Tr 6 Challan Customs Word Format

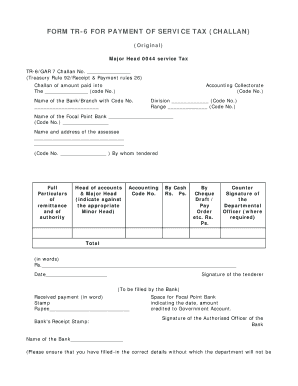

What is the TR 6 Challan Customs Word Format

The TR 6 Challan Customs Word Format is a specific document used in the United States for customs duty payments. This form serves as a payment receipt for customs duties owed to the government. It is essential for individuals and businesses engaging in international trade to accurately complete this form to ensure compliance with customs regulations. The TR 6 Challan is designed to facilitate the electronic submission of payment details, making it easier to manage customs duties efficiently.

How to Use the TR 6 Challan Customs Word Format

Using the TR 6 Challan Customs Word Format involves several steps to ensure that all necessary information is correctly filled out. First, download the form in Word format from a trusted source. Next, open the document and fill in the required fields, including details such as the payer's name, address, and the amount of duty being paid. After completing the form, review it for accuracy before printing or saving it for submission. This process streamlines the payment of customs duties, making it more manageable for users.

Steps to Complete the TR 6 Challan Customs Word Format

Completing the TR 6 Challan Customs Word Format requires attention to detail. Follow these steps:

- Download the TR 6 Challan in Word format.

- Open the document and enter your personal information in the designated fields.

- Input the customs duty amount accurately.

- Include any additional required information, such as transaction details.

- Review the form for any errors or omissions.

- Save the completed form for your records or print it for submission.

Legal Use of the TR 6 Challan Customs Word Format

The TR 6 Challan Customs Word Format is legally recognized as a valid document for customs duty payments when completed correctly. It must comply with relevant customs regulations and guidelines to ensure its acceptance by authorities. Users should be aware that any inaccuracies or incomplete information may lead to delays or penalties. Therefore, it is crucial to follow the established legal requirements when filling out this form.

Key Elements of the TR 6 Challan Customs Word Format

Several key elements must be included in the TR 6 Challan Customs Word Format to ensure its validity:

- Payer Information: Name and address of the individual or business making the payment.

- Payment Amount: The total customs duty owed.

- Transaction Details: Information about the goods being imported.

- Date of Payment: The date when the payment is made.

- Signature: The payer's signature or a digital equivalent if submitted electronically.

Examples of Using the TR 6 Challan Customs Word Format

Examples of using the TR 6 Challan Customs Word Format include situations where businesses import goods from overseas and need to pay customs duties. For instance, a company importing electronics may fill out the TR 6 Challan to document their payment of duties associated with their shipment. Similarly, individuals bringing personal items into the country may use this form to ensure compliance with customs regulations. Each use case emphasizes the importance of accurate completion to avoid potential legal issues.

Quick guide on how to complete tr 6 challan customs word format

Complete Tr 6 Challan Customs Word Format effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Tr 6 Challan Customs Word Format on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Tr 6 Challan Customs Word Format without hassle

- Obtain Tr 6 Challan Customs Word Format and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and then click the Done button to save your changes.

- Choose your method for sending the form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Tr 6 Challan Customs Word Format and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tr 6 challan customs word format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the tr form 6 word format and how can airSlate SignNow help?

The tr form 6 word format is a specific document format used for applications and submissions. With airSlate SignNow, you can easily create, edit, and eSign documents in the tr form 6 word format, streamlining your submission process.

-

How can I use airSlate SignNow to complete my tr form 6 word format?

To complete your tr form 6 word format using airSlate SignNow, simply upload your document, fill in the necessary information, and use our intuitive signature features to finalize your form. This process is efficient and user-friendly.

-

Is airSlate SignNow suitable for businesses of all sizes dealing with tr form 6 word format?

Yes, airSlate SignNow is designed to cater to businesses of all sizes. Whether you're a small startup or a large corporation, you can benefit from our efficient solutions for handling the tr form 6 word format.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers various pricing plans to fit different business needs. Our options include monthly and annual subscriptions, ensuring you have access to essential features for managing documents like the tr form 6 word format.

-

What features does airSlate SignNow offer for managing tr form 6 word format?

With airSlate SignNow, you get features such as document editing, eSignature capabilities, templates for the tr form 6 word format, and secure cloud storage. These tools enhance your productivity and ensure compliance.

-

Can I integrate airSlate SignNow with other apps for managing tr form 6 word format?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage the tr form 6 word format alongside your existing tools. This integration fosters a more streamlined workflow.

-

How does airSlate SignNow ensure the security of my tr form 6 word format?

Security is a top priority for airSlate SignNow. We employ industry-standard encryption and secure access protocols to protect your documents, including those in the tr form 6 word format, ensuring they remain confidential.

Get more for Tr 6 Challan Customs Word Format

Find out other Tr 6 Challan Customs Word Format

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online