.

-

Are there any costs associated with using airSlate SignNow for my profit and loss statement for hair stylist?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost will depend on the features you choose, such as document storage and integrations. However, using airSlate SignNow can be more cost-effective compared to other platforms, making it a smart choice for managing your profit and loss statement for hair stylist.

-

What features does airSlate SignNow provide for managing financial documents?

airSlate SignNow offers several features such as document templates, secure e-signatures, and collaboration tools. These features simplify your financial document management, including the profit and loss statement for hair stylist. You can also automate workflows and create reminders, ensuring timely document handling.

-

Can I integrate airSlate SignNow with my accounting software?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing you to synchronize data effortlessly. This means you can easily pull in financial figures for your profit and loss statement for hair stylist without manual data entry. Integration helps maintain accuracy and saves valuable time.

-

How does using a profit and loss statement benefit my hair styling business?

Using a profit and loss statement enables you to keep track of your income and expenses, which is vital for financial health. For hair stylists, this insight can help in understanding pricing strategies and identifying cost-saving opportunities. Ultimately, it supports making informed decisions that contribute to business growth.

-

Is it easy to update my profit and loss statement for hair stylist with airSlate SignNow?

Yes, it is straightforward to update your profit and loss statement for hair stylist using airSlate SignNow. You can make changes directly within the document, and the platform allows for easy version tracking. This ensures you always have the latest financial information at your fingertips.

Get more for Profit And Loss Statement For Self Employed Hairdresser

Find out other Profit And Loss Statement For Self Employed Hairdresser

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer